Question: Can someone type out how they got this answer please im very confused. Thank you Question 1 O out of 10 points Bonds issued by

Can someone type out how they got this answer please im very confused. Thank you

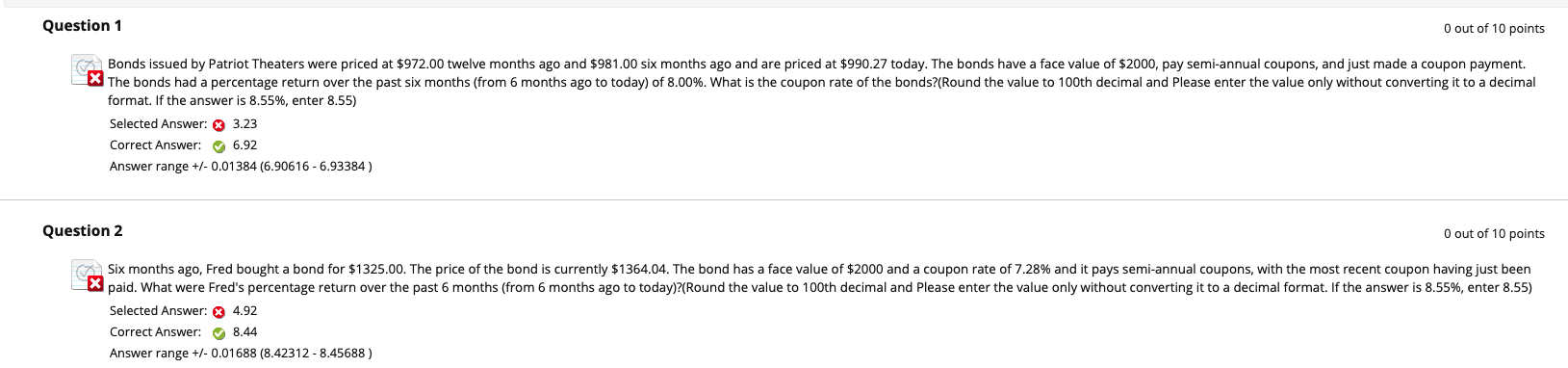

Question 1 O out of 10 points Bonds issued by Patriot Theaters were priced at $972.00 twelve months ago and $981.00 six months ago and are priced at $990.27 today. The bonds have a face value of $2000, pay semi-annual coupons, and just made a coupon payment. X The bonds had a percentage return over the past six months (from 6 months ago to today) of 8.00%. What is the coupon rate of the bonds?(round the value to 100th decimal and Please enter the value only without converting it to a decimal format. If the answer is 8.55%, enter 8.55) Selected Answer: 3.23 Correct Answer: 6.92 Answer range +/- 0.01384 (6.90616-6.93384) Question 2 O out of 10 points Six months ago, Fred bought a bond for $1325.00. The price of the bond is currently $1364.04. The bond has a face value of $2000 and a coupon rate of 7.28% and it pays semi-annual coupons, with the most recent coupon having just been paid. What were Fred's percentage return over the past 6 months (from 6 months ago to today)?(round the value to 100th decimal and Please enter the value only without converting it to a decimal format. If the answer is 8.55%, enter 8.55) Selected Answer: 4.92 Correct Answer: 8.44 Answer range +/- 0.01688 (8.42312 - 8.45688)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts