Question: Can someone please solve this using the excel template? Thank you! Assignment #2 Stock Valuation A. Choose a stock (dividend-paying stock traded in the US)

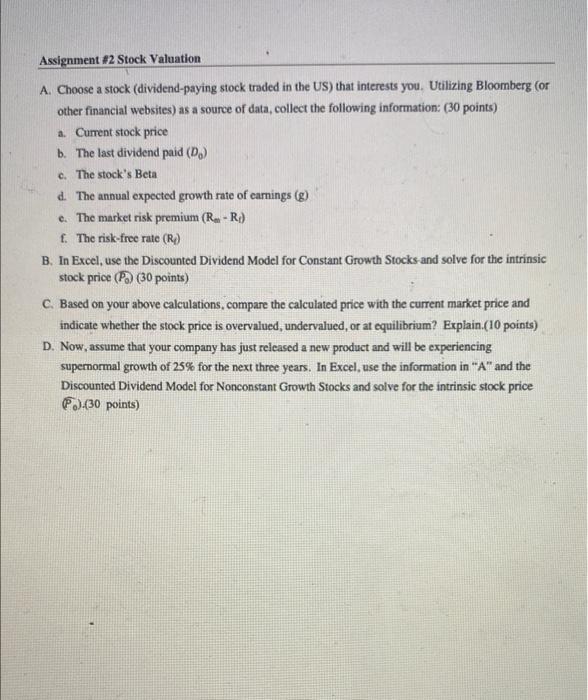

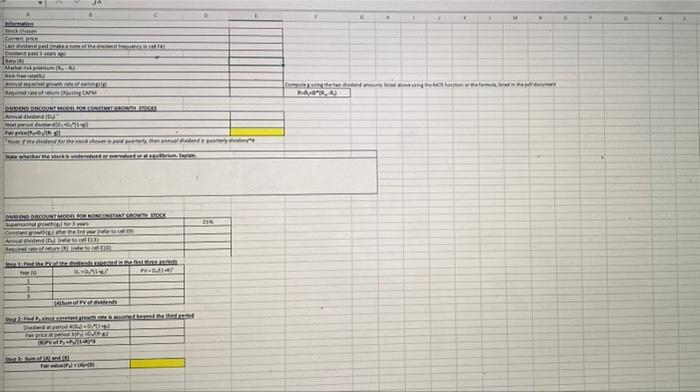

Assignment #2 Stock Valuation A. Choose a stock (dividend-paying stock traded in the US) that interests you. Utilizing Bloomberg (or other financial websites) as a source of data, collect the following information: (30 points) a. Current stock price b. The last dividend paid (D) c. The stock's Beta d. The annual expected growth rate of earnings (g) e. The market risk premium (Re-R) f. The risk-free rate (R) B. In Excel, use the Discounted Dividend Model for Constant Growth Stocks and solve for the intrinsic stock price (P) (30 points) C. Based on your above calculations, compare the calculated price with the current market price and indicate whether the stock price is overvalued, undervalued, or at equilibrium? Explain.(10 points) D. Now, assume that your company has just released a new product and will be experiencing supernormal growth of 25% for the next three years. In Excel, use the information in "A" and the Discounted Dividend Model for Nonconstant Growth Stocks and solve for the intrinsic stock price P) (30 points) marm (Cum [D Ha Tas par ai kodbilang proper pepp mo AINTTATS Palp . tera 13|tn lvvu T Mounamalroutfevery Conment growth in the And didmet Inders Required te of inferto 101 Year Branly Dudend &pronJ (RUPV of Py +P/(1+R) TTHEM prefer to co Vall pust peu va puiki pratom a muda would prepares a N [campiter sargytate omin . W . Assignment #2 Stock Valuation A. Choose a stock (dividend-paying stock traded in the US) that interests you. Utilizing Bloomberg (or other financial websites) as a source of data, collect the following information: (30 points) a. Current stock price b. The last dividend paid (D) c. The stock's Beta d. The annual expected growth rate of earnings (g) e. The market risk premium (Re-R) f. The risk-free rate (R) B. In Excel, use the Discounted Dividend Model for Constant Growth Stocks and solve for the intrinsic stock price (P) (30 points) C. Based on your above calculations, compare the calculated price with the current market price and indicate whether the stock price is overvalued, undervalued, or at equilibrium? Explain.(10 points) D. Now, assume that your company has just released a new product and will be experiencing supernormal growth of 25% for the next three years. In Excel, use the information in "A" and the Discounted Dividend Model for Nonconstant Growth Stocks and solve for the intrinsic stock price P) (30 points) marm (Cum [D Ha Tas par ai kodbilang proper pepp mo AINTTATS Palp . tera 13|tn lvvu T Mounamalroutfevery Conment growth in the And didmet Inders Required te of inferto 101 Year Branly Dudend &pronJ (RUPV of Py +P/(1+R) TTHEM prefer to co Vall pust peu va puiki pratom a muda would prepares a N [campiter sargytate omin . W

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts