Question: can someone teach me how to work step by step please 1-Suppose you have the following information about country B. Yield on US 10-year Treasury

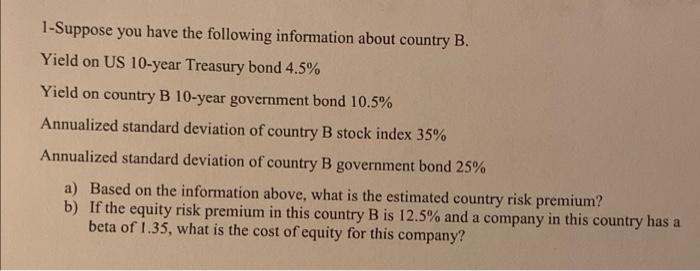

1-Suppose you have the following information about country B. Yield on US 10-year Treasury bond 4.5% Yield on country B 10-year government bond 10.5% Annualized standard deviation of country B stock index 35% Annualized standard deviation of country B government bond 25% a) Based on the information above, what is the estimated country risk premium? b) If the equity risk premium in this country B is 12.5% and a company in this country has a beta of 1.35, what is the cost of equity for this company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts