Question: can someone solve this please Presented below is information related to the defined benefit pension plan of Swiss Chard Ltd. for the year 2021 The

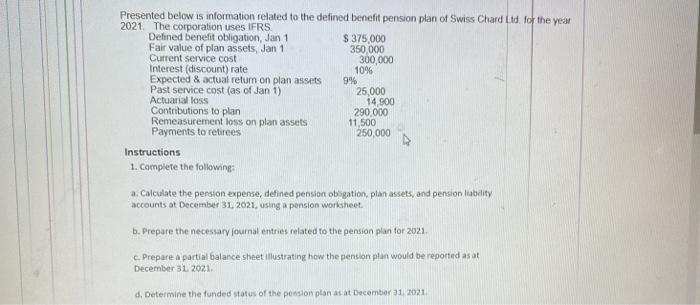

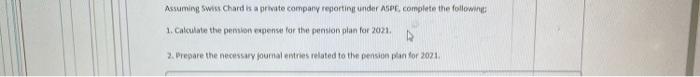

Presented below is information related to the defined benefit pension plan of Swiss Chard Ltd. for the year 2021 The corporation uses IFRS Defined benefit obligation, Jan 1 $375,000 Fair value of plan assets, Jan 1 350,000 Current service cost 300,000 Interest (discount) rate 10% Expected & actual retum on plan assets 9% Past service cost (as of Jan 1) 25,000 Actuarial loss 14.900 Contributions to plan 290,000 Remeasurement loss on plan assets 11,500 Payments to retirees 250,000 Instructions 1. Complete the following a. Calculate the pension expense, defined pension obligation, plan assets, and pension liability accounts at December 31, 2021, using a pension worksheet. b. Prepare the necessary fournal ents related to the pension plan for 2021 c. Prepare a partial balance sheet illustrating how the pension plan would be reported as at December 31, 2021 d. Determine the funded status of the pension plans at December 31, 2021 Assuming swiChard is a private company reporting under ASPE, complete the following 1. Calculate the pension expense for the pension plan for 2021 2. Prepare the necessary foumal entries related to the pension plan for 2021. Presented below is information related to the defined benefit pension plan of Swiss Chard Ltd. for the year 2021 The corporation uses IFRS Defined benefit obligation, Jan 1 $375,000 Fair value of plan assets, Jan 1 350,000 Current service cost 300,000 Interest (discount) rate 10% Expected & actual retum on plan assets 9% Past service cost (as of Jan 1) 25,000 Actuarial loss 14.900 Contributions to plan 290,000 Remeasurement loss on plan assets 11,500 Payments to retirees 250,000 Instructions 1. Complete the following a. Calculate the pension expense, defined pension obligation, plan assets, and pension liability accounts at December 31, 2021, using a pension worksheet. b. Prepare the necessary fournal ents related to the pension plan for 2021 c. Prepare a partial balance sheet illustrating how the pension plan would be reported as at December 31, 2021 d. Determine the funded status of the pension plans at December 31, 2021 Assuming swiChard is a private company reporting under ASPE, complete the following 1. Calculate the pension expense for the pension plan for 2021 2. Prepare the necessary foumal entries related to the pension plan for 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts