Question: Can the problems be solved without formulas or a financial calculator? Simple math? Jameson, Inc. a. Required return of stockholders = 12.0% b. Just paid

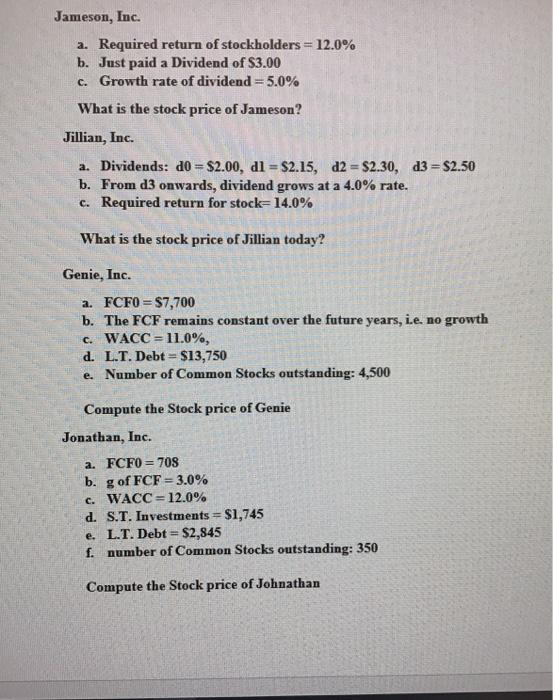

Jameson, Inc. a. Required return of stockholders = 12.0% b. Just paid a Dividend of S3.00 c. Growth rate of dividend=5.0% What is the stock price of Jameson? Jillian, Inc. a. Dividends: d0 = $2.00, di = $2.15, d2 = $2.30, d3 = $2.50 b. From d3 onwards, dividend grows at a 4.0% rate. c. Required return for stock=14.0% What is the stock price of Jillian today? Genie, Inc. a. FCFO = $7,700 b. The FCF remains constant over the future years, i.e. no growth c. WACC = 11.0%, d. L.T. Debt-$13,750 e. Number of Common Stocks outstanding: 4,500 Compute the Stock price of Genie Jonathan, Inc. a. FCF0= 708 b. g of FCF = 3.0% c. WACC = 12.0% d. S.T. Investments = $1,745 e. L.T. Debt = $2,845 f. number of Common Stocks outstanding: 350 Compute the Stock price of Johnathan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts