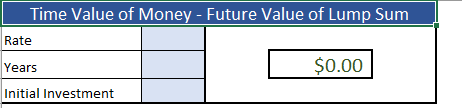

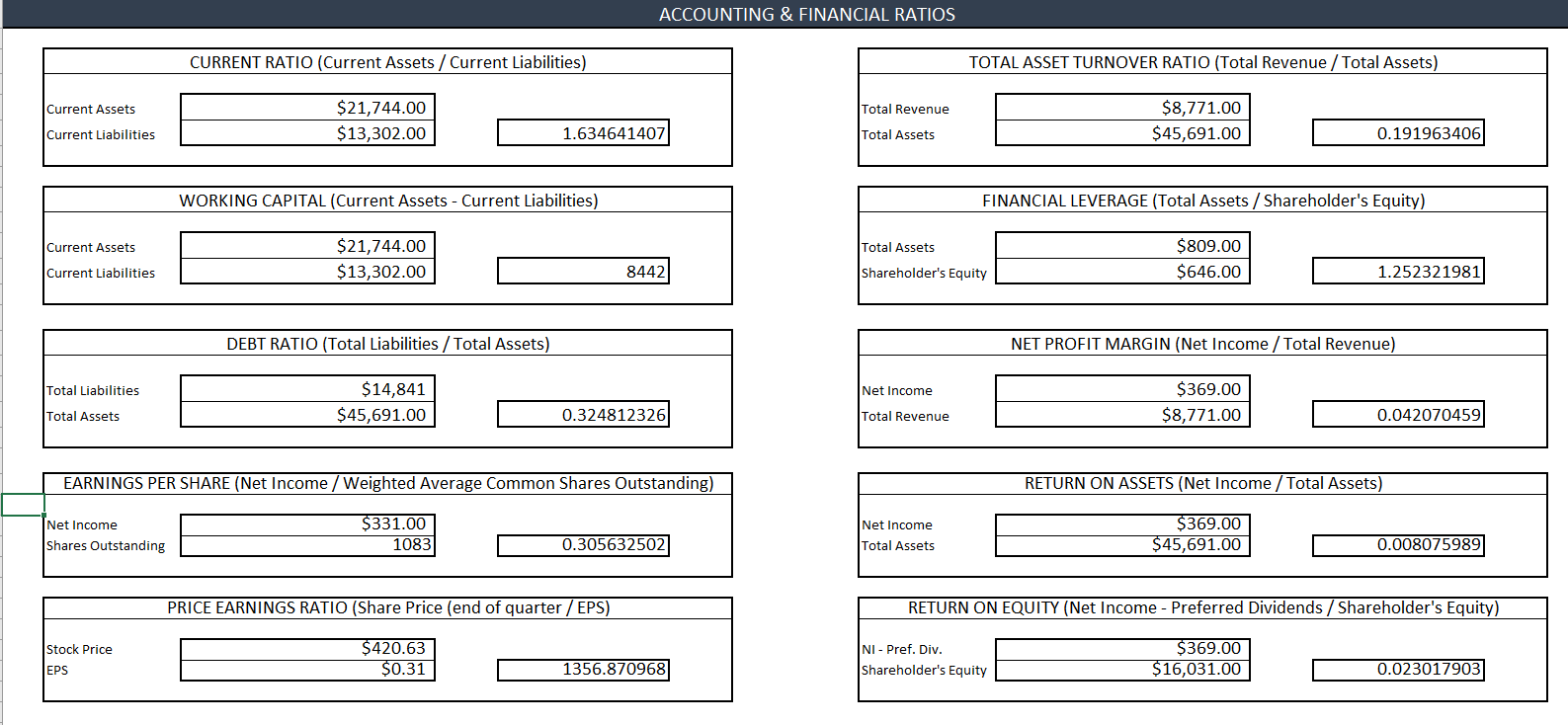

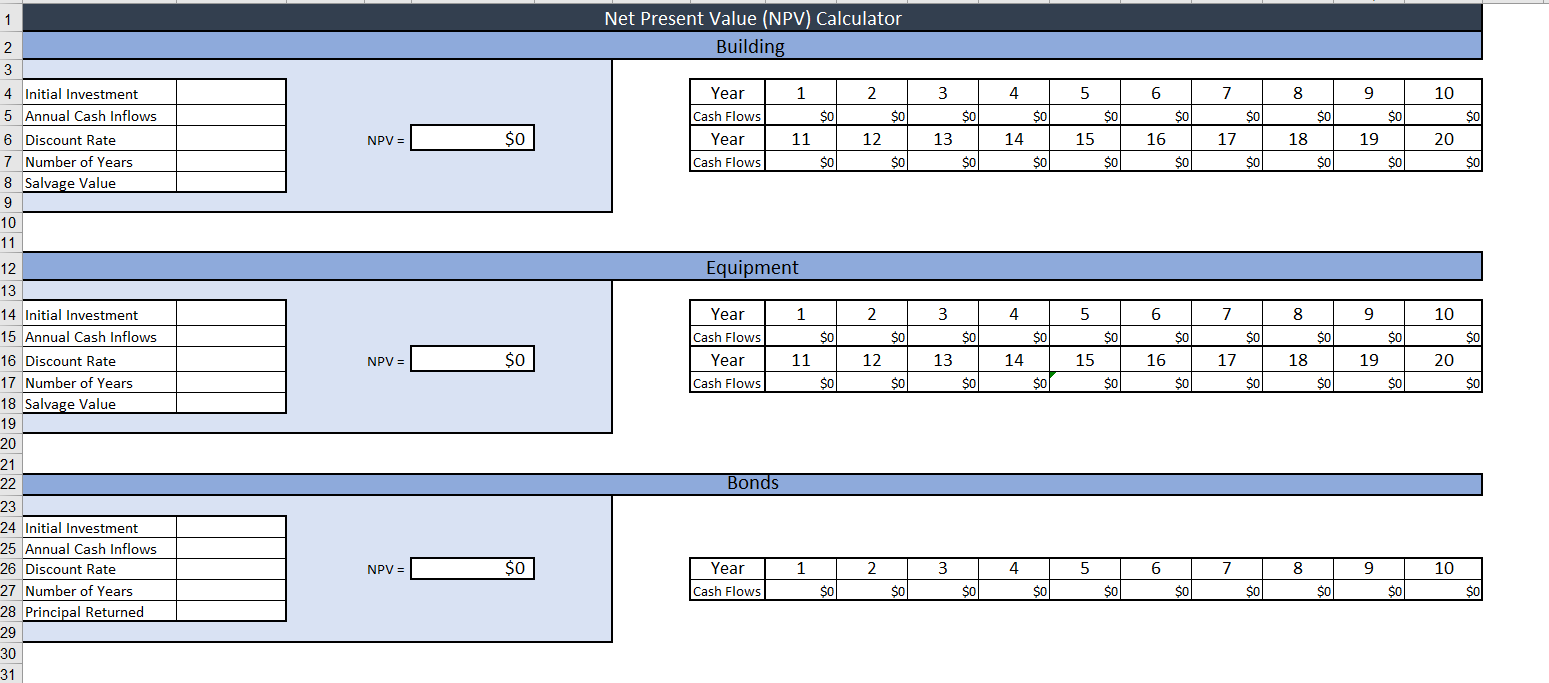

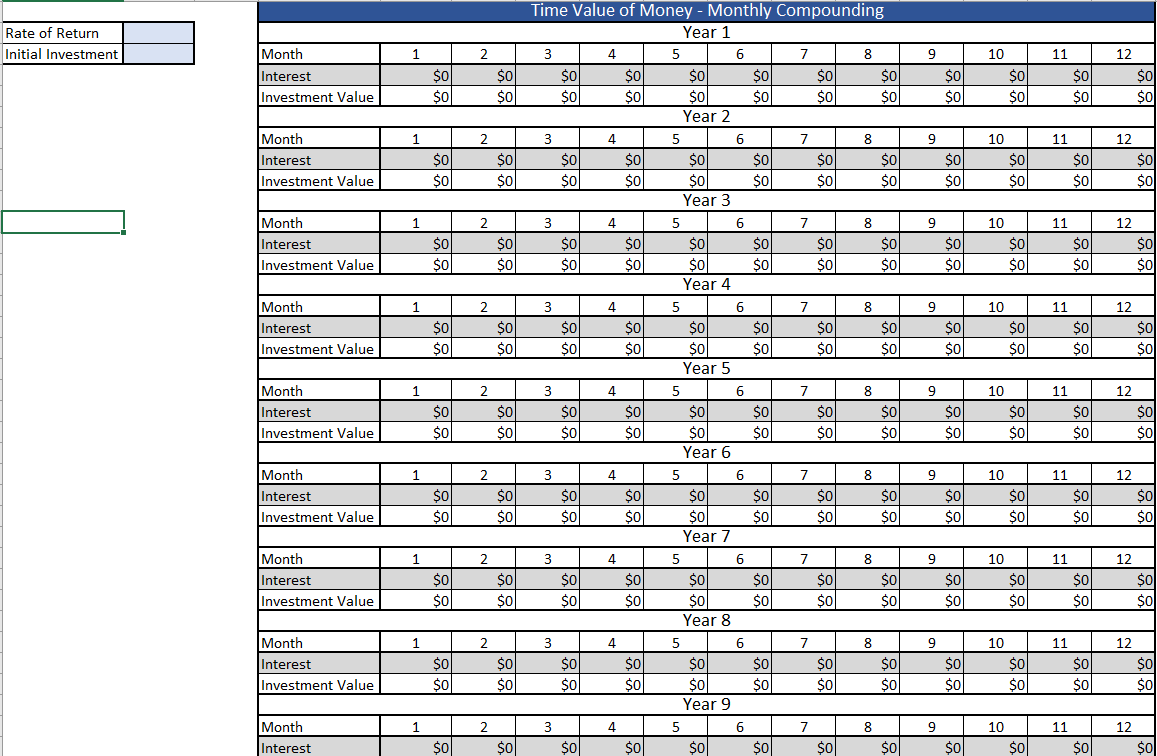

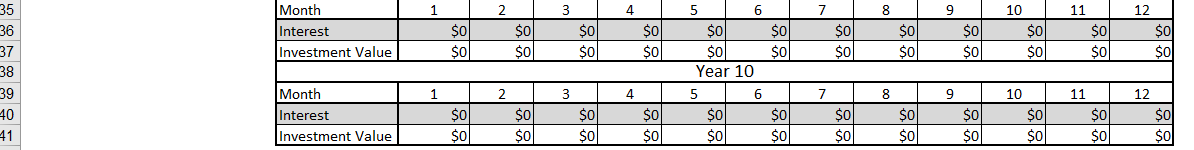

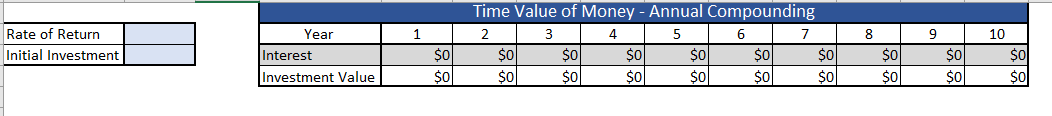

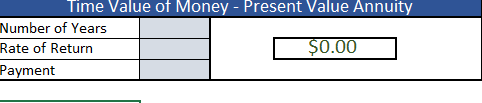

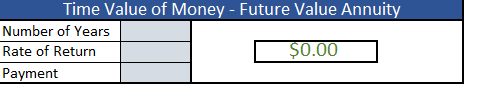

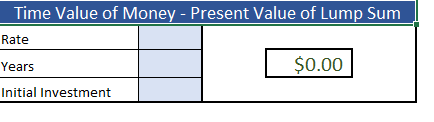

Question: Can we fill in the below charts please? Time Value of Money - Future Value of Lump Sum Rate Years $0.00 Initial InvestmentACCOUNTING & FINANCIAL

Can we fill in the below charts please?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock