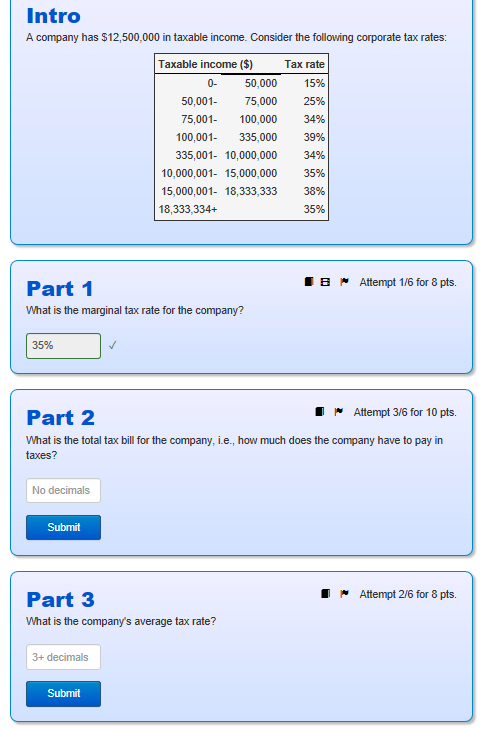

Question: Can you also explain how you got to your answer? Thank You Intro A company has $12,500,000 in taxable income. Consider the following corporate tax

Can you also explain how you got to your answer? Thank You

Intro A company has $12,500,000 in taxable income. Consider the following corporate tax rates: Taxable income () Tax rate 0-50,000 15% 50,001. 75,000 25% 75,001-100,000 34% 100,001. 335,000 39% 335,001-10,000,000 34% 10,000,001. 15,000,000 35% 15,000,001. 18,333,333 38% 35% 18,333,334+ E Attempt 1/6 for 8 pts. Part 1 What is the marginal tax rate for the company? 35% Part 2 Attempt 3/6 for 10 pts. What is the total tax bill for the company, i.e., how much does the company have to pay in taxes? No decimals Submit Attempt 2/6 for 8 pts. Part 3 What is the company's average tax rate? 3+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts