Question: Can someone show the step by step calculation? - FIN 442 Investments HOMEWORK ASSIGNMENT # 2 Part a: Based on the following information, calculate the

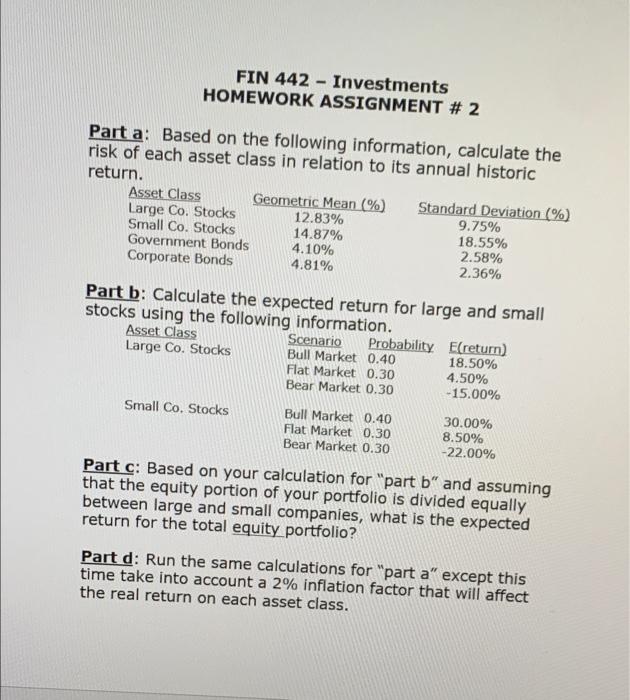

- FIN 442 Investments HOMEWORK ASSIGNMENT # 2 Part a: Based on the following information, calculate the risk of each asset class in relation to its annual historic return. Asset Class Geometric Mean (%) Standard Deviation (%) Large Co. Stocks 12.83% 9.75% Small Co. Stocks 14.87% 18.55% Government Bonds 4.10% 2.58% Corporate Bonds 4.81% 2.36% Part b: Calculate the expected return for large and small stocks using the following information. Asset Class Scenario Probability (return) Large Co. Stocks Bull Market 0.40 18.50% Flat Market 0.30 4.50% Bear Market 0.30 -15.00% Small Co. Stocks Bull Market 0.40 30.00% Flat Market 0.30 8.50% Bear Market 0.30 -22.00% Part c: Based on your calculation for "part b" and assuming that the equity portion of your portfolio is divided equally between large and small companies, what is the expected return for the total equity portfolio? Part d: Run the same calculations for "part a" except this time take into account a 2% inflation factor that will affect the real return on each asset class. - FIN 442 Investments HOMEWORK ASSIGNMENT # 2 Part a: Based on the following information, calculate the risk of each asset class in relation to its annual historic return. Asset Class Geometric Mean (%) Standard Deviation (%) Large Co. Stocks 12.83% 9.75% Small Co. Stocks 14.87% 18.55% Government Bonds 4.10% 2.58% Corporate Bonds 4.81% 2.36% Part b: Calculate the expected return for large and small stocks using the following information. Asset Class Scenario Probability (return) Large Co. Stocks Bull Market 0.40 18.50% Flat Market 0.30 4.50% Bear Market 0.30 -15.00% Small Co. Stocks Bull Market 0.40 30.00% Flat Market 0.30 8.50% Bear Market 0.30 -22.00% Part c: Based on your calculation for "part b" and assuming that the equity portion of your portfolio is divided equally between large and small companies, what is the expected return for the total equity portfolio? Part d: Run the same calculations for "part a" except this time take into account a 2% inflation factor that will affect the real return on each asset class

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts