Question: CAN YOU ANSWER 2,3,4,6,7?????? 2- Calculate the future value in four years of $15,000 invested today in an account that pays a stated annual interest

CAN YOU ANSWER 2,3,4,6,7??????

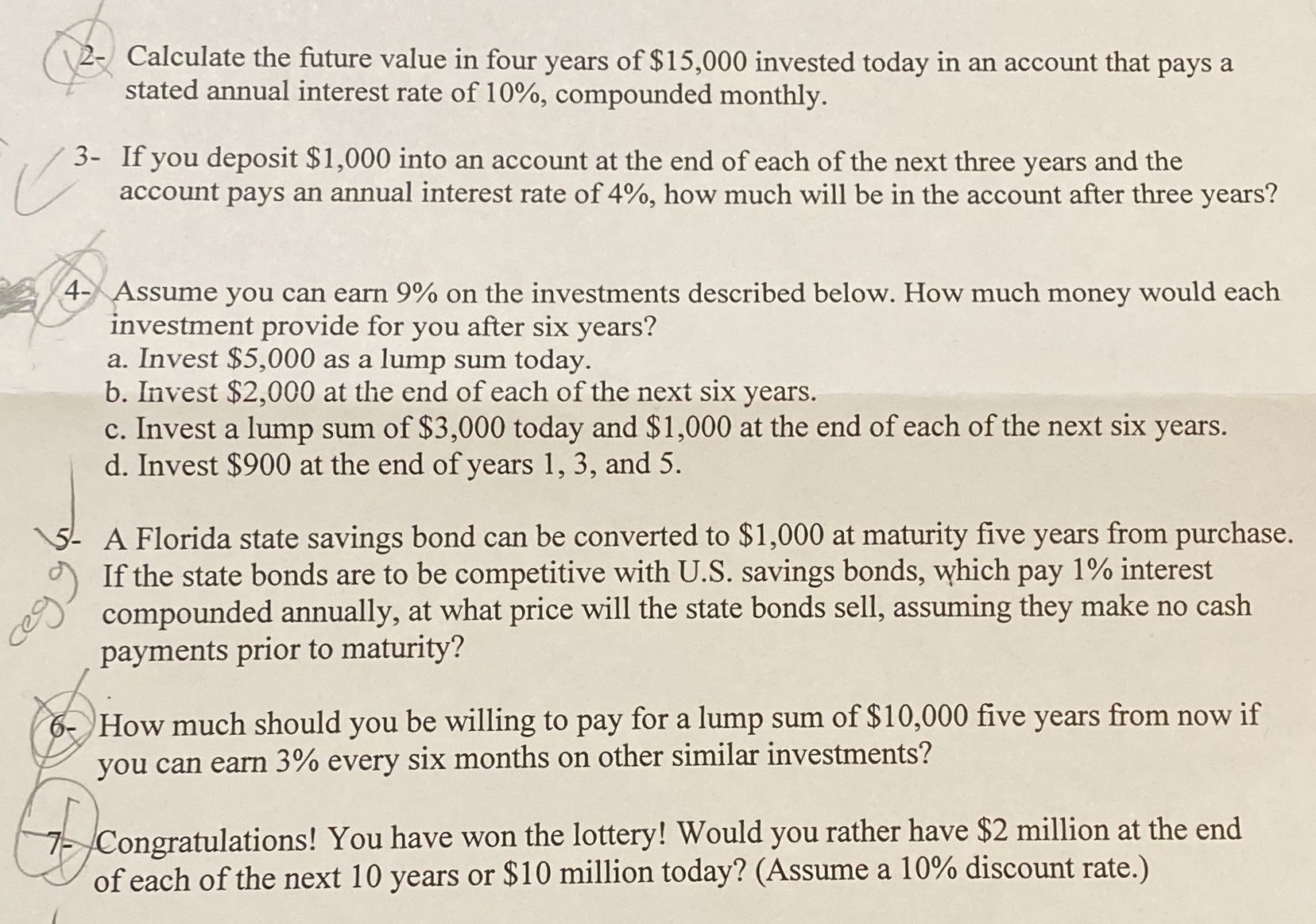

2- Calculate the future value in four years of $15,000 invested today in an account that pays a stated annual interest rate of 10%, compounded monthly. If you deposit $1,000 into an account at the end of each of the next three years and the account pays an annual interest rate of 4%, how much will be in the account after three years? Assume you can earn 9% on the investments described below. How much money would each investment provide for you after six years? a. Invest $5,000 as a lump sum today. b. Invest $2,000 at the end of each of the next six years. c. Invest a lump sum of $3,000 today and $1,000 at the end of each of the next six years. d. Invest $900 at the end of years 1,3 , and 5 . A Florida state savings bond can be converted to $1,000 at maturity five years from purchase If the state bonds are to be competitive with U.S. savings bonds, which pay 1% interest compounded annually, at what price will the state bonds sell, assuming they make no cash payments prior to maturity? How much should you be willing to pay for a lump sum of $10,000 five years from now if you can earn 3% every six months on other similar investments? Congratulations! You have won the lottery! Would you rather have $2 million at the end of each of the next 10 years or $10 million today? (Assume a 10% discount rate.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts