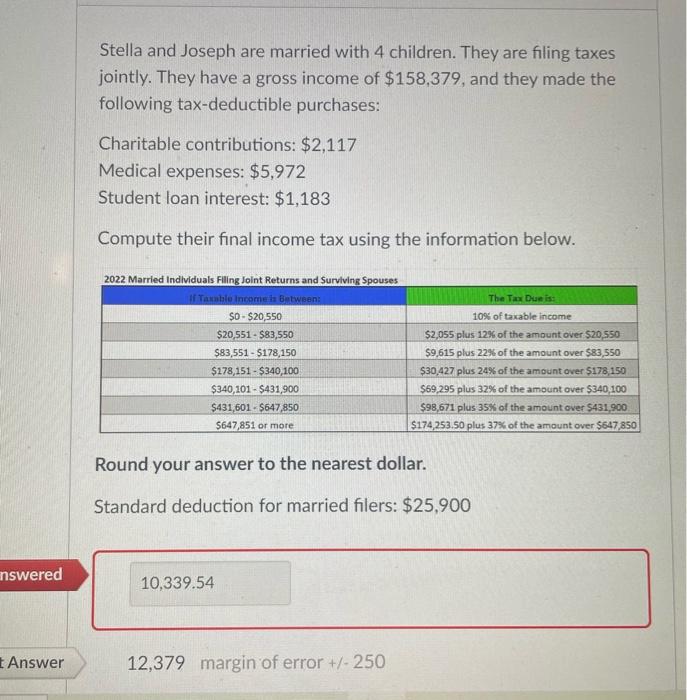

Question: can someone show me the work the correct answer is 12,379 Stella and Joseph are married with 4 children. They are filing taxes jointly. They

Stella and Joseph are married with 4 children. They are filing taxes jointly. They have a gross income of $158,379, and they made the following tax-deductible purchases: Charitable contributions: $2,117 Medical expenses: $5,972 Student loan interest: $1,183 Compute their final income tax using the information below. Round your answer to the nearest dollar. Standard deduction for married filers: $25,900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts