Question: Can someone please show the work for this. Cash Problem 1 (10 points) Edward Enterprises recently reported an EBITDA of $1,062 million and net income

Can someone please show the work for this.

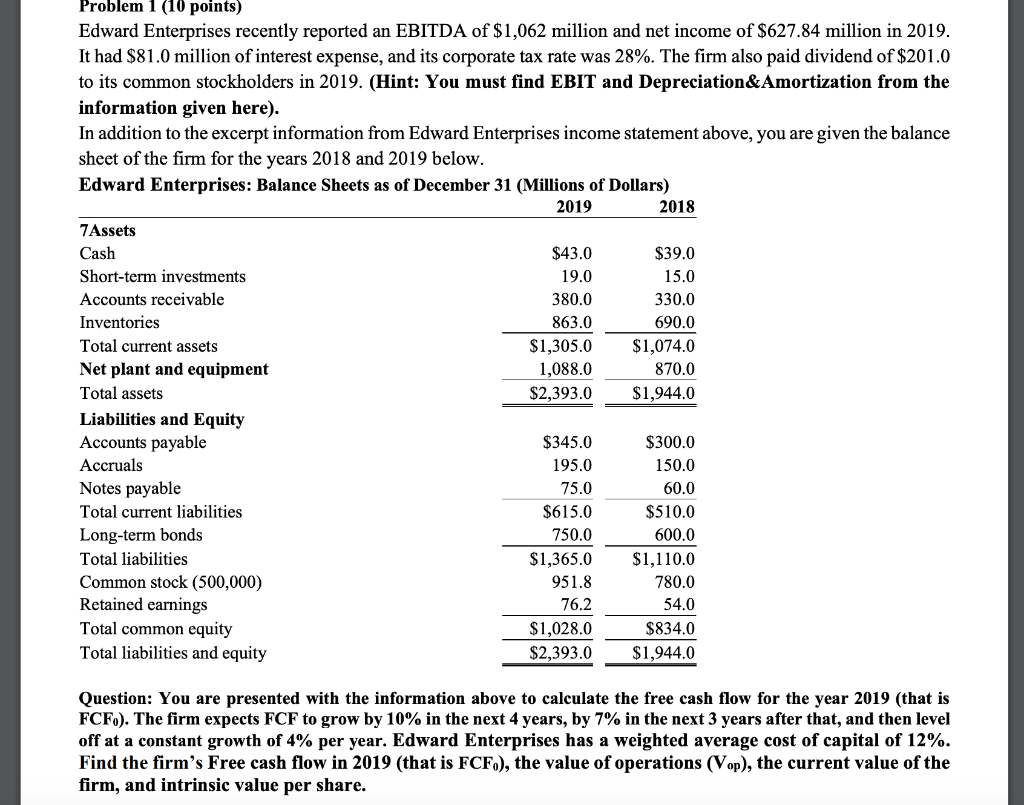

Cash Problem 1 (10 points) Edward Enterprises recently reported an EBITDA of $1,062 million and net income of $627.84 million in 2019. It had $81.0 million of interest expense, and its corporate tax rate was 28%. The firm also paid dividend of $201.0 to its common stockholders in 2019. (Hint: You must find EBIT and Depreciation&Amortization from the information given here). In addition to the excerpt information from Edward Enterprises income statement above, you are given the balance sheet of the firm for the years 2018 and 2019 below. Edward Enterprises: Balance Sheets as of December 31 (Millions of Dollars) 2019 2018 7 Assets $43.0 $39.0 Short-term investments 19.0 15.0 Accounts receivable 380.0 330.0 Inventories 863.0 690.0 Total current assets $1,305.0 $1,074.0 Net plant and equipment 1,088.0 870.0 Total assets $2,393.0 $1,944.0 Liabilities and Equity Accounts payable $345.0 $300.0 Accruals 195.0 150.0 Notes payable 75.0 60.0 Total current liabilities $615.0 $510.0 Long-term bonds 750.0 600.0 Total liabilities $1,365.0 $1,110.0 Common stock (500,000) 951.8 780.0 Retained earnings 76.2 54.0 Total common equity $1,028.0 $834.0 Total liabilities and equity $2,393.0 $1,944.0 Question: You are presented with the information above to calculate the free cash flow for the year 2019 (that is FCF.). The firm expects FCF to grow by 10% in the next 4 years, by 7% in the next 3 years after that, and then level off at a constant growth of 4% per year. Edward Enterprises has a weighted average cost of capital of 12%. Find the firm's Free cash flow in 2019 (that is FCF.), the value of operations (Vop), the current value of the firm, and intrinsic value per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts