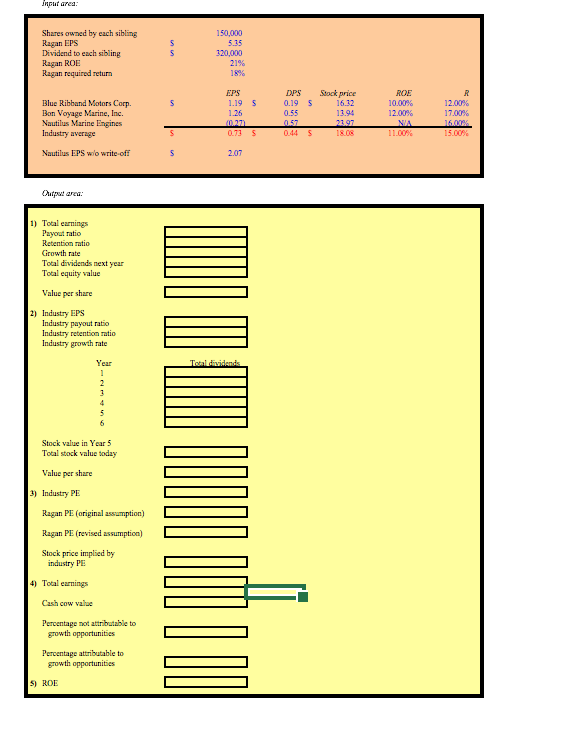

Question: Can someone show me how to solve this using excel formulas? Trout area: Shares owned by cach sibling Ragan EPS Dividend to each sibling Ragan

Can someone show me how to solve this using excel formulas?

Trout area: Shares owned by cach sibling Ragan EPS Dividend to each sibling Ragan ROE Ragan required return 150,000 5.15 320,000 21% 18% S EPS 1.19 S 1.26 021 0.735 Blue Ribbund Motors Corp. Bon Voyage Marine, Inc. Nautilus Marine Engines Industry average DPS 0.195 0.55 0.57 0.44 $ Sock price 16.12 13.94 21.97 1&OS ROE 10.00% 12.00% NA 11.00% R 12.00% 17.00% 15.00% Nautilus EPS wo write of! S 2.07 Ourul are: 1) Total earnings Payout ratio Retention ratio Growth rate Total dividends next year Total equity value Value per share 2) Industry EPS Industry payout ratio Industry retention ratio Industry growth rate Til dividende Year 1 2 3 Stock value in Year 5 Total stock value today Value per share DODOO 3) Industry PE Ragan PE (original assumption) Ragan PE (revised assumption) Stock price implied by industry PE 4) Total earnings Cash cow value Percentage not attributable to growth opportunities Percentage attributable to growth opportunities S ROE Trout area: Shares owned by cach sibling Ragan EPS Dividend to each sibling Ragan ROE Ragan required return 150,000 5.15 320,000 21% 18% S EPS 1.19 S 1.26 021 0.735 Blue Ribbund Motors Corp. Bon Voyage Marine, Inc. Nautilus Marine Engines Industry average DPS 0.195 0.55 0.57 0.44 $ Sock price 16.12 13.94 21.97 1&OS ROE 10.00% 12.00% NA 11.00% R 12.00% 17.00% 15.00% Nautilus EPS wo write of! S 2.07 Ourul are: 1) Total earnings Payout ratio Retention ratio Growth rate Total dividends next year Total equity value Value per share 2) Industry EPS Industry payout ratio Industry retention ratio Industry growth rate Til dividende Year 1 2 3 Stock value in Year 5 Total stock value today Value per share DODOO 3) Industry PE Ragan PE (original assumption) Ragan PE (revised assumption) Stock price implied by industry PE 4) Total earnings Cash cow value Percentage not attributable to growth opportunities Percentage attributable to growth opportunities S ROE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts