Question: Can someone solve this using the TI-84 plus calculator? Using N= I%= PV= PMT= FV= P/Y= C/Y= You find the following Treasury bond quotes. To

Can someone solve this using the TI-84 plus calculator? Using

N=

I%=

PV=

PMT=

FV=

P/Y=

C/Y=

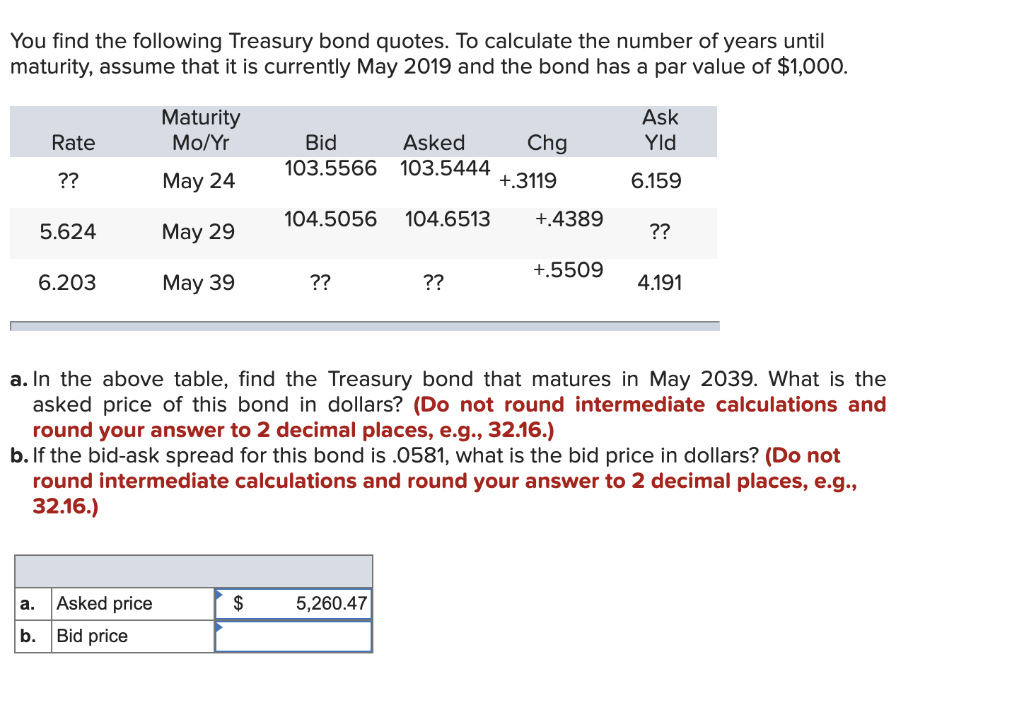

You find the following Treasury bond quotes. To calculate the number of years until maturity, assume that it is currently May 2019 and the bond has a par value of $1,000. Rate Maturity Mo/Yr May 24 ?? Ask Bid Asked Chg Yld 103.5566 103.5444 +.3119 6.159 104.5056 104.6513 +.438922 5.624 May 29 6.203 May 39 ?? ?? +.5509 4191 a. In the above table, find the Treasury bond that matures in May 2039. What is the asked price of this bond in dollars? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. If the bid-ask spread for this bond is .0581, what is the bid price in dollars? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) $ 5,260.47 a. Asked price b. Bid price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts