Question: can u help me as soon as possible ? Exercise 2: On 1 of January 2020 the company purchased machinery for $90,000 The estimated salvage

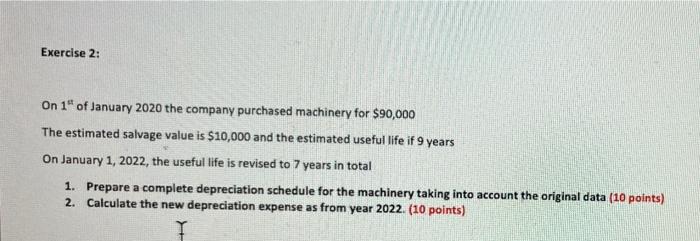

Exercise 2: On 1" of January 2020 the company purchased machinery for $90,000 The estimated salvage value is $10,000 and the estimated useful life if 9 years On January 1, 2022, the useful life is revised to 7 years in total 1. Prepare a complete depreciation schedule for the machinery taking into account the original data (10 points) 2. Calculate the new depreciation expense as from year 2022. (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts