Question: can you answer all the questions CHAPTER 6.The Mon e gurement of Risk and Re Review Questions All Review Questi 6-1. a. Wha expiew Questions

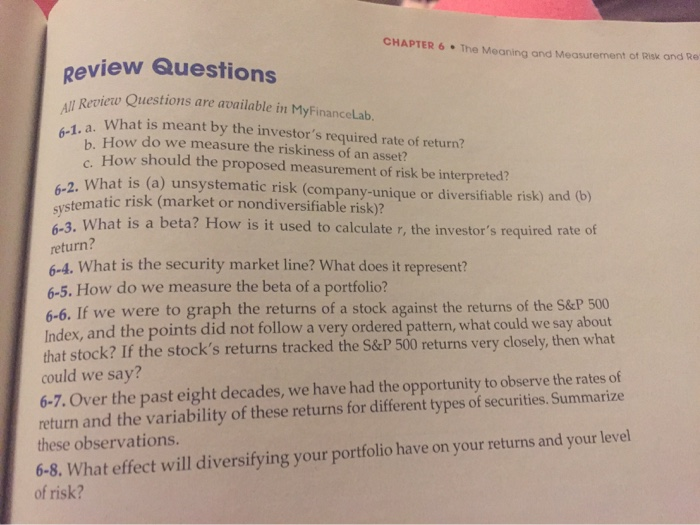

CHAPTER 6.The Mon e gurement of Risk and Re Review Questions All Review Questi 6-1. a. Wha expiew Questions are available in MyFinanceLab, What is meant by the investor's required rate of return? b. How do we measure the riskiness of an asset? c. How should the proposed measurement of risk be interpreted?! What is (a) unsystematic risk (company-unique or diversifiable risk) and (b) stematic risk (market or nondiversifiable risk)? -3. What is a beta? How is it used to calculater, the investor's required rate of 6-2. What return? 6-4. What is the security market line? What does it represent? 6-5. How do we measure the beta of a portfolio?! 6-6. If we were to graph the returns of a stock against the returns of the S&P 500 Index, and the points did not follow a very ordered pattern, what could we say about that stock? If the stock's returns tracked the S&P 500 returns very closely, then what could we say? 6-7. Over the past eight decades, we have had the opportunity to observe the rates of return and the variability of these returns for different types of securities. Summarize these observations. 6-8. What effect will diversifying your portfolio have on your returns and your level of risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts