Question: Can someone show me how to do this without using excel and explain in detail? Thank you! 8. Modified internal rate of return (MIRR) The

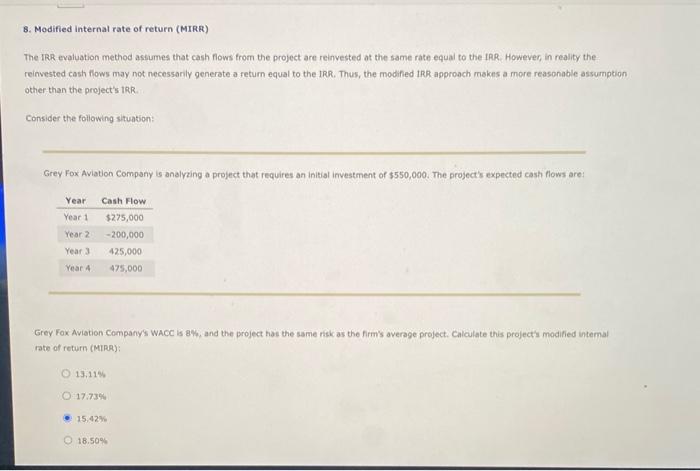

8. Modified internal rate of return (MIRR) The IRR evaluation method astumes that cash fows from the project are reinvested at the same rate equal to the IRR. However in reality the reinvested cash flows may not necessarily generate a feturn equal to the IRR. Thus, the modifed IRR approach makes a more reasonable assumption other than the project's inR. Consider the following situation: Grey Fox Aviation Company is analyzing a project that requires an initial investment of $550,000. The project's expected cash flows are: Grey Fox Aviation Companyss WACc is g\%w, and the project has the same risk as the firm's average project. Calculate this project's modified intemal rate of return (MIRR) 13,11% 17.739 15.42% 18.50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts