Question: Can someone pls help me answer this question as soon as possible :) pls show work and formulas, NO EXCEL PLSS ! ! ! !

Can someone pls help me answer this question as soon as possible :) pls show work and formulas, NO EXCEL PLSS :

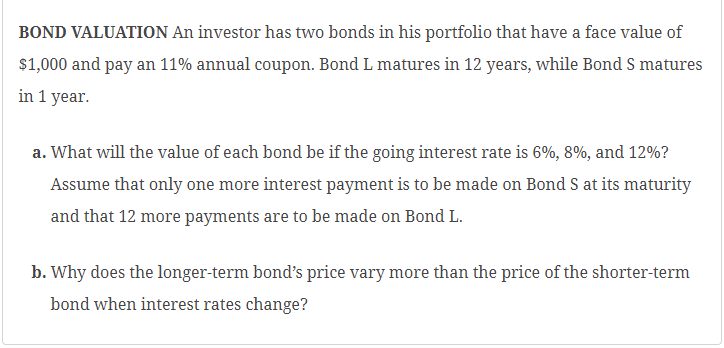

BOND VALUATION An investor has two bonds in his portfolio that have a face value of

$ and pay an annual coupon. Bond L matures in years, while Bond S matures

in year.

a What will the value of each bond be if the going interest rate is and

Assume that only one more interest payment is to be made on Bond at its maturity

and that more payments are to be made on Bond

b Why does the longerterm bond's price vary more than the price of the shorterterm

bond when interest rates change?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock