Question: Can someone solve this on paper step by step for me? Your manager is proposing a new investment. If the company pursues the investment, it

Can someone solve this on paper step by step for me?

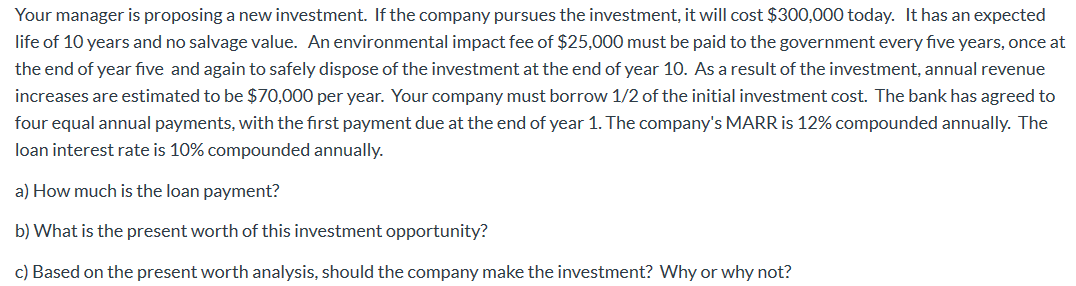

Your manager is proposing a new investment. If the company pursues the investment, it will cost $300,000 today. It has an expected life of 10 years and no salvage value. An environmental impact fee of $25,000 must be paid to the government every five years, once at the end of year five and again to safely dispose of the investment at the end of year 10. As a result of the investment, annual revenue increases are estimated to be $70,000 per year. Your company must borrow 1/2 of the initial investment cost. The bank has agreed to four equal annual payments, with the first payment due at the end of year 1. The company's MARR is 12% compounded annually. The loan interest rate is 10% compounded annually. a) How much is the loan payment? b) What is the present worth of this investment opportunity? c) Based on the present worth analysis, should the company make the investment? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts