Question: can u plzzzz make it quick Sampson Company has three employees who are paid on an hourly basis, plus time and one half for hours

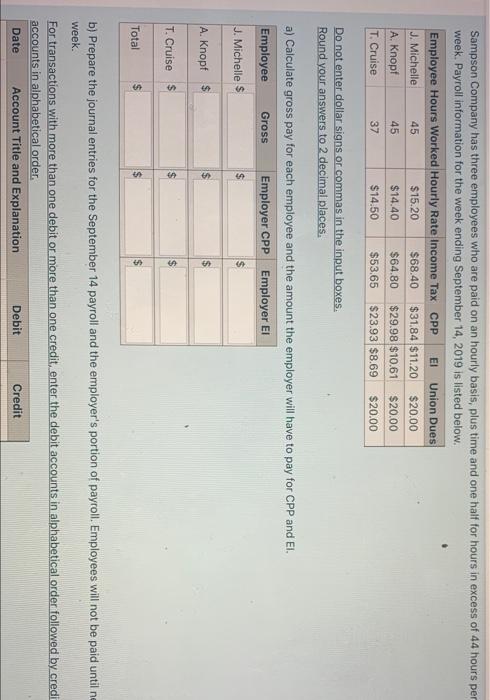

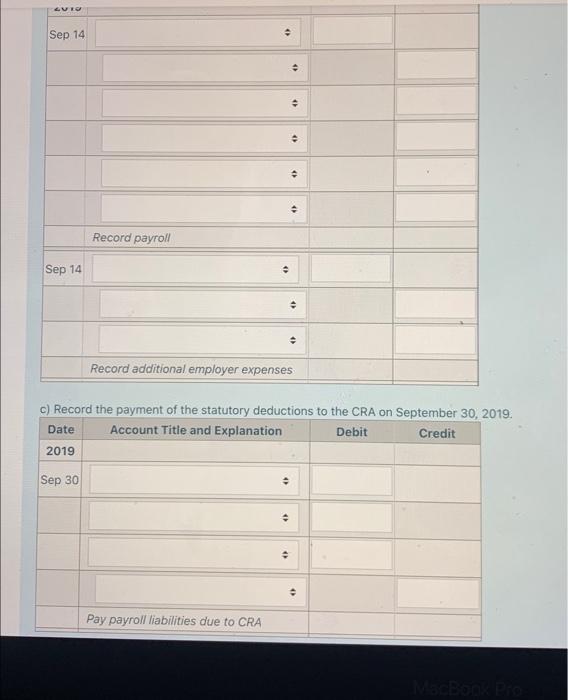

Sampson Company has three employees who are paid on an hourly basis, plus time and one half for hours in excess of 44 hours per week. Payroll information for the week ending September 14, 2019 is listed below. Employee Hours Worked Hourly Rate Income Tax CPP Union Dues J. Michelle 45 $15.20 $68.40 $31.84 $11.20 $20.00 A. Knopf 45 $14.40 $64.80 $29.98 $10.61 $20.00 T. Cruise 37 $14.50 $53.65 $23.93 $8.69 $20.00 Do not enter dollar signs or commas in the input boxes. Round your answers to 2 decimal places a) Calculate gross pay for each employee and the amount the employer will have to pay for CPP and EI, Employee Gross Employer CPP Employer El J. Michelle $ $ $ $ A. Knopf $ T. Cruise $ $ $ $ Total $ $ b) Prepare the journal entries for the September 14 payroll and the employer's portion of payroll. Employees will not be paid until ne week. For transactions with more than one debit or more than one credit, enter the debit accounts in alphabetical order followed by credi accounts in alphabetical order. Date Account Title and Explanation Debit Credit AVEO Sep 14 . Record payroll Sep 14 Record additional employer expenses c) Record the payment of the statutory deductions to the CRA on September 30, 2019. Date Account Title and Explanation Credit 2019 Debit Sep 30 a 4 . . Pay payroll liabilities due to CRA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts