Question: can u make it quick plzzz i need only answers gage An employee has the following information for her pay for the week ending February

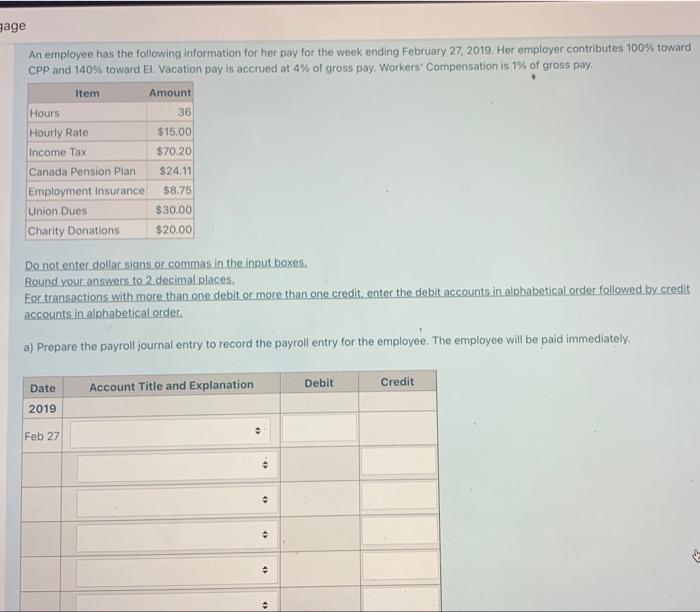

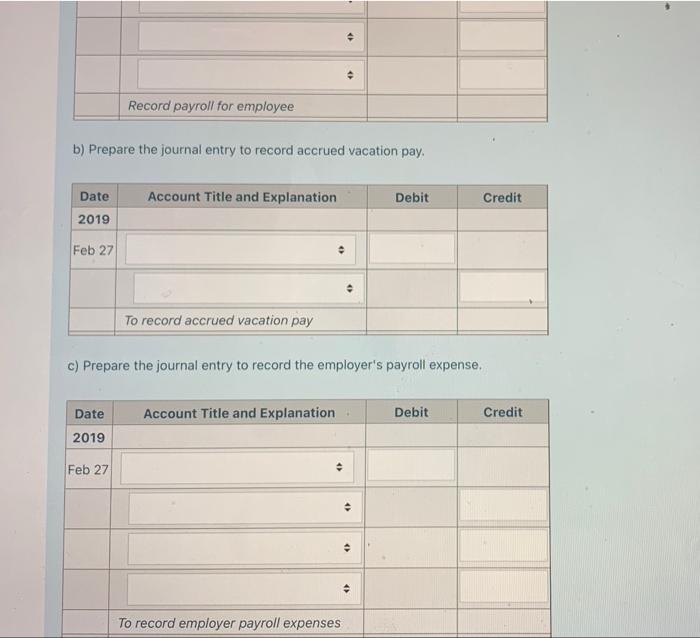

gage An employee has the following information for her pay for the week ending February 27, 2019. Her employer contributes 100% toward CPP and 140% toward El. Vacation pay is accrued at 4% of gross pay. Workers' Compensation is 1% of gross pay. Item Amount Hours 36 Hourly Rate $15.00 Income Tax $70.20 Canada Pension Plan $24.11 Employment Insurance $8.75 Union Dues $30.00 Charity Donations $20,00 Do not enter dollar signs or commas in the input boxes. Round your answers to 2 decimal places For transactions with more than one debit or more than one credit, enter the debit accounts in alphabetical order followed by credit accounts in alphabetical order. a) Prepare the payroll journal entry to record the payroll entry for the employee. The employee will be paid immediately Account Title and Explanation Debit Credit Date 2019 Feb 27 . . 4) . 4) > Record payroll for employee b) Prepare the journal entry to record accrued vacation pay. Account Title and Explanation Debit Credit Date 2019 Feb 27 To record accrued vacation pay c) Prepare the journal entry to record the employer's payroll expense. Account Title and Explanation Debit Credit Date 2019 Feb 27 . .

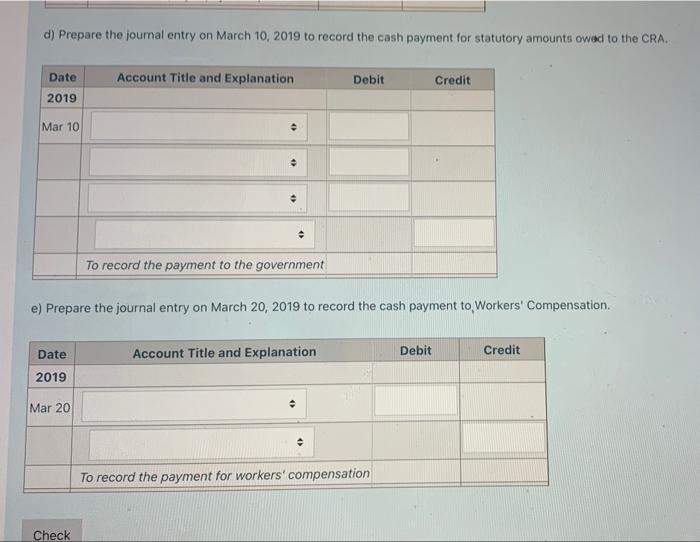

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts