Question: can you answer C D and E asap please IntegrativeOptimal capital structureThe board of directors of Morales Publishing, Inc., has commissioned a capital structure study.

can you answer C D and E asap please

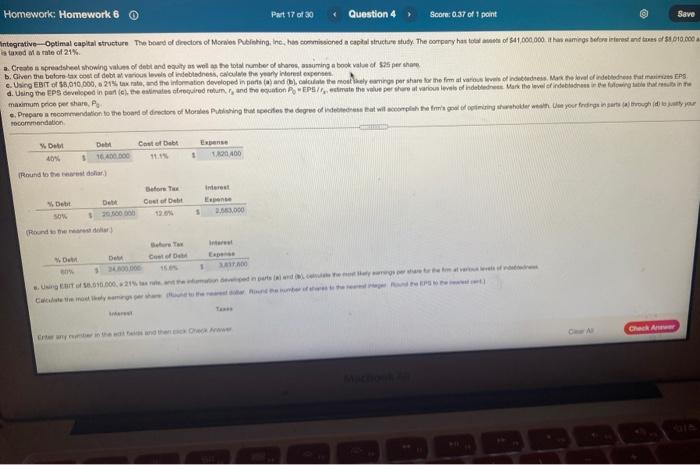

IntegrativeOptimal capital structureThe board of directors of Morales Publishing, Inc., has commissioned a capital structure study. The company has total assets of $41,000,000 . It has earnings before interest and taxes of $8,010,000 and is taxed at a rate of 21%. a. Create a spreadsheet showing values of debt and equity as well as the total number of shares, assuming a book value of$25 per share. b. Given the before-tax cost of debt at various levels of indebtedness, calculate the yearly interest expenses. c. Using EBIT of $8,010,000, a 21% tax rate, and the information developed in parts (a) and (b), calculate the most likely earnings per share for the firm at various levels of indebtedness. Mark the level of indebtedness that maximizes EPS. d. Using the EPS developed in part (c), the estimates of required return rs and the equation P0=EPS/rs, estimate the value per share at various levels of indebtedness. Mark the level of indebtedness in the following table that results in the maximum price per share P0 . e. Prepare a recommendation to the board of directors of Morales Publishing that specifies the degree of indebtedness that will accomplish the firm's goal of optimizing shareholder wealth. Use your findings in parts (a) through (d) to justify your recommendation.

Please answer C,D,E asap

OTTO nowo Score of point Save Integration optimal capital structure. The board of directors of Morales Publishing, tre, has commisicned a capital structure tally. The company has total asets of 41.000,000. us eating before interest and the 12.019.000 % Crewe prodhon showing one and equity will as the total number of shares, auming a book value of $25 per share b. Given te bekor las cost of retrouvel nostres calculate the yearly interest Using ENT SA 010,000.21texto, end the information developed in parts and cards the most likely worringe per share for the firm at various invited indebtedness Month of debat masini EPS d. Using the developed in partesthe these gured ratum, and the nation PEPSImate the vale per bare at various of relatnos. Malheud af indberet the wing tablettraut umum pro por share Prepare a comandaten te hebeard of director of Morales Patlabang that diden te degree of andebtedneme hat will complah the free goal of optimung started weath. Utan your finding perto (ran como to share Homework: Homework 6 O Part 17 of 30 Question 4 Score: 0.37 of 1 point Save mintegrative-Optimal capital structure The board of directors of Moseshing, Inc. he commissioned a capital structure study. The company has to $1.000.000. It has namings before interest and to 31.010.000 is taxed Matute of 21% a Create a present whowing alom oldebt and equity as well as the total number of shares, assuming a book value of $5 per home b. Given the before tax cost of debt vous levels of indebtedness, love this yearly interest expone c. Using EBIT of $8.010.000, 215. d the information developed in parts and the most come per share for the firm at various les dess Mark the level of indebted that is EPS d. Using the EP developed in parte), the ruired return, and the otion Edit the value at various levende Mar the level of industrie maximum priore share. Po .. Prepare a recommandation to the board of director of Montering that species degree of chat with one of orcing where your fedegenert og ty commendation Cost of Debt Expense 1.2000 . Y De Dar 40% 16.400.000 Round to the rest dar) Before Custofa D Debt SO 263.000 and other ST Det D . TO D 1 To... 21 O Check OTTO nowo Score of point Save Integration optimal capital structure. The board of directors of Morales Publishing, tre, has commisicned a capital structure tally. The company has total asets of 41.000,000. us eating before interest and the 12.019.000 % Crewe prodhon showing one and equity will as the total number of shares, auming a book value of $25 per share b. Given te bekor las cost of retrouvel nostres calculate the yearly interest Using ENT SA 010,000.21texto, end the information developed in parts and cards the most likely worringe per share for the firm at various invited indebtedness Month of debat masini EPS d. Using the developed in partesthe these gured ratum, and the nation PEPSImate the vale per bare at various of relatnos. Malheud af indberet the wing tablettraut umum pro por share Prepare a comandaten te hebeard of director of Morales Patlabang that diden te degree of andebtedneme hat will complah the free goal of optimung started weath. Utan your finding perto (ran como to share Homework: Homework 6 O Part 17 of 30 Question 4 Score: 0.37 of 1 point Save mintegrative-Optimal capital structure The board of directors of Moseshing, Inc. he commissioned a capital structure study. The company has to $1.000.000. It has namings before interest and to 31.010.000 is taxed Matute of 21% a Create a present whowing alom oldebt and equity as well as the total number of shares, assuming a book value of $5 per home b. Given the before tax cost of debt vous levels of indebtedness, love this yearly interest expone c. Using EBIT of $8.010.000, 215. d the information developed in parts and the most come per share for the firm at various les dess Mark the level of indebted that is EPS d. Using the EP developed in parte), the ruired return, and the otion Edit the value at various levende Mar the level of industrie maximum priore share. Po .. Prepare a recommandation to the board of director of Montering that species degree of chat with one of orcing where your fedegenert og ty commendation Cost of Debt Expense 1.2000 . Y De Dar 40% 16.400.000 Round to the rest dar) Before Custofa D Debt SO 263.000 and other ST Det D . TO D 1 To... 21 O Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts