Question: can someone please tell me how to do the work for this question I just do not understand? Question 4 0 / 1 pts You

can someone please tell me how to do the work for this question I just do not understand?

can someone please tell me how to do the work for this question I just do not understand?

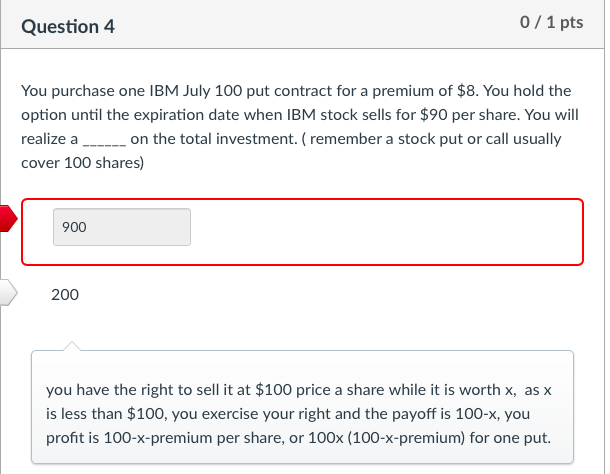

Question 4 0 / 1 pts You purchase one IBM July 100 put contract for a premium of $8. You hold the option until the expiration date when IBM stock sells for $90 per share. You will realize a ------ on the total investment. ( remember a stock put or call usually cover 100 shares) 900 200 you have the right to sell it at $100 price a share while it is worth x, as x is less than $100, you exercise your right and the payoff is 100-x, you profit is 100-x-premium per share, or 100x (100-x-premium) for one put

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock