Question: can someone solve this question for me i really need answer for this question asap, thankyou Instructions: The following information is a hypothetical exercise examining

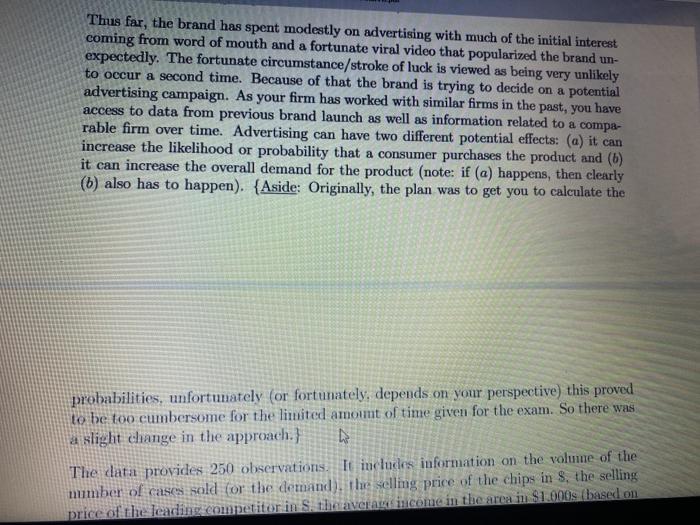

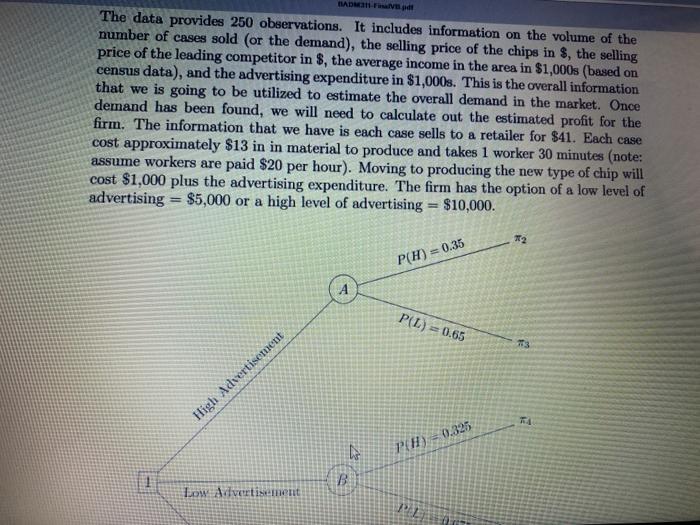

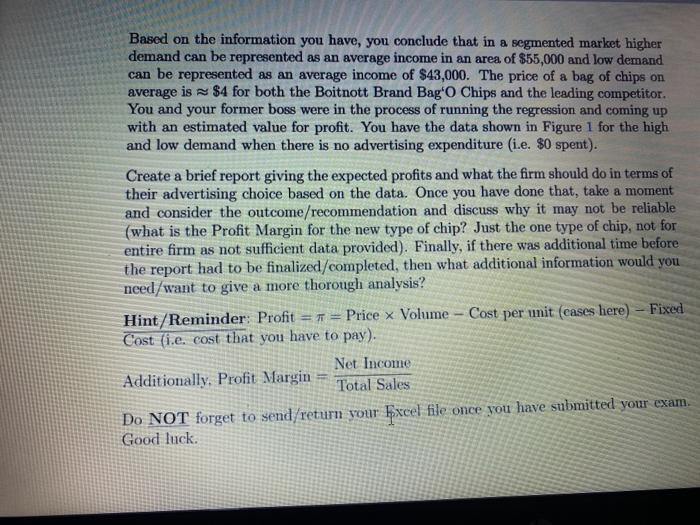

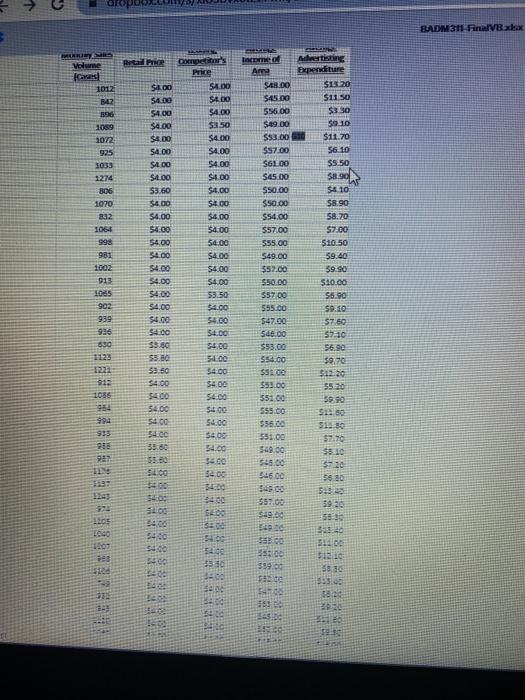

Instructions: The following information is a hypothetical exercise examining devel- oping a report to provide some insight into the possible success of introducing Celtic Sea Salt Chips by Boitnott Brand Bag'o Chips. Your firm has been hired to provide analysis of the situation. You have been working closely with your boss on developing an insight into the market and the possible consumer demand. The bad news is that the report needs to be finalized and your boss just took a better job opportunity at an alternative firm. Your boss's boss has suggested that you can finalize the report on your own. Boitnott Brand Bag'o Chips successfully launched a plain potato chip in 2018, by 2020 the profit margin for the simple potato chip was approximately 17%. This margin is slightly higher than the average and much higher than most smaller/local producers. In general, larger brands expect a profit margin around 15-16% with smaller brands generally only able to achieve a margin of 12-13%. Due to the success the firm's CEO Rachel Boitnott has decided to explore the introduction of alternative flavours to cap- ture new customers and help maintain market share in the area. This would represent the first flavoured" option for the firm in this market. The current production is steady with the a suggestion that the brand may be losing some appeal and likely to have smaller margins if it selects not to innovate/expand into new options To produce the chips, Boitnott Brand Bag O Chips will be need to make adjustments to their cur- rent production with an overall expected increase in labour cost as the firm will need to introduce another shift to meet the potential demand (note: shift size will depend on type of sales and are mainly related to labour/training which is significantly easier to adjust that having to purchase new machines). Thus far, the brand has spent modestly on advertising with much of the initial interest coming from word of mouth and a fortunate viral video that popularized the brand um- Thus far, the brand has spent modestly on advertising with much of the initial interest coming from word of mouth and a fortunate viral video that popularized the brand un- expectedly. The fortunate circumstance/stroke of luck is viewed as being very unlikely to occur a second time. Because of that the brand is trying to decide on a potential advertising campaign. As your firm has worked with similar firms in the past, you have access to data from previous brand launch as well as information related to a compa- rable firm over time. Advertising can have two different potential effects: (a) it can increase the likelihood or probability that a consumer purchases the product and (b) it can increase the overall demand for the product (note: if (a) happens, then clearly (b) also has to happen). {Aside: Originally, the plan was to get you to calculate the probabilities, unfortunately (or fortunately, depends on your perspective) this proved to be too cumbersome for the limited amount of time given for the exam. So there was a slight change in the approach.} h The data provides 250 observations. It includes information on the volume of the number of cases sold for the demand) the selling price of the chips in 8, the selling price of the leading competitor in the vera income in the area in $1.000 (based on t rt The data provides 250 observations. It includes information on the volume of the number of cases sold (or the demand), the selling price of the chips in $, the selling price of the leading competitor in $, the average income in the area in $1,000s (based on census data), and the advertising expenditure in $1,000s. This is the overall information that we is going to be utilized to estimate the overall demand in the market. Once demand has been found, we will need to calculate out the estimated profit for the firm. The information that we have is each case sells to a retailer for $41. Each case cost approximately $13 in in material to produce and takes 1 worker 30 minutes (note: assume workers are paid $20 per hour). Moving to producing the new type of chip will cost $1,000 plus the advertising expenditure. The firm has the option of a low level of advertising = $5,000 or a high level of advertising = $10,000. T2 P(H) = 0.35 P(L) = 0.65 773 High Advertisement 4 PH) = 0.325 B Low Advertisement Pez 22 P(H) = 0.35 P(L) = 0.65 High Advertisement PH) = 0.325 1 Low Advertisement B P(L) = 0.675 No Advertisement $15.722 PH)=0.30 P0.70 T=813.058 Based on the information you have, you conclude that in a segmented market higher demand can be represented as an average income in an area of $55,000 and low demand can be represented as an average income of $43,000. The price of a bag of chips on average is $4 for both the Boitnott Brand Bag'o Chips and the leading competitor. You and your former boss were in the process of running the regression and coming up with an estimated value for profit. You have the data shown in Figure 1 for the high and low demand when there is no advertising expenditure (i.e. $0 spent). Create a brief report giving the expected profits and what the firm should do in terms of their advertising choice based on the data. Once you have done that, take a moment and consider the outcome/recommendation and discuss why it may not be reliable (what is the Profit Margin for the new type of chip? Just the one type of chip, not for entire firm as not sufficient data provided). Finally, if there was additional time before the report had to be finalized/completed, then what additional information would you need/want to give a more thorough analysis? Hint/Reminder: Profit = = Price x Volume - Cost per unit (eases here) - Fixed Cost (i.e. cost that you have to pay). Net Income Additionally. Profit Margin Total Sales Do NOT forget to send/return vour Excel file once you have submitted your exam. Good luck BADM 311 FinalVxbox 3 Volume Fas 1012 542 896 1059 2072 925 1033 1274 806 1070 832 1065 998 981 10 Ritale Donction Price $4.00 SALDO 54.00 St.DO 54.00 34.00 $4.00 $350 $4.00 $4.00 54.00 $4.00 $4.00 54.00 $1.00 $4.00 $3.60 $4.00 $4.00 $4.00 $4.00 $4.00 $4.00 $4.00 54.00 5400 34.00 $4.00 54.00 $4.00 $4.00 $4.00 $4.00 53.50 54.00 $4.00 54.00 54.00 $4.00 34.00 53.80 54.00 55.80 SEC 34.00 34.00 $4.00 S400 5400 54.00 54.00 $4.00 5400 3400 TACO Advertising Experiture $1.00 $13.20 $45.00 $11.50 556.00 $330 $49.00 $9.10 $3.000 $11.70 $57.00 56 10 S61.00 $5.50 $45.00 $8.90 LAS $50.00 56 10 $50.00 $8.90 $54.00 58.70 $57.00 57.00 $55.00 510:50 $49.00 59.40 $57.00 39.90 550.DO $10.00 $57.00 55.90 555.00 59.10 $47.00 $7.50 546.00 5.10 553.00 56.90 554.co 58.70 SS. SA220 352.00 55100 555.00 500 $35.00 S1.50 351.00 52.70 $49.00 545.00 $45.00 $5.30 113 1065 902 939 926 830 1123 1086 933 288 54.00 55.00 32.00 3510 3120 2466 5400 3920 557.00 S49. ECO 12s LOGO 33349 512 2000 140 350 300 23:00 599.00 00 3.30 58 15 2312 Instructions: The following information is a hypothetical exercise examining devel- oping a report to provide some insight into the possible success of introducing Celtic Sea Salt Chips by Boitnott Brand Bag'o Chips. Your firm has been hired to provide analysis of the situation. You have been working closely with your boss on developing an insight into the market and the possible consumer demand. The bad news is that the report needs to be finalized and your boss just took a better job opportunity at an alternative firm. Your boss's boss has suggested that you can finalize the report on your own. Boitnott Brand Bag'o Chips successfully launched a plain potato chip in 2018, by 2020 the profit margin for the simple potato chip was approximately 17%. This margin is slightly higher than the average and much higher than most smaller/local producers. In general, larger brands expect a profit margin around 15-16% with smaller brands generally only able to achieve a margin of 12-13%. Due to the success the firm's CEO Rachel Boitnott has decided to explore the introduction of alternative flavours to cap- ture new customers and help maintain market share in the area. This would represent the first flavoured" option for the firm in this market. The current production is steady with the a suggestion that the brand may be losing some appeal and likely to have smaller margins if it selects not to innovate/expand into new options To produce the chips, Boitnott Brand Bag O Chips will be need to make adjustments to their cur- rent production with an overall expected increase in labour cost as the firm will need to introduce another shift to meet the potential demand (note: shift size will depend on type of sales and are mainly related to labour/training which is significantly easier to adjust that having to purchase new machines). Thus far, the brand has spent modestly on advertising with much of the initial interest coming from word of mouth and a fortunate viral video that popularized the brand um- Thus far, the brand has spent modestly on advertising with much of the initial interest coming from word of mouth and a fortunate viral video that popularized the brand un- expectedly. The fortunate circumstance/stroke of luck is viewed as being very unlikely to occur a second time. Because of that the brand is trying to decide on a potential advertising campaign. As your firm has worked with similar firms in the past, you have access to data from previous brand launch as well as information related to a compa- rable firm over time. Advertising can have two different potential effects: (a) it can increase the likelihood or probability that a consumer purchases the product and (b) it can increase the overall demand for the product (note: if (a) happens, then clearly (b) also has to happen). {Aside: Originally, the plan was to get you to calculate the probabilities, unfortunately (or fortunately, depends on your perspective) this proved to be too cumbersome for the limited amount of time given for the exam. So there was a slight change in the approach.} h The data provides 250 observations. It includes information on the volume of the number of cases sold for the demand) the selling price of the chips in 8, the selling price of the leading competitor in the vera income in the area in $1.000 (based on t rt The data provides 250 observations. It includes information on the volume of the number of cases sold (or the demand), the selling price of the chips in $, the selling price of the leading competitor in $, the average income in the area in $1,000s (based on census data), and the advertising expenditure in $1,000s. This is the overall information that we is going to be utilized to estimate the overall demand in the market. Once demand has been found, we will need to calculate out the estimated profit for the firm. The information that we have is each case sells to a retailer for $41. Each case cost approximately $13 in in material to produce and takes 1 worker 30 minutes (note: assume workers are paid $20 per hour). Moving to producing the new type of chip will cost $1,000 plus the advertising expenditure. The firm has the option of a low level of advertising = $5,000 or a high level of advertising = $10,000. T2 P(H) = 0.35 P(L) = 0.65 773 High Advertisement 4 PH) = 0.325 B Low Advertisement Pez 22 P(H) = 0.35 P(L) = 0.65 High Advertisement PH) = 0.325 1 Low Advertisement B P(L) = 0.675 No Advertisement $15.722 PH)=0.30 P0.70 T=813.058 Based on the information you have, you conclude that in a segmented market higher demand can be represented as an average income in an area of $55,000 and low demand can be represented as an average income of $43,000. The price of a bag of chips on average is $4 for both the Boitnott Brand Bag'o Chips and the leading competitor. You and your former boss were in the process of running the regression and coming up with an estimated value for profit. You have the data shown in Figure 1 for the high and low demand when there is no advertising expenditure (i.e. $0 spent). Create a brief report giving the expected profits and what the firm should do in terms of their advertising choice based on the data. Once you have done that, take a moment and consider the outcome/recommendation and discuss why it may not be reliable (what is the Profit Margin for the new type of chip? Just the one type of chip, not for entire firm as not sufficient data provided). Finally, if there was additional time before the report had to be finalized/completed, then what additional information would you need/want to give a more thorough analysis? Hint/Reminder: Profit = = Price x Volume - Cost per unit (eases here) - Fixed Cost (i.e. cost that you have to pay). Net Income Additionally. Profit Margin Total Sales Do NOT forget to send/return vour Excel file once you have submitted your exam. Good luck BADM 311 FinalVxbox 3 Volume Fas 1012 542 896 1059 2072 925 1033 1274 806 1070 832 1065 998 981 10 Ritale Donction Price $4.00 SALDO 54.00 St.DO 54.00 34.00 $4.00 $350 $4.00 $4.00 54.00 $4.00 $4.00 54.00 $1.00 $4.00 $3.60 $4.00 $4.00 $4.00 $4.00 $4.00 $4.00 $4.00 54.00 5400 34.00 $4.00 54.00 $4.00 $4.00 $4.00 $4.00 53.50 54.00 $4.00 54.00 54.00 $4.00 34.00 53.80 54.00 55.80 SEC 34.00 34.00 $4.00 S400 5400 54.00 54.00 $4.00 5400 3400 TACO Advertising Experiture $1.00 $13.20 $45.00 $11.50 556.00 $330 $49.00 $9.10 $3.000 $11.70 $57.00 56 10 S61.00 $5.50 $45.00 $8.90 LAS $50.00 56 10 $50.00 $8.90 $54.00 58.70 $57.00 57.00 $55.00 510:50 $49.00 59.40 $57.00 39.90 550.DO $10.00 $57.00 55.90 555.00 59.10 $47.00 $7.50 546.00 5.10 553.00 56.90 554.co 58.70 SS. SA220 352.00 55100 555.00 500 $35.00 S1.50 351.00 52.70 $49.00 545.00 $45.00 $5.30 113 1065 902 939 926 830 1123 1086 933 288 54.00 55.00 32.00 3510 3120 2466 5400 3920 557.00 S49. ECO 12s LOGO 33349 512 2000 140 350 300 23:00 599.00 00 3.30 58 15 2312

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts