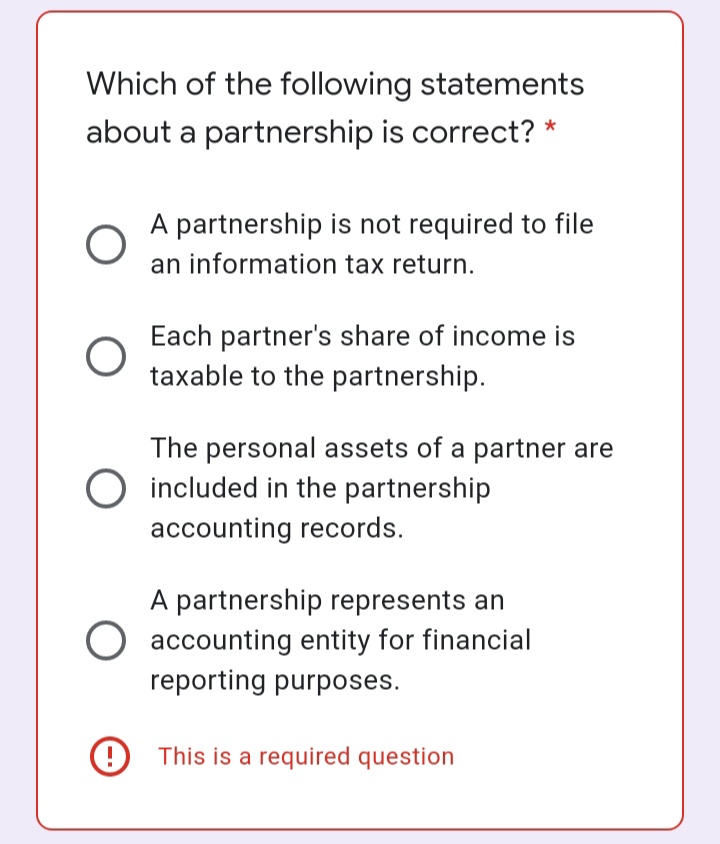

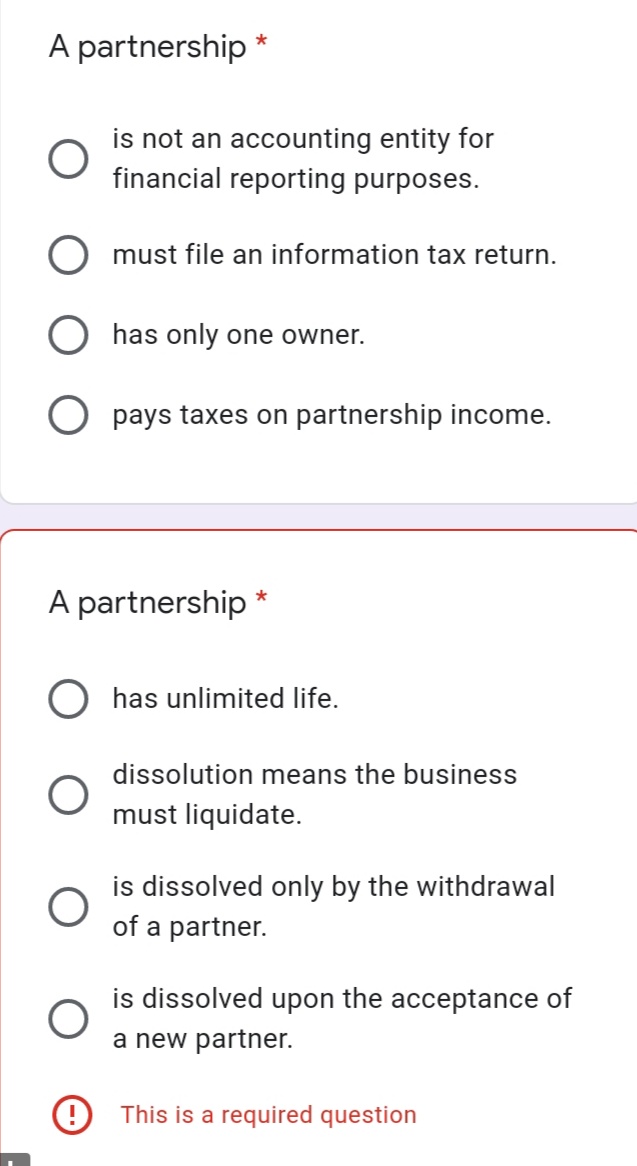

Question: Can tou answer within 2hours and 30min? Ineed the answer antill 2:30 pm Which of the following statements about a partnership is correct? * O

Can tou answer within 2hours and 30min? Ineed the answer antill 2:30 pm

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock