Question: Can someone please solve the model for this case study. The model is the third picture. Case Study Then Alimentation Couche-Tard purchased Statoil Fuel and

Can someone please solve the model for this case study. The model is the third picture.

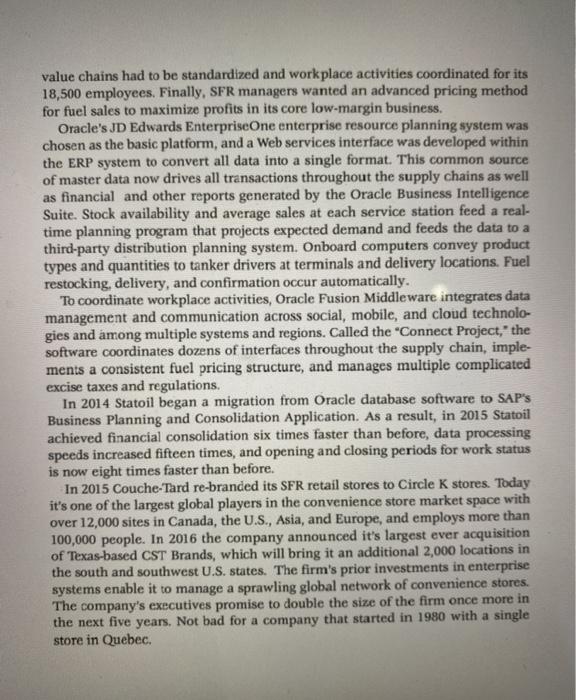

Case Study Then Alimentation Couche-Tard purchased Statoil Fuel and Retail (SFR) in April 2012, it was the Canadian convenience store giant's most ambitious acquisition to date (2.058 billion). SFR, a division of Statoil, the Norwegian State Oil Company, had been spun off from its parent in October 2010. The purchase added 2,300 retail fuel stations-most full-service with a convenience store-throughout North America and expanded Couche- Tard's reach to cight European countries-- Norway, Sweden, Denmark, Poland, Estonia, Latvia, Lithuania, and Russia. In 2016 the firm had 12,000 sites and employed over 105,000 people. SFR operates in both the B2C (sales to consumers) and B2B (sales to other businesses) sectors. Fuel products including gasoline blends, diesel fuels, bio- fuels, and LPG (liquefied petroleum gas) generate 70 percent of its business. The full-service retail stations offer product lines that differ according to operator and location factors. Some prefer a product mix that concen- trates on auto supplies and services while others focus on food-related products, beverages, and even fast- food. SFR's 12 terminals, 38 depots, and 400 road tankers provide bulk sales to com- mercial customers, includ- ing bus and car rental com panies, road construction crews, and independent resellers Couche-Tard welcomed both the opportunities and the challenges of its acquisition. Immediate synergies between Couche-Tard and SFR could not completely cover the remaining expenses from SFR's split from Statoil, rebranding efforts, and the replacement of an antiquated IT infra- structure and enterprise resource planning (ERP) system. The old system used different processes in each country and market, resulting in over 5,000 custom software objects for the IT department to manage in addition to mas- sive operational inefficiencies. SFR needed to maximize supply chain efficiency for three closely related value chains the fuel value chain, the grocery value chain, and the lubri- cants value chain. All corporate functions that provided shared services to the value chains had to be standardized and work place activities coordinated for its 18,500 employees. Finally, SFR managers wanted an advanced pricing method for fuel sales to maximize profits in its core low-margin business. Oracle's JD Edwards EnterpriseOne enterprise resource planning system was chosen as the basic platform, and a Web services interface was developed within the ERP system to convert all data into a single format. This common source of master data now drives all transactions throughout the supply chains as well as financial and other reports generated by the Oracle Business Intelligence Suite. Stock availability and average sales at each service station feed a real- time planning program that projects expected demand and feeds the data to a third-party distribution planning system. Onboard computers convey product types and quantities to tanker drivers at terminals and delivery locations. Fuel restocking, delivery, and confirmation occur automatically. To coordinate workplace activities, Oracle Fusion Middleware integrates data management and communication across social, mobile, and cloud technolo- gies and among multiple systems and regions. Called the "Connect Project," the software coordinates dozens of interfaces throughout the supply chain, imple- ments a consistent fuel pricing structure, and manages multiple complicated excise taxes and regulations. In 2014 Statoil began a migration from Oracle database software to SAP's Business Planning and Consolidation Application. As a result, in 2015 Statoil achieved financial consolidation six times faster than before, data processing speeds increased fifteen times, and opening and closing periods for work status is now eight times faster than before. In 2015 Couche-Tard re-branded its SFR retail stores to Circle K stores. Today it's one of the largest global players in the convenience store market space with over 12,000 sites in Canada, the U.S., Asia, and Europe, and employs more than 100,000 people. In 2016 the company announced it's largest ever acquisition of Texas-based CST Brands, which will bring it an additional 2,000 locations in the south and southwest U.S. states. The firm's prior investments in enterprise systems enable it to manage a sprawling global network of convenience stores. The company's executives promise to double the size of the firm once more in the next five years. Not bad for a company that started in 1980 with a single store in Quebec Model for Case Study Case Study Box 7 Box 8 Box1 Box 2 Box 9 Box 3 Box 5 Box 6 Box 11 Box 12 Box 4 Box 10 Case Study Then Alimentation Couche-Tard purchased Statoil Fuel and Retail (SFR) in April 2012, it was the Canadian convenience store giant's most ambitious acquisition to date (2.058 billion). SFR, a division of Statoil, the Norwegian State Oil Company, had been spun off from its parent in October 2010. The purchase added 2,300 retail fuel stations-most full-service with a convenience store-throughout North America and expanded Couche- Tard's reach to cight European countries-- Norway, Sweden, Denmark, Poland, Estonia, Latvia, Lithuania, and Russia. In 2016 the firm had 12,000 sites and employed over 105,000 people. SFR operates in both the B2C (sales to consumers) and B2B (sales to other businesses) sectors. Fuel products including gasoline blends, diesel fuels, bio- fuels, and LPG (liquefied petroleum gas) generate 70 percent of its business. The full-service retail stations offer product lines that differ according to operator and location factors. Some prefer a product mix that concen- trates on auto supplies and services while others focus on food-related products, beverages, and even fast- food. SFR's 12 terminals, 38 depots, and 400 road tankers provide bulk sales to com- mercial customers, includ- ing bus and car rental com panies, road construction crews, and independent resellers Couche-Tard welcomed both the opportunities and the challenges of its acquisition. Immediate synergies between Couche-Tard and SFR could not completely cover the remaining expenses from SFR's split from Statoil, rebranding efforts, and the replacement of an antiquated IT infra- structure and enterprise resource planning (ERP) system. The old system used different processes in each country and market, resulting in over 5,000 custom software objects for the IT department to manage in addition to mas- sive operational inefficiencies. SFR needed to maximize supply chain efficiency for three closely related value chains the fuel value chain, the grocery value chain, and the lubri- cants value chain. All corporate functions that provided shared services to the value chains had to be standardized and work place activities coordinated for its 18,500 employees. Finally, SFR managers wanted an advanced pricing method for fuel sales to maximize profits in its core low-margin business. Oracle's JD Edwards EnterpriseOne enterprise resource planning system was chosen as the basic platform, and a Web services interface was developed within the ERP system to convert all data into a single format. This common source of master data now drives all transactions throughout the supply chains as well as financial and other reports generated by the Oracle Business Intelligence Suite. Stock availability and average sales at each service station feed a real- time planning program that projects expected demand and feeds the data to a third-party distribution planning system. Onboard computers convey product types and quantities to tanker drivers at terminals and delivery locations. Fuel restocking, delivery, and confirmation occur automatically. To coordinate workplace activities, Oracle Fusion Middleware integrates data management and communication across social, mobile, and cloud technolo- gies and among multiple systems and regions. Called the "Connect Project," the software coordinates dozens of interfaces throughout the supply chain, imple- ments a consistent fuel pricing structure, and manages multiple complicated excise taxes and regulations. In 2014 Statoil began a migration from Oracle database software to SAP's Business Planning and Consolidation Application. As a result, in 2015 Statoil achieved financial consolidation six times faster than before, data processing speeds increased fifteen times, and opening and closing periods for work status is now eight times faster than before. In 2015 Couche-Tard re-branded its SFR retail stores to Circle K stores. Today it's one of the largest global players in the convenience store market space with over 12,000 sites in Canada, the U.S., Asia, and Europe, and employs more than 100,000 people. In 2016 the company announced it's largest ever acquisition of Texas-based CST Brands, which will bring it an additional 2,000 locations in the south and southwest U.S. states. The firm's prior investments in enterprise systems enable it to manage a sprawling global network of convenience stores. The company's executives promise to double the size of the firm once more in the next five years. Not bad for a company that started in 1980 with a single store in Quebec Model for Case Study Case Study Box 7 Box 8 Box1 Box 2 Box 9 Box 3 Box 5 Box 6 Box 11 Box 12 Box 4 Box 10