Question: can u explained it's pls The following information has been extracted from the records of Bradbury Pty Ltd, which is a retailer of office stationery

can u explained it's pls

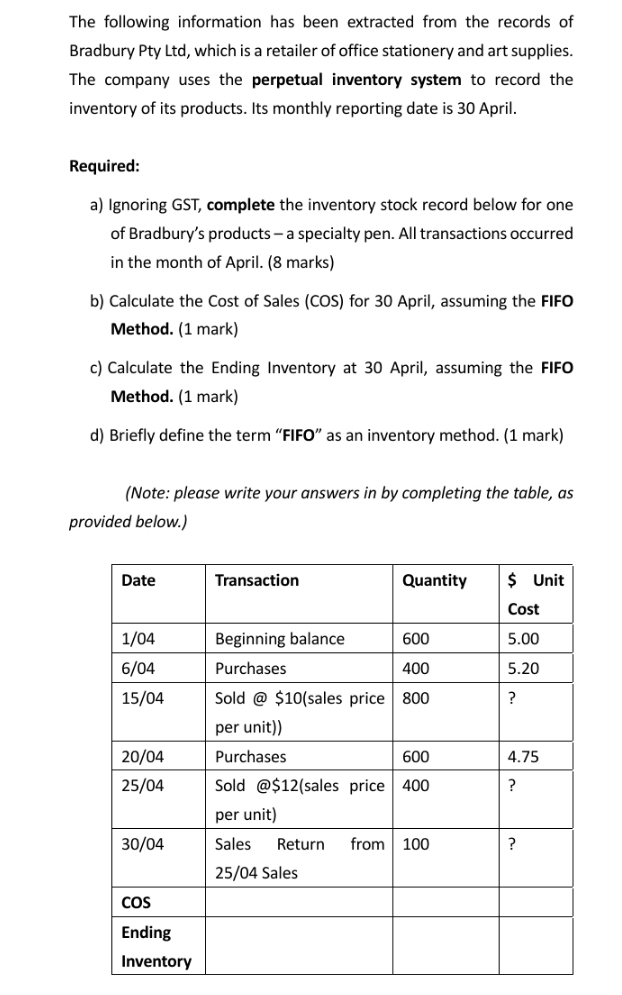

The following information has been extracted from the records of Bradbury Pty Ltd, which is a retailer of office stationery and art supplies. The company uses the perpetual inventory system to record the inventory of its products. Its monthly reporting date is 30 April. Required: a) Ignoring GST, complete the inventory stock record below for one of Bradbury's products - a specialty pen. All transactions occurred in the month of April. (8 marks) b) Calculate the Cost of Sales (COS) for 30 April, assuming the FIFO Method. (1 mark) c) Calculate the Ending Inventory at 30 April, assuming the FIFO Method. (1 mark) d) Briefly define the term "FIFO" as an inventory method. (1 mark) (Note: please write your answers in by completing the table, as provided below.) Date Transaction Quantity $ Unit Cost 1/04 Beginning balance 600 5.00 6/04 Purchases 400 5.20 15/04 Sold @ $10(sales price 800 2 per unit)) 20/04 Purchases 600 4.75 25/04 Sold @$12(sales price 400 ? per unit) 30/04 Sales Return from 100 ? 25/04 Sales COS Ending Inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts