Question: can u please help me in answering this question correctly asap Question y Dewey, Cheatham & Howe, a regional brokerage house, has an issue of

can u please help me in answering this question correctly asap

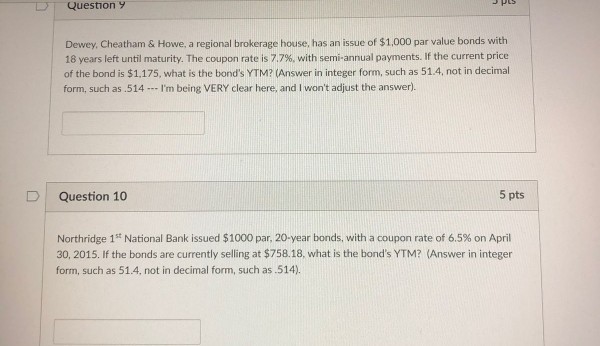

Question y Dewey, Cheatham & Howe, a regional brokerage house, has an issue of $1,000 par value bonds with 18 years left until maturity. The coupon rate is 7.7%, with semi-annual payments. If the current price of the bond is $1.175, what is the bond's YTM? Answer in integer form, such as 51.4, not in decimal form, such as.514I'm being VERY clear here, and I won't adjust the answer). D Question 10 5 pts Northridge 1st National Bank issued $1000 par, 20-year bonds, with a coupon rate of 6.5% on April 30, 2015. If the bonds are currently selling at $758.18, what is the bond's YTM? (Answer in integer form, such as 51.4, not in decimal form, such as .514)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts