Question: can you answer 3,4,5 please Work the following problems using your financial calculator for exam practice. 1. 2. Constant dividend growth model. Generic Brands Corp.

can you answer 3,4,5 please

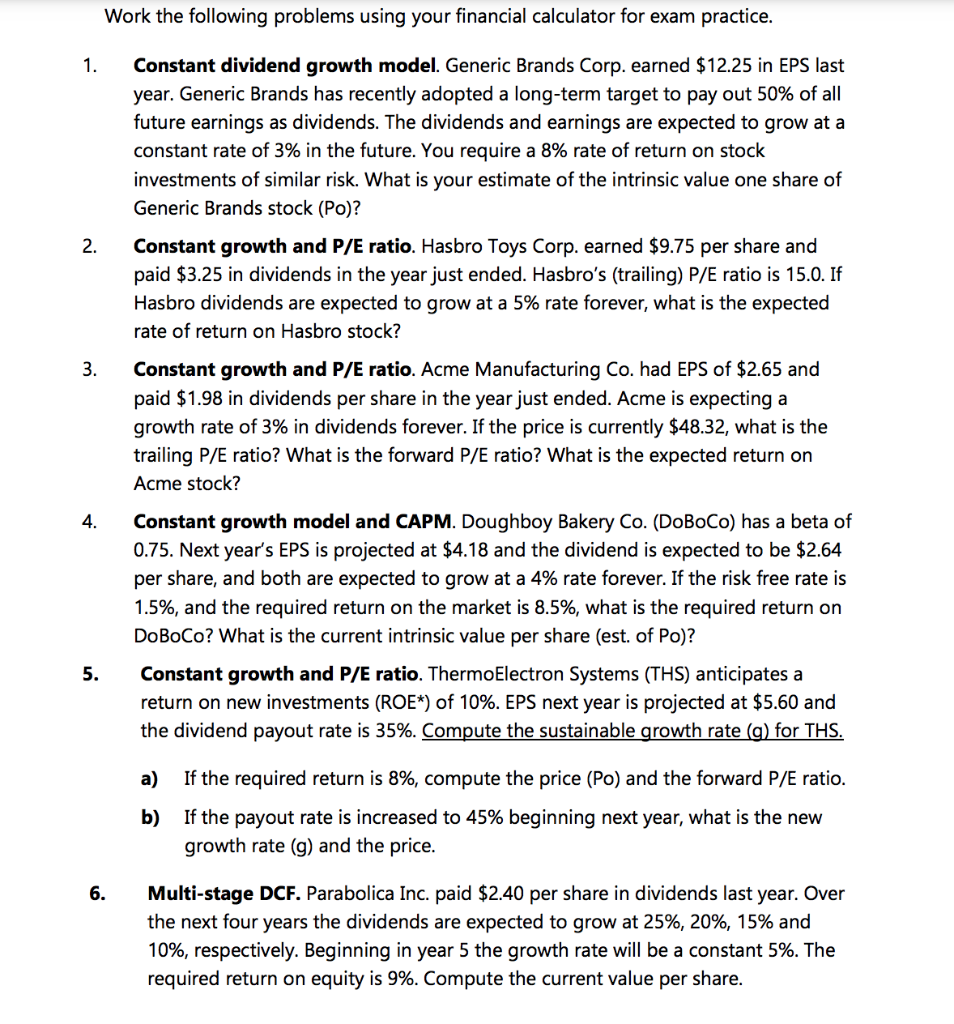

Work the following problems using your financial calculator for exam practice. 1. 2. Constant dividend growth model. Generic Brands Corp. earned $12.25 in EPS last year. Generic Brands has recently adopted a long-term target to pay out 50% of all future earnings as dividends. The dividends and earnings are expected to grow at a constant rate of 3% in the future. You require a 8% rate of return on stock investments of similar risk. What is your estimate of the intrinsic value one share of Generic Brands stock (Po)? Constant growth and P/E ratio. Hasbro Toys Corp. earned $9.75 per share and paid $3.25 in dividends in the year just ended. Hasbro's (trailing) P/E ratio is 15.0. If Hasbro dividends are expected to grow at a 5% rate forever, what is the expected rate of return on Hasbro stock? Constant growth and P/E ratio. Acme Manufacturing Co. had EPS of $2.65 and paid $1.98 in dividends per share in the year just ended. Acme is expecting a growth rate of 3% in dividends forever. If the price is currently $48.32, what is the trailing P/E ratio? What is the forward P/E ratio? What is the expected return on Acme stock? 3. 4. Constant growth model and CAPM. Doughboy Bakery Co. (DoBoCo) has a beta of 0.75. Next year's EPS is projected at $4.18 and the dividend is expected to be $2.64 per share, and both are expected to grow at a 4% rate forever. If the risk free rate is 1.5%, and the required return on the market is 8.5%, what is the required return on DoBoCo? What is the current intrinsic value per share (est. of Po)? Constant growth and P/E ratio. Thermo Electron Systems (THS) anticipates a return on new investments (ROE*) of 10%. EPS next year is projected at $5.60 and the dividend payout rate is 35%. Compute the sustainable growth rate (g) for THS. 5. a) If the required return is 8%, compute the price (Po) and the forward P/E ratio. b) If the payout rate is increased to 45% beginning next year, what is the new growth rate (g) and the price. 6. Multi-stage DCF. Parabolica Inc. paid $2.40 per share in dividends last year. Over the next four years the dividends are expected to grow at 25%, 20%, 15% and 10%, respectively. Beginning in year 5 the growth rate will be a constant 5%. The required return on equity is 9%. Compute the current value per share. Work the following problems using your financial calculator for exam practice. 1. 2. Constant dividend growth model. Generic Brands Corp. earned $12.25 in EPS last year. Generic Brands has recently adopted a long-term target to pay out 50% of all future earnings as dividends. The dividends and earnings are expected to grow at a constant rate of 3% in the future. You require a 8% rate of return on stock investments of similar risk. What is your estimate of the intrinsic value one share of Generic Brands stock (Po)? Constant growth and P/E ratio. Hasbro Toys Corp. earned $9.75 per share and paid $3.25 in dividends in the year just ended. Hasbro's (trailing) P/E ratio is 15.0. If Hasbro dividends are expected to grow at a 5% rate forever, what is the expected rate of return on Hasbro stock? Constant growth and P/E ratio. Acme Manufacturing Co. had EPS of $2.65 and paid $1.98 in dividends per share in the year just ended. Acme is expecting a growth rate of 3% in dividends forever. If the price is currently $48.32, what is the trailing P/E ratio? What is the forward P/E ratio? What is the expected return on Acme stock? 3. 4. Constant growth model and CAPM. Doughboy Bakery Co. (DoBoCo) has a beta of 0.75. Next year's EPS is projected at $4.18 and the dividend is expected to be $2.64 per share, and both are expected to grow at a 4% rate forever. If the risk free rate is 1.5%, and the required return on the market is 8.5%, what is the required return on DoBoCo? What is the current intrinsic value per share (est. of Po)? Constant growth and P/E ratio. Thermo Electron Systems (THS) anticipates a return on new investments (ROE*) of 10%. EPS next year is projected at $5.60 and the dividend payout rate is 35%. Compute the sustainable growth rate (g) for THS. 5. a) If the required return is 8%, compute the price (Po) and the forward P/E ratio. b) If the payout rate is increased to 45% beginning next year, what is the new growth rate (g) and the price. 6. Multi-stage DCF. Parabolica Inc. paid $2.40 per share in dividends last year. Over the next four years the dividends are expected to grow at 25%, 20%, 15% and 10%, respectively. Beginning in year 5 the growth rate will be a constant 5%. The required return on equity is 9%. Compute the current value per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts