Question: can u abswer 7-1 abd 7-2 please PROBLEMS 7-1 Easy Problems 1-4 7-2 7-3 7-4 BOND VALUATION Callaghan Motors's bonds have 10 years remaining to

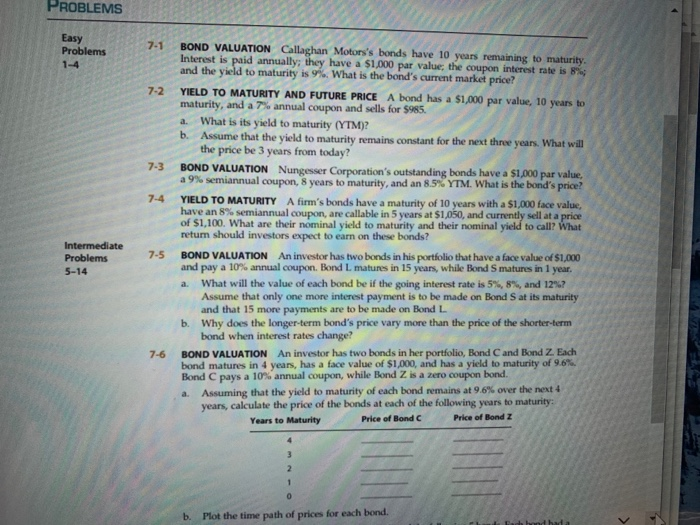

PROBLEMS 7-1 Easy Problems 1-4 7-2 7-3 7-4 BOND VALUATION Callaghan Motors's bonds have 10 years remaining to maturity. Interest is paid annually; they have a $1.000 par value the coupon interest rate is on and the yield to maturity is 9%. What is the bond's current market price? YIELD TO MATURITY AND FUTURE PRICE A bond has a $1,000 par value, 10 years to maturity, and a 7% annual coupon and sells for $985. a. What is its yield to maturity (YTM)? b. Assume that the yield to maturity remains constant for the next three years. What will the price be 3 years from today? BOND VALUATION Nungesser Corporation's outstanding bonds have a $1,000 par value, a 9% semiannual coupon, 8 years to maturity, and an 8.5% YTM. What is the bond's price? YIELD TO MATURITY A firm's bonds have a maturity of 10 years with a $1,000 face value, have an 8% semiannual coupon, are callable in 5 years at $1,050, and currently sell at a price of $1,100. What are their nominal yield to maturity and their nominal yield to call? What return should investors expect to earn on these bonds? BOND VALUATION An investor has two bonds in his portfolio that have a face value of $1,000 and pay a 10% annual coupon. Bond L matures in 15 years, while Bond S matures in 1 year. What will the value of each bond be if the going interest rate is 5%, 8%, and 12%? Assume that only one more interest payment is to be made on Bond S at its maturity and that 15 more payments are to be made on Bond L b. Why does the longer-term bond's price vary more than the price of the shorter-term bond when interest rates change? BOND VALUATION An investor has two bonds in her portfolio, Bond Cand Bond Z. Each bond matures in 4 years, has a face value of $1,000, and has a yield to maturity of 9.6%. Bond C pays a 10% annual coupon, while Bond Z is a zero coupon bond. a. Assuming that the yield to maturity of each bond remains at 9.6% over the next 4 years, calculate the price of the bonds at each of the following years to maturity Years to Maturity Price of Bond Intermediate Problems 5-14 7-5 7-6 Price of Bond Z 4 3 2 1 0 b. Plot the time path of prices for each bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts