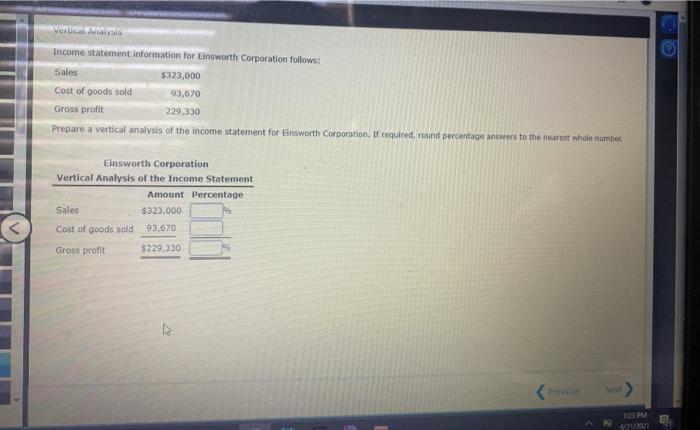

Question: can you answer both questions Vertical Analysis Income statement information for Einsworth Corporation follows: Sales $323,000 Cost of goods sold 93,670 Gross profit 229,330 Prepare

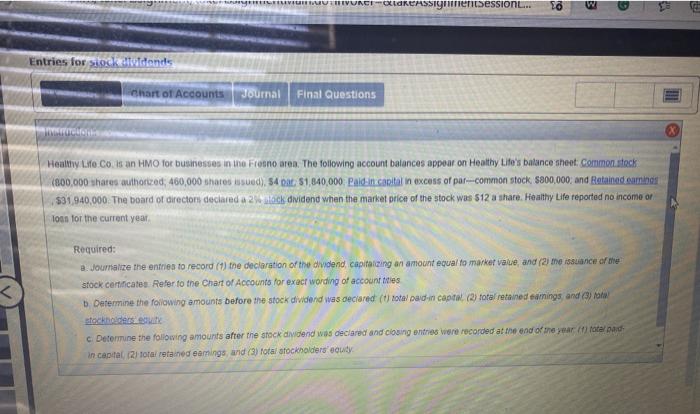

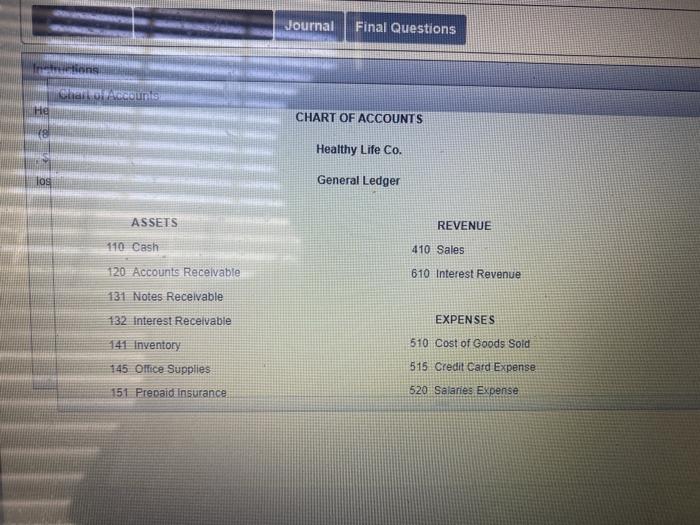

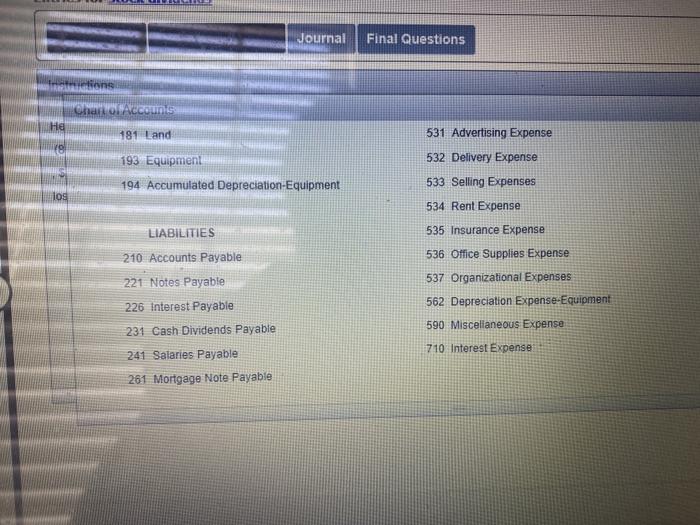

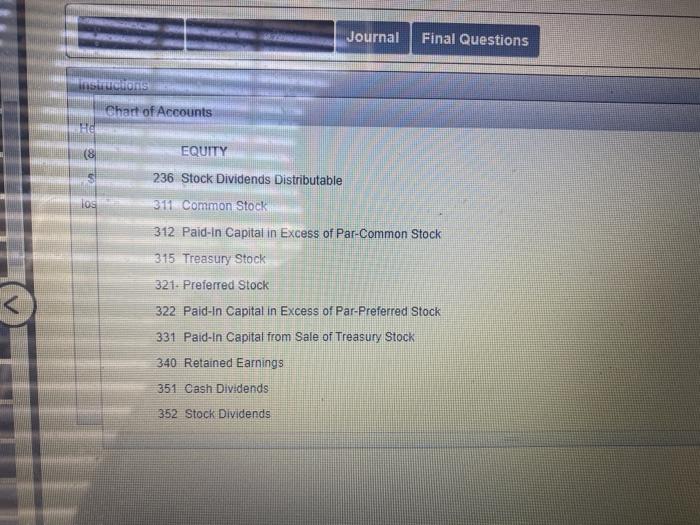

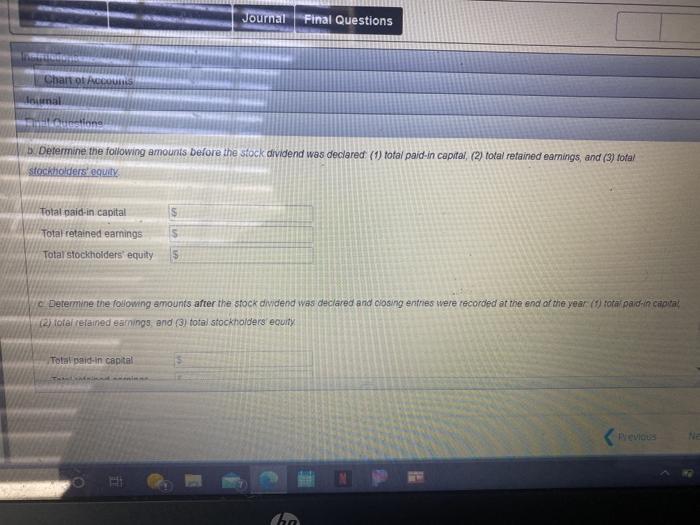

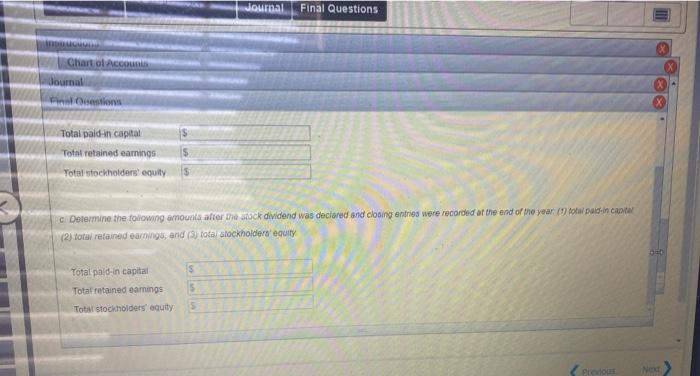

Vertical Analysis Income statement information for Einsworth Corporation follows: Sales $323,000 Cost of goods sold 93,670 Gross profit 229,330 Prepare a vertical analysis of the income statement for Einsworth Corporation. It required, round percentage answers to the nearest whole number. Einsworth Corporation Vertical Analysis of the Income Statement Amount Percentage Sales $323,000 he Cost of goods sold 93,670 Gross profit $229,330 123 FM VULTURCEOLOREASSIGNnentSession... 26 Entries for stock watends Chart of Accounts Journal Final Questions Healthy Life.Co.Is an HMO for businesses in ino Frosno area. The following account balances appear on Healthy Life's balance sheet commensteck (800,000 shares authorized: 460,000 shares tused), 54 at 51,840,000 Paldin carital in excess of par--common stock $800,000, and Retained coming 531,940,000. The board of directors declared a 2 wock dividend when the market price of the stock was 512 a share. Healthy Life reported no income or foon for the current year Required: Journalize the entries to record (1) the declaration of the dividend capitalcing an amount equal to market value and (2) messuance of the stock certificates Refer to the Chart of Accounts for exact wording of accounties b. Determine the following amounts before the stock dividend was declared (total pad-in cap. (2) total retained earnings and (3) stockholders Determine the following amounts after the stock dividend was declared and cong entries were recorded at the end of the year / fotela in capital (2) total retained earings, and (3) Total stockholders' couty Journal Final Questions Intens han ABOUT He CHART OF ACCOUNTS (el Healthy Life Co. los General Ledger ASSETS REVENUE 110 Cash 410 Sales 120 Accounts Receivable 610 Interest Revenue 131 Notes Receivable 132 Interest Receivable EXPENSES 510 Cost of Goods Sold 141 Inventory 145 Office Supplies 515 Credit Card Expense 151 Prepaid insurance 520 Salaries Expense Journal Final Questions Inicions Ona ACCOUNT He 181 Land 19 193 Equipment 194 Accumulated Depreciation Equipment log LIABILITIES 531 Advertising Expense 532 Delivery Expense 533 Selling Expenses 534 Rent Expense 535 Insurance Expense 536 Office Supplies Expense 537 Organizational Expenses 562 Depreciation Expense-Equipment 590 Miscelianeous Expense 710 Interest Expense 210 Accounts Payable 221 Notes Payable 226 Interest Payable 231 Cash Dividends Payable 241 Salaries Payable 261 Mortgage Note Payable Journal Final Questions Mere Chart of Accounts HEI EQUITY (8 236 Stock Dividends Distributable los 311 Common Stock 312 Paid-in Capital in Excess of Par-Common Stock 315 Treasury Stock 321. Preferred Stock 322 Paid-In Capital in Excess of Par-Preferred Stock 331 Paid-In Capital from Sale of Treasury Stock 340 Retained Earnings 351 Cash Dividends 352 Stock Dividends Journal Final Questions Charot US Antanal estone Determine the following amounts before the stock dividend was declared (1) total paid-in capital (2) total retained earnings, and (3) fofa/ stockholders equity Total paid-in capital Total retained earnings S Total stockholders' equity c Determine the following amounts after the stock dividend was declared and closing entries were recorded at the end of the year (9) total paid in eaota: (2) total relained earnings, and (3) total stockholders' equity Total aid in capital Nevis Journal Final Questions Charol Accounts Journal al cestions Total pald.in capital Total retained earnings Yotal stockholders' equilty S c Dotermine the following amounts after the stock dividend was declared and closing entries were recorded at the end of the year for pain can (2) fotorelained ourning, and total stockholders equity Total pa din capital Total retained comings Total stockholders' equity $ 5 5 Pidous

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts