Question: can u answer this. Hint:To solve this problem, remember we are figuring out how much he actually paid in taxes throughout the year (from paycheck

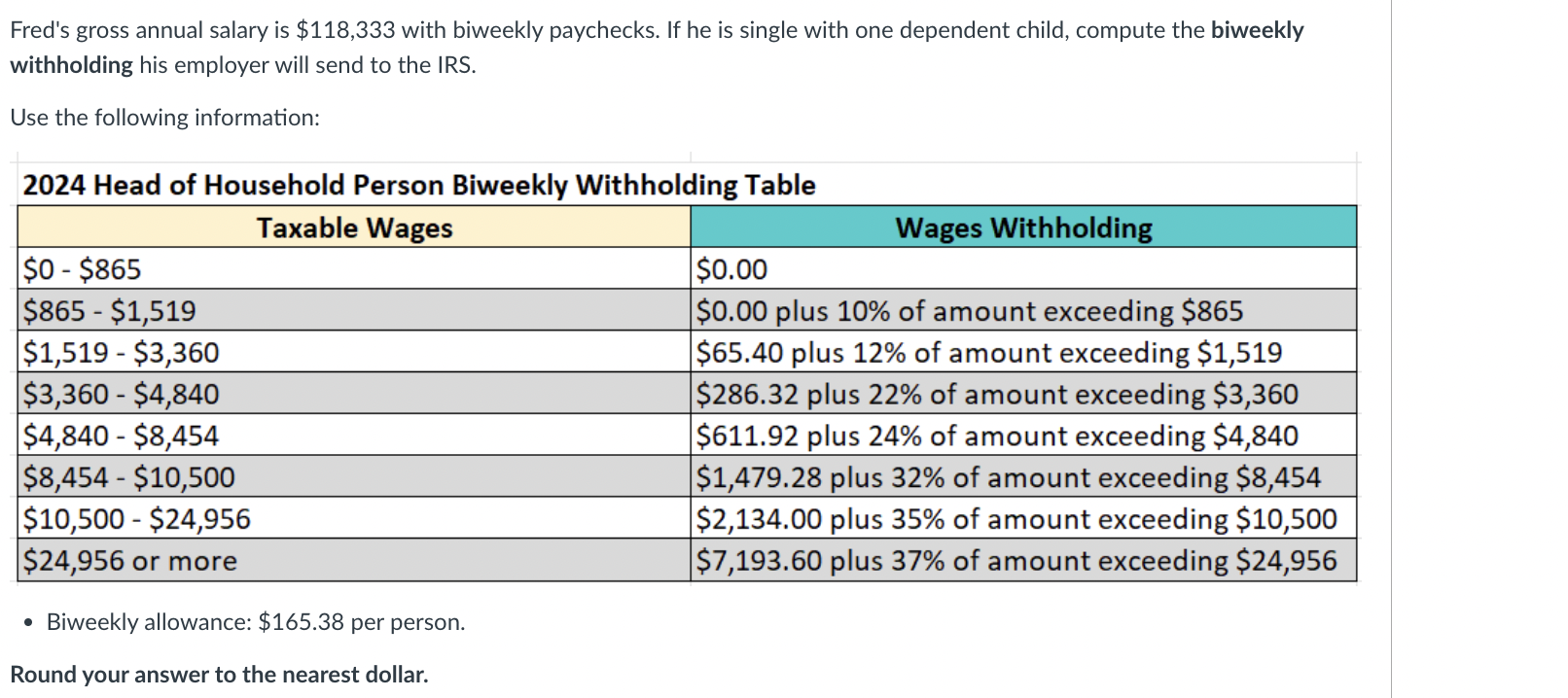

can u answer this. Hint:To solve this problem, remember we are figuring out how much he actually paid in taxes throughout the year (from paycheck withholdings). For that, you will need to compute the bi-weekly taxable wages. (Taxable wages = Gross paycheck - Allowances), and use it to compute the bi-weekly withholding.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts