Question: can these be sloved using excel c. Determine the bond's price if foreign investors require a yield to maturity of 4.2% on euro bonds issued

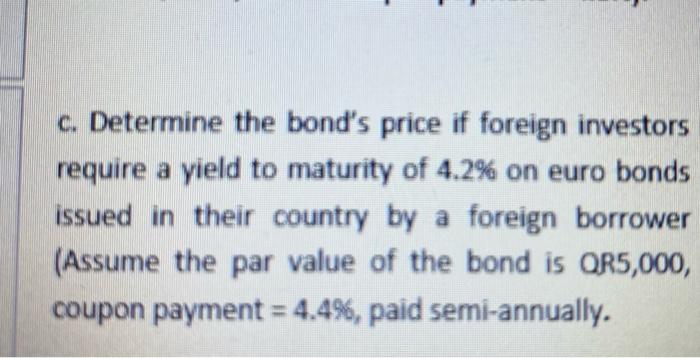

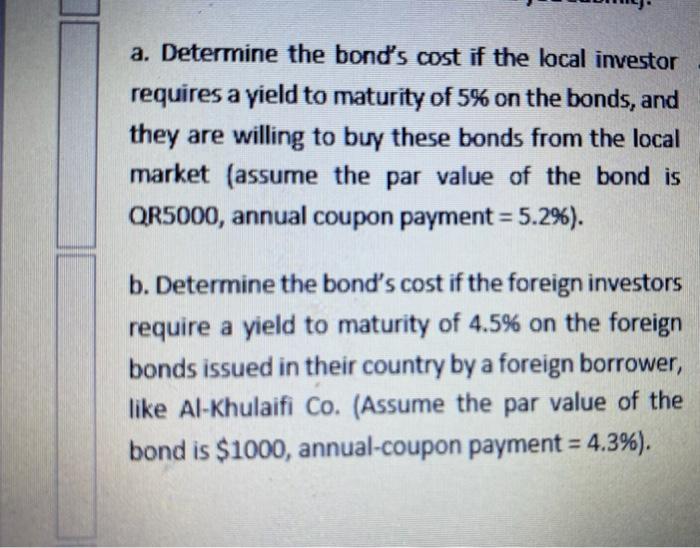

c. Determine the bond's price if foreign investors require a yield to maturity of 4.2% on euro bonds issued in their country by a foreign borrower (Assume the par value of the bond is OR5,000, coupon payment = 4.4%, paid semi-annually. a. Determine the bond's cost if the local investor requires a yield to maturity of 5% on the bonds, and they are willing to buy these bonds from the local market (assume the par value of the bond is QR5000, annual coupon payment = 5.2%). b. Determine the bond's cost if the foreign investors require a yield to maturity of 4.5% on the foreign bonds issued in their country by a foreign borrower, like Al-Khulaifi Co. (Assume the par value of the bond is $1000, annual-coupon payment = 4.3%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts