Question: can someone pls help ?? its all on EXCEL Part 2 Minimum Variance and Tangent Portfolios Instruction: You have two customers that have different tastes

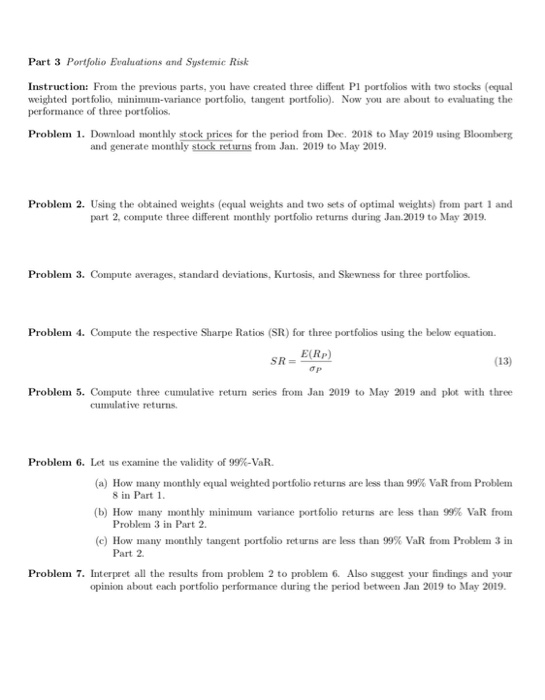

Part 2 Minimum Variance and Tangent Portfolios Instruction: You have two customers that have different tastes of risk. The first customer is a risk averter who find the way of minimizing investment risk. The other customer is a kind of person who taking affordable risk that makes a risk adjusted return. Your boss asks you to find optimal weights of investments satisfying their risk-preferences. Problem 1. Using the first portfolio, find out optimal weights that minimizes the portfolio standard devi- ation (Minimum Variance Portfolio). min WAAPLMSFT subject to WAAPL 20 (11) MSFT 20 AAPL+ MSFT! Problem 2. Using the first portfolio, find out optimal weights that maximizing the portfolio standard deviation (Tangent Portfolio). E(R) max AAPL MSPT subject to AAPL 20 (12) MSFT 20 AAPL+MSFT 1 Problem 3. Compute 99%-VaR amd ES for the minimum variance portfolio and tangent portfolio and explain these values Part 3 Portfolio Evaluations and Systemic Risk Instruction: From the previous parts, you have created three diffent Pl portfolios with two stocks (equal weighted port folio, minimum-variance portfolio, tangent portfolio). Now you are about to evaluating the performance of three portfolios. Problem 1. Donload mont hly stock prices for the period from Dec. 2018 to May 2019 using Bloomberg and generate monthly stock returns from Jan. 2019 to May 2019 Problem 2. Using the obtained weights (equal weights and two sets of optimal weights) from part 1 and part 2, compute three different monthly portfolio returns during Jan.2019 to May 2019. Problem 3. Compute averages, standard deviations, Kurtosis, and Skewness for three portfolios Problem 4. Compute the respective Sharpe Ratios (SR) for three portfolios using the below equation. E(Rp) SR= (13) Problem 5. Compute three cumulative retun series from Jan 2019 to May 2019 and plot with three cumulative returns Problem 6. Let us examine the validity of 99% - VaR. (a) How many monthly equal weighted portfolio returns are less than 99% VaR from Problem 8 in Part 1 (b) How many mont hly minimum variance portfolio returns are less than 99% VaR from Problem 3 in Part 2 (c) How many monthly tangent portfolio returns are less than 99% VaR from Problem 3 in Part 2 Problem 7. Interpret all the results from problem 2 to problem 6. Also suggest your findings and your opinion about each portfolio performance during the period between Jan 2019 to May 2019. Part 2 Minimum Variance and Tangent Portfolios Instruction: You have two customers that have different tastes of risk. The first customer is a risk averter who find the way of minimizing investment risk. The other customer is a kind of person who taking affordable risk that makes a risk adjusted return. Your boss asks you to find optimal weights of investments satisfying their risk-preferences. Problem 1. Using the first portfolio, find out optimal weights that minimizes the portfolio standard devi- ation (Minimum Variance Portfolio). min WAAPLMSFT subject to WAAPL 20 (11) MSFT 20 AAPL+ MSFT! Problem 2. Using the first portfolio, find out optimal weights that maximizing the portfolio standard deviation (Tangent Portfolio). E(R) max AAPL MSPT subject to AAPL 20 (12) MSFT 20 AAPL+MSFT 1 Problem 3. Compute 99%-VaR amd ES for the minimum variance portfolio and tangent portfolio and explain these values Part 3 Portfolio Evaluations and Systemic Risk Instruction: From the previous parts, you have created three diffent Pl portfolios with two stocks (equal weighted port folio, minimum-variance portfolio, tangent portfolio). Now you are about to evaluating the performance of three portfolios. Problem 1. Donload mont hly stock prices for the period from Dec. 2018 to May 2019 using Bloomberg and generate monthly stock returns from Jan. 2019 to May 2019 Problem 2. Using the obtained weights (equal weights and two sets of optimal weights) from part 1 and part 2, compute three different monthly portfolio returns during Jan.2019 to May 2019. Problem 3. Compute averages, standard deviations, Kurtosis, and Skewness for three portfolios Problem 4. Compute the respective Sharpe Ratios (SR) for three portfolios using the below equation. E(Rp) SR= (13) Problem 5. Compute three cumulative retun series from Jan 2019 to May 2019 and plot with three cumulative returns Problem 6. Let us examine the validity of 99% - VaR. (a) How many monthly equal weighted portfolio returns are less than 99% VaR from Problem 8 in Part 1 (b) How many mont hly minimum variance portfolio returns are less than 99% VaR from Problem 3 in Part 2 (c) How many monthly tangent portfolio returns are less than 99% VaR from Problem 3 in Part 2 Problem 7. Interpret all the results from problem 2 to problem 6. Also suggest your findings and your opinion about each portfolio performance during the period between Jan 2019 to May 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts