Question: Can someone please solve this problem and show there work? Problem 26, 27, and 28 26) Your boss requested you to underwrite the following borrowers

Can someone please solve this problem and show there work?

Problem 26, 27, and 28

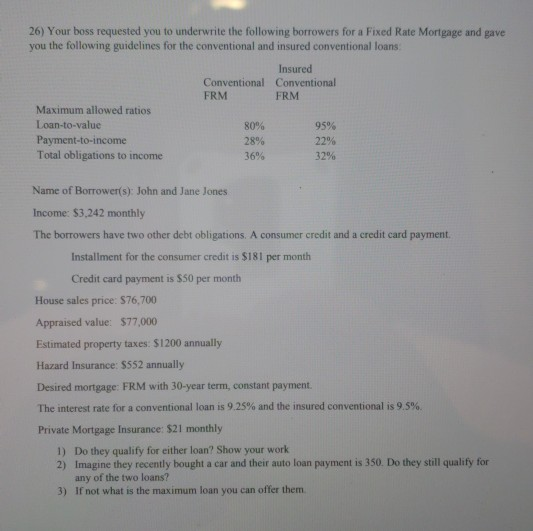

26) Your boss requested you to underwrite the following borrowers for a Fixed Rate Mortgage and gave you the following guidelines for the conventional and insured conventional loans Insured Conventional Conventional FRM FRM Maximum allowed ratios Loan-to-value Payment-to-income Total obligations to income 80% 28% 36% 95% 22% 32% Name of Borrower(s): John and Jane Jones Income: $3,242 monthly The borrowers have two other debt obligations. A consumer credit and a credit card payment Installment for the consumer credit is $181 per month Credit card payment is $50 per month House sales price: $76,700 Appraised value: $77,000 Estimated property taxes: $1200 annually Hazard Insurance: $552 annually Desired mortgage: FRM with 30-year term, constant payment The interest rate for a conventional loan is 9.25% and the insured conventional is 9.5%. Private Mortgage Insurance: $21 monthly 1) Do they qualify for either loan? Show your work 2) Imagine they recently bought a car and their auto loan payment is 350. Do they still qualify for any of the two loans? If not what is the maximum loan you can offer them 3) 26) Your boss requested you to underwrite the following borrowers for a Fixed Rate Mortgage and gave you the following guidelines for the conventional and insured conventional loans Insured Conventional Conventional FRM FRM Maximum allowed ratios Loan-to-value Payment-to-income Total obligations to income 80% 28% 36% 95% 22% 32% Name of Borrower(s): John and Jane Jones Income: $3,242 monthly The borrowers have two other debt obligations. A consumer credit and a credit card payment Installment for the consumer credit is $181 per month Credit card payment is $50 per month House sales price: $76,700 Appraised value: $77,000 Estimated property taxes: $1200 annually Hazard Insurance: $552 annually Desired mortgage: FRM with 30-year term, constant payment The interest rate for a conventional loan is 9.25% and the insured conventional is 9.5%. Private Mortgage Insurance: $21 monthly 1) Do they qualify for either loan? Show your work 2) Imagine they recently bought a car and their auto loan payment is 350. Do they still qualify for any of the two loans? If not what is the maximum loan you can offer them 3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts