Question: can u help me to know how to prepare master budget Metal Parts Inc. is preparing its monthly budget for 2024. The following estimates and

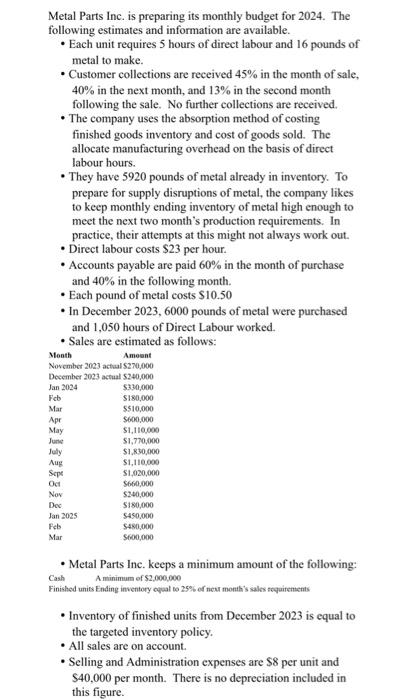

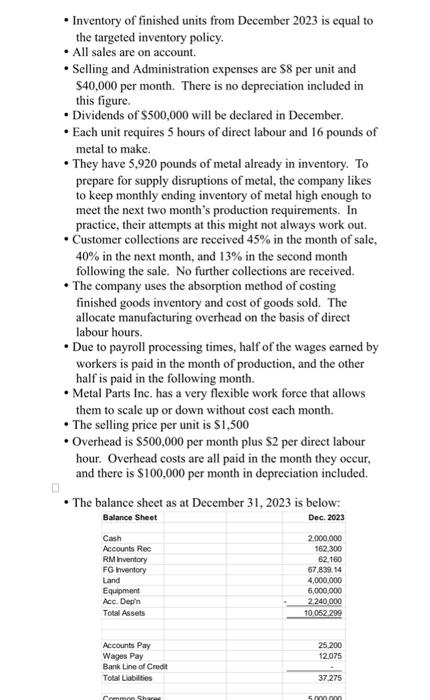

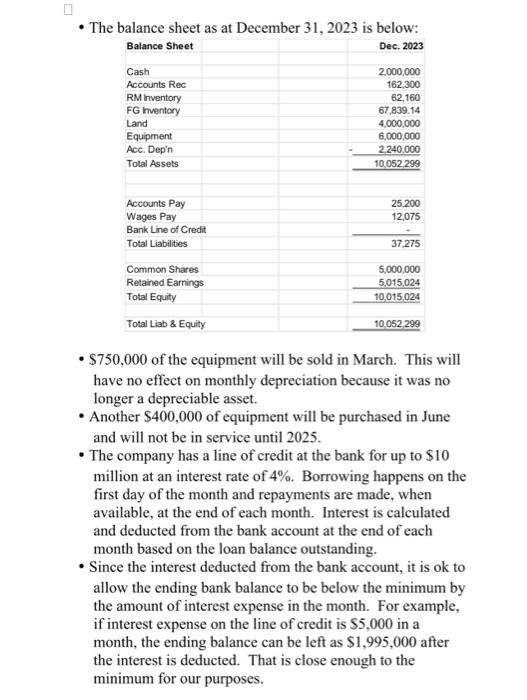

Metal Parts Inc. is preparing its monthly budget for 2024. The following estimates and information are available. - Each unit requires 5 hours of direct labour and 16 pounds of metal to make. - Customer collections are received 45% in the month of sale, 40% in the next month, and 13% in the second month following the sale. No further collections are received. - The company uses the absorption method of costing finished goods inventory and cost of goods sold. The allocate manufacturing overhead on the basis of direct labour hours. - They have 5920 pounds of metal already in inventory. To prepare for supply disruptions of metal, the company likes to keep monthly ending inventory of metal high enough to meet the next two month's production requirements. In practice, their attempts at this might not always work out. - Direct labour costs \$23 per hour. - Accounts payable are paid 60% in the month of purchase and 40% in the following month. - Each pound of metal costs $10.50 - In December 2023, 6000 pounds of metal were purchased and 1,050 hours of Direct Labour worked. - Sales are estimated as follows: - Metal Parts Inc. keeps a minimum amount of the following: Cash A minimum of $2,000,000 Finished uniss Ending inventory oqual to 25% of ned month's sales toquirensents - Inventory of finished units from December 2023 is equal to the targeted inventory policy. - All sales are on account. - Selling and Administration expenses are $8 per unit and $40,000 per month. There is no depreciation included in this figure. - Inventory of finished units from December 2023 is equal to the targeted inventory policy. - All sales are on account. - Selling and Administration expenses are $8 per unit and $40,000 per month. There is no depreciation included in this figure. - Dividends of $500,000 will be declared in December. - Each unit requires 5 hours of direct labour and 16 pounds of metal to make. - They have 5,920 pounds of metal already in inventory. To prepare for supply disruptions of metal, the company likes to keep monthly ending inventory of metal high enough to meet the next two month's production requirements. In practice, their attempts at this might not always work out. - Customer collections are received 45% in the month of sale, 40% in the next month, and 13% in the second month following the sale. No further collections are received. - The company uses the absorption method of costing finished goods inventory and cost of goods sold. The allocate manufacturing overhead on the basis of direct labour hours. - Due to payroll processing times, half of the wages earned by workers is paid in the month of production, and the other half is paid in the following month. - Metal Parts Inc. has a very flexible work force that allows them to scale up or down without cost each month. - The selling price per unit is $1,500 - Overhead is $500,000 per month plus $2 per direct labour hour. Overhead costs are all paid in the month they occur, and there is $100,000 per month in depreciation included. - The balance sheet as at December 31.2023 is below: - The balance sheet as at December 31.2023 is below: - $750,000 of the equipment will be sold in March. This will have no effect on monthly depreciation because it was no longer a depreciable asset. - Another $400,000 of equipment will be purchased in June and will not be in service until 2025. - The company has a line of credit at the bank for up to $10 million at an interest rate of 4%. Borrowing happens on the first day of the month and repayments are made, when available, at the end of each month. Interest is calculated and deducted from the bank account at the end of each month based on the loan balance outstanding. - Since the interest deducted from the bank account, it is ok to allow the ending bank balance to be below the minimum by the amount of interest expense in the month. For example, if interest expense on the line of credit is $5,000 in a month, the ending balance can be left as $1,995,000 after the interest is deducted. That is close enough to the minimum for our purposes. Metal Parts Inc. is preparing its monthly budget for 2024. The following estimates and information are available. - Each unit requires 5 hours of direct labour and 16 pounds of metal to make. - Customer collections are received 45% in the month of sale, 40% in the next month, and 13% in the second month following the sale. No further collections are received. - The company uses the absorption method of costing finished goods inventory and cost of goods sold. The allocate manufacturing overhead on the basis of direct labour hours. - They have 5920 pounds of metal already in inventory. To prepare for supply disruptions of metal, the company likes to keep monthly ending inventory of metal high enough to meet the next two month's production requirements. In practice, their attempts at this might not always work out. - Direct labour costs \$23 per hour. - Accounts payable are paid 60% in the month of purchase and 40% in the following month. - Each pound of metal costs $10.50 - In December 2023, 6000 pounds of metal were purchased and 1,050 hours of Direct Labour worked. - Sales are estimated as follows: - Metal Parts Inc. keeps a minimum amount of the following: Cash A minimum of $2,000,000 Finished uniss Ending inventory oqual to 25% of ned month's sales toquirensents - Inventory of finished units from December 2023 is equal to the targeted inventory policy. - All sales are on account. - Selling and Administration expenses are $8 per unit and $40,000 per month. There is no depreciation included in this figure. - Inventory of finished units from December 2023 is equal to the targeted inventory policy. - All sales are on account. - Selling and Administration expenses are $8 per unit and $40,000 per month. There is no depreciation included in this figure. - Dividends of $500,000 will be declared in December. - Each unit requires 5 hours of direct labour and 16 pounds of metal to make. - They have 5,920 pounds of metal already in inventory. To prepare for supply disruptions of metal, the company likes to keep monthly ending inventory of metal high enough to meet the next two month's production requirements. In practice, their attempts at this might not always work out. - Customer collections are received 45% in the month of sale, 40% in the next month, and 13% in the second month following the sale. No further collections are received. - The company uses the absorption method of costing finished goods inventory and cost of goods sold. The allocate manufacturing overhead on the basis of direct labour hours. - Due to payroll processing times, half of the wages earned by workers is paid in the month of production, and the other half is paid in the following month. - Metal Parts Inc. has a very flexible work force that allows them to scale up or down without cost each month. - The selling price per unit is $1,500 - Overhead is $500,000 per month plus $2 per direct labour hour. Overhead costs are all paid in the month they occur, and there is $100,000 per month in depreciation included. - The balance sheet as at December 31.2023 is below: - The balance sheet as at December 31.2023 is below: - $750,000 of the equipment will be sold in March. This will have no effect on monthly depreciation because it was no longer a depreciable asset. - Another $400,000 of equipment will be purchased in June and will not be in service until 2025. - The company has a line of credit at the bank for up to $10 million at an interest rate of 4%. Borrowing happens on the first day of the month and repayments are made, when available, at the end of each month. Interest is calculated and deducted from the bank account at the end of each month based on the loan balance outstanding. - Since the interest deducted from the bank account, it is ok to allow the ending bank balance to be below the minimum by the amount of interest expense in the month. For example, if interest expense on the line of credit is $5,000 in a month, the ending balance can be left as $1,995,000 after the interest is deducted. That is close enough to the minimum for our purposes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts