Question: can someone please solve these 2 questions The returns on the common stock of Alpha Cycles, Inc. are quite cyclical. In a boom economy, the

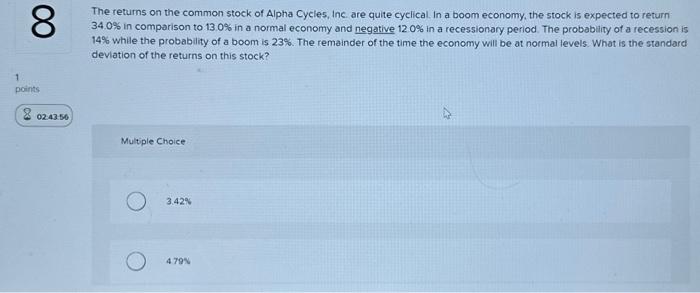

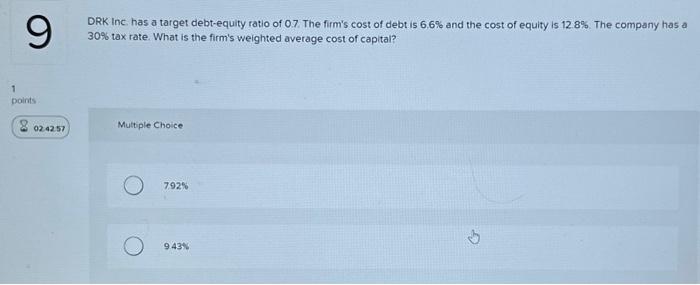

The returns on the common stock of Alpha Cycles, Inc. are quite cyclical. In a boom economy, the stock is expected to return \34.0 in comparison to \13.0 in a normal economy and negative \12.0 in a recessionary period. The probability of a recession is \14 while the probability of a boom is \23. The remainder of the time the economy will be at normal levels. What is the standard deviation of the returns on this stock? Multiple Choice \3.42 \\( 479 \\times \\) DRK Inc. has a target debt-equity ratio of 0.7 . The firm's cost of debt is \6.6 and the cost of equity is \12.8. The company has a \30 tax rate. What is the firm's weighted average cost of capital? Multiple Choice \792 9434

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts