Question: can u post with the excel formulas if we need E4.6 (LO 1), AP In its first year of operations, Gomes Company recognized $28,000 in

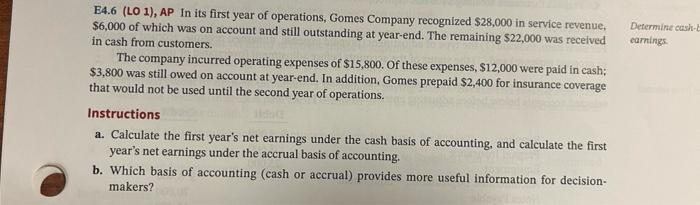

E4.6 (LO 1), AP In its first year of operations, Gomes Company recognized $28,000 in service revenue, Determine cash-l $6,000 of which was on account and still outstanding at year-end. The remaining $22,000 was received carnings in cash from customers. The company incurred operating expenses of $15,800. Of these expenses, $12,000 were paid in cash; $3,800 was still owed on account at year-end. In addition, Gomes prepaid \$2,400 for insurance coverage that would not be used until the second year of operations. Instructions a. Calculate the first year's net earnings under the cash basis of accounting, and calculate the first year's net earnings under the accrual basis of accounting. b. Which basis of accounting (cash or accrual) provides more useful information for decisionmakers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts