Question: Can someone please solve this using TI-84 plus calculator using NPV( #, # ) Howell Petroleum, Inc., is trying to evaluate a generation project

Can someone please solve this using TI-84 plus calculator using " NPV( #, # )

Can someone please solve this using TI-84 plus calculator using " NPV( #, # )

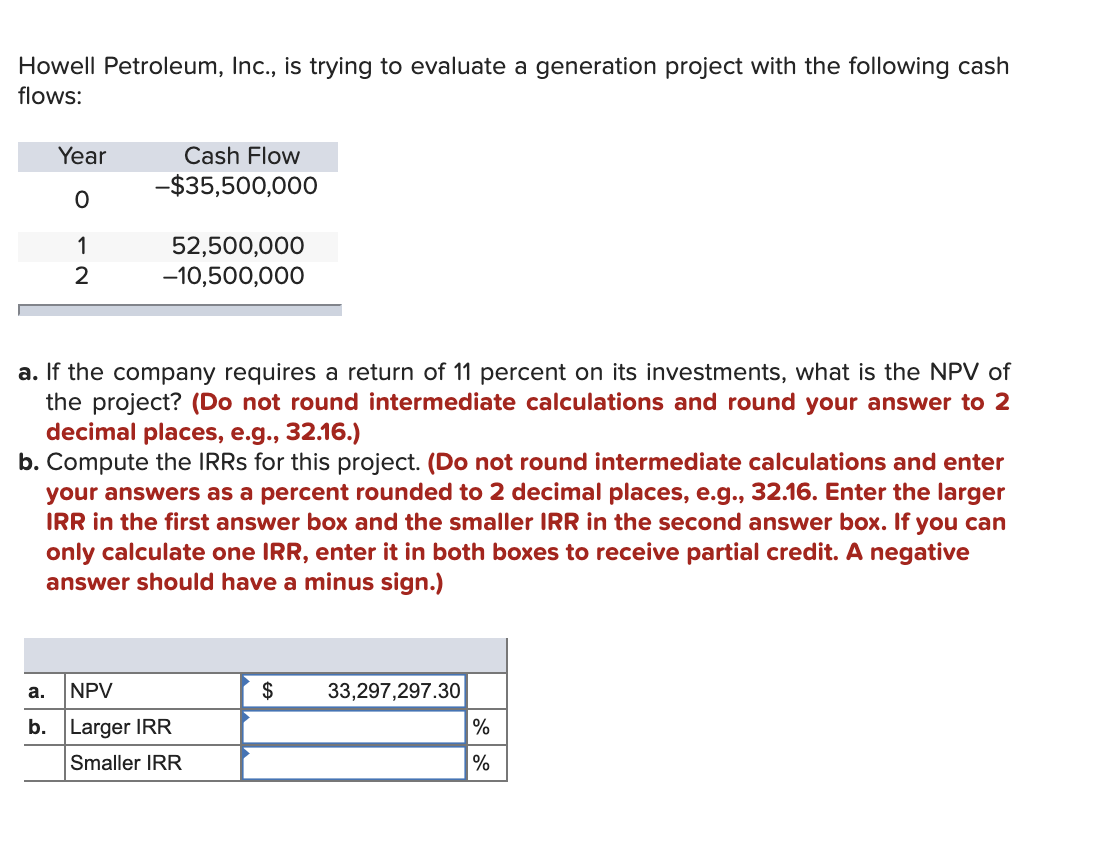

Howell Petroleum, Inc., is trying to evaluate a generation project with the following cash flows: Year o Cash Flow -$35,500,000 52,500,000 -10,500,000 2 a. If the company requires a return of 11 percent on its investments, what is the NPV of the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. Compute the IRRs for this project. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Enter the larger IRR in the first answer box and the smaller IRR in the second answer box. If you can only calculate one IRR, enter it in both boxes to receive partial credit. A negative answer should have a minus sign.) $ 33,297,297.30 a. NPV b. Larger IRR Smaller IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts