Question: can you answer both so I can see the difference? A tax-exempt municipal bond with a coupon rate of 7.00% has a market price of

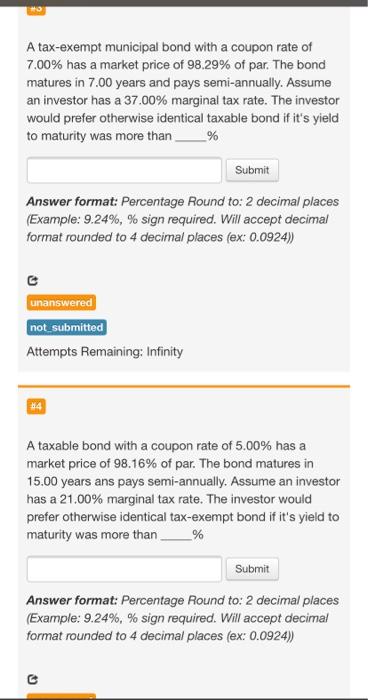

A tax-exempt municipal bond with a coupon rate of 7.00% has a market price of 98.29% of par. The bond matures in 7.00 years and pays semi-annually. Assume an investor has a 37.00% marginal tax rate. The investor would prefer otherwise identical taxable bond if it's yield to maturity was more than _% Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) unanswered not submitted Attempts Remaining: Infinity #4 A taxable bond with a coupon rate of 5.00% has a market price of 98.16% of par. The bond matures in 15.00 years ans pays semi-annually. Assume an investor has a 21.00% marginal tax rate. The investor would prefer otherwise identical tax-exempt bond if it's yield to maturity was more than_% Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts