Question: Can someone please solve 2b please. I have included 2a if that is needed. Please be sure to do 2B and not 2A I will

Can someone please solve 2b please. I have included 2a if that is needed. Please be sure to do 2B and not 2A I will be sure to upvote thanks.

Can someone please answer 2a. Thanks

2A Solution-

List of Accounts-

Accumulated Amortization - Patent

Accumulated Depreciation - Buildings

Accumulated Depreciation - Equipment

Accumulated Depreciation - Equipment A

Accumulated Depreciation - Equipment B

Accumulated Depreciation - Furniture

Accumulated Depreciation - Machinery

Accumulated Depreciation - Machinery X

Accumulated Depreciation - Machinery Y

Accumulated Depreciation - Packaging Equipment

Accumulated Depreciation - Processing Equipment

Accumulated Depreciation - Sat. A

Accumulated Depreciation - Sat. B

Accumulated Depreciation - Trucks

Accumulated Depreciation - Vehicles

Accumulated Impairment Losses - Buildings

Accumulated Impairment Losses - Equipment

Accumulated Impairment Losses - Patent

Amortization Expense - Franchise

Amortization Expense - Patent

Buildings

Cash

Depreciation Expense

Depreciation Expense - Machine

Equipment

Equipment A

Equipment B

Franchises

Furniture

Gain on Disposal

Goodwill

Income Tax Expense

Land

Land Improvements

Loss on Disposal

Loss on Impairment

Machinery

Machine X

Machine Y

No Entry

Notes Payable

Other Operating Expenses

Packaging Equipment

Patents

Processing Equipment

Rent Expense

Sat. A

Sat. B

Salaries and Wages Expense

Truck

Vehicles

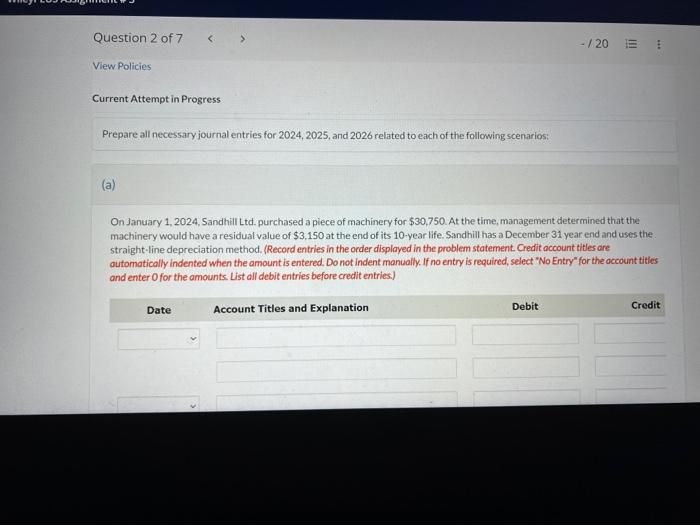

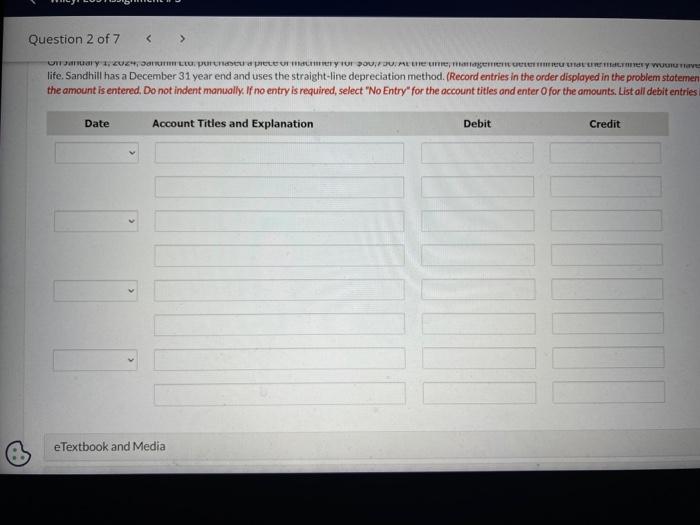

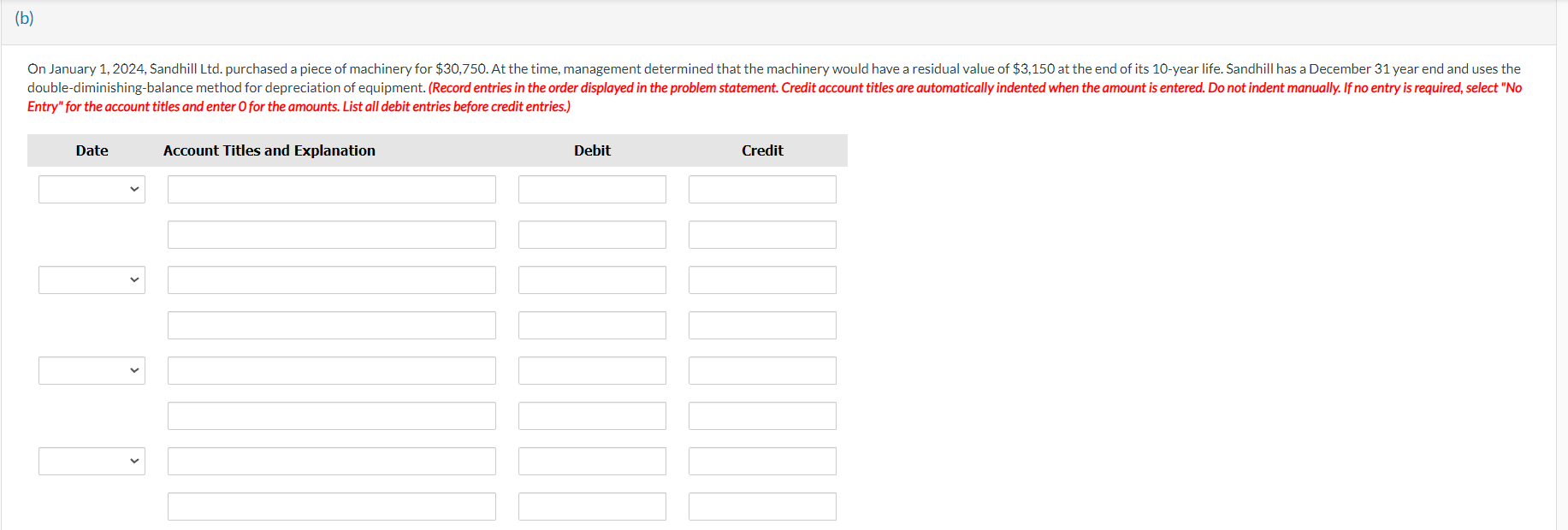

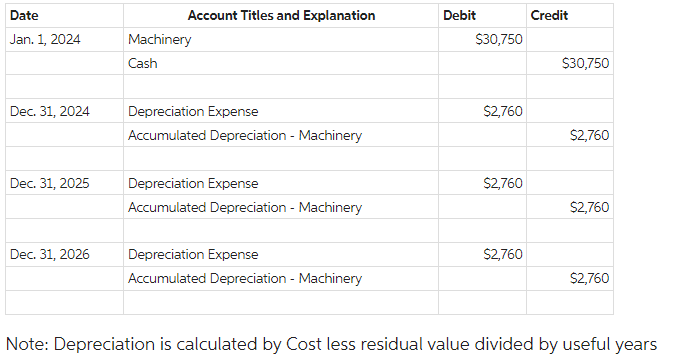

Prepare all necessary journal entries for 2024,2025 , and 2026 related to each of the following scenarios: (a) On January 1, 2024, Sandhill Ltd. purchased a piece of machinery for $30,750. At the time, management determined that the machinery would have a residual value of $3,150 at the end of its 10 -year life. Sandhill has a December 31 year end and uses the straight-line depreciation method. (Record entries in the order displayed in the problem statement. Credit account titles are outomatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount tities and enter O for the amounts List all debit entries before credit entries.) life. Sandhill has a December 31 year end and uses the straight-line depreciation method. (Record entries in the order displayed in the problem stateme the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount titles and enter Ofor the amounts. List all debit entrie Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Note: Depreciation is calculated by Cost less residual value divided by useful years Prepare all necessary journal entries for 2024,2025 , and 2026 related to each of the following scenarios: (a) On January 1, 2024, Sandhill Ltd. purchased a piece of machinery for $30,750. At the time, management determined that the machinery would have a residual value of $3,150 at the end of its 10 -year life. Sandhill has a December 31 year end and uses the straight-line depreciation method. (Record entries in the order displayed in the problem statement. Credit account titles are outomatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount tities and enter O for the amounts List all debit entries before credit entries.) life. Sandhill has a December 31 year end and uses the straight-line depreciation method. (Record entries in the order displayed in the problem stateme the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount titles and enter Ofor the amounts. List all debit entrie Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Note: Depreciation is calculated by Cost less residual value divided by useful years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts