Question: Can the Fl immunize itself from interest rate risk exposure by setting the maturity gap equal to zero? A B No, but if the maturity

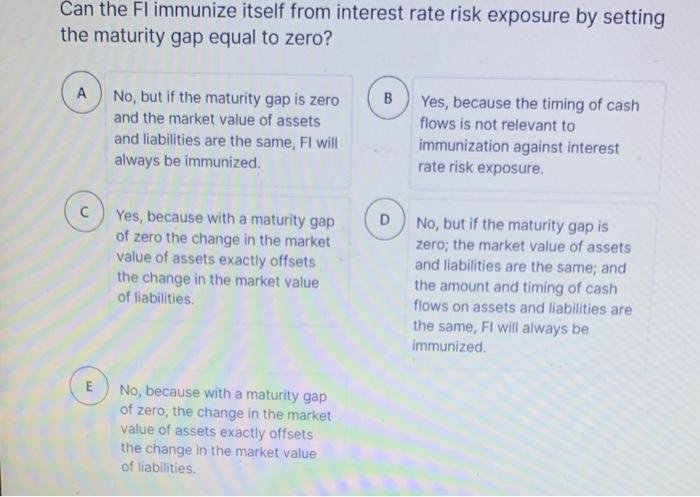

Can the Fl immunize itself from interest rate risk exposure by setting the maturity gap equal to zero? A B No, but if the maturity gap is zero and the market value of assets and liabilities are the same, Fl will always be immunized. Yes, because the timing of cash flows is not relevant to immunization against interest rate risk exposure. D Yes, because with a maturity gap of zero the change in the market value of assets exactly offsets the change in the market value of liabilities No, but if the maturity gap is zero; the market value of assets and liabilities are the same; and the amount and timing of cash flows on assets and liabilities are the same, FI will always be immunized. E No, because with a maturity gap of zero, the change in the market value of assets exactly offsets the change in the market value of liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts