Question: can you answer the 25 questions! a 1. The equilibrium interest rate Is when the total (or aggregate) demand for funds (ie money) intersects with

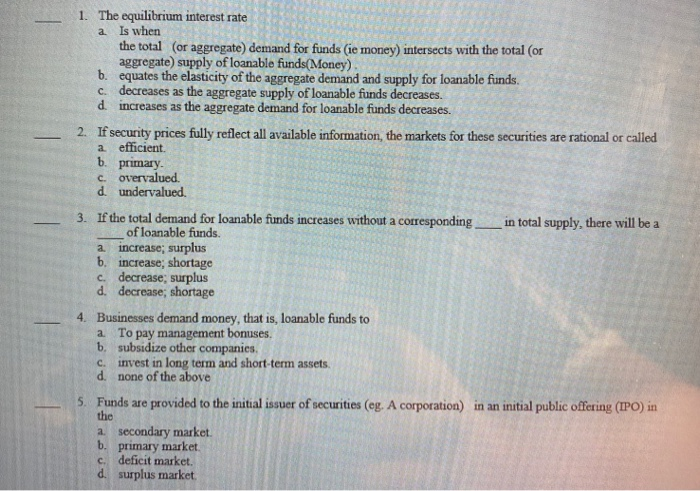

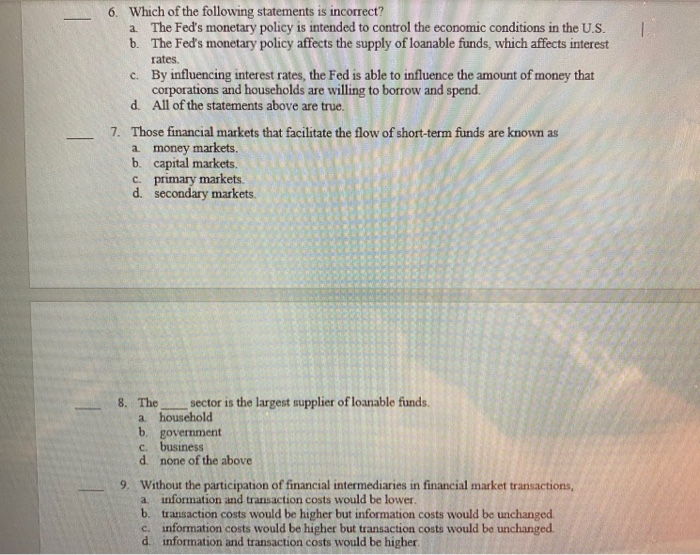

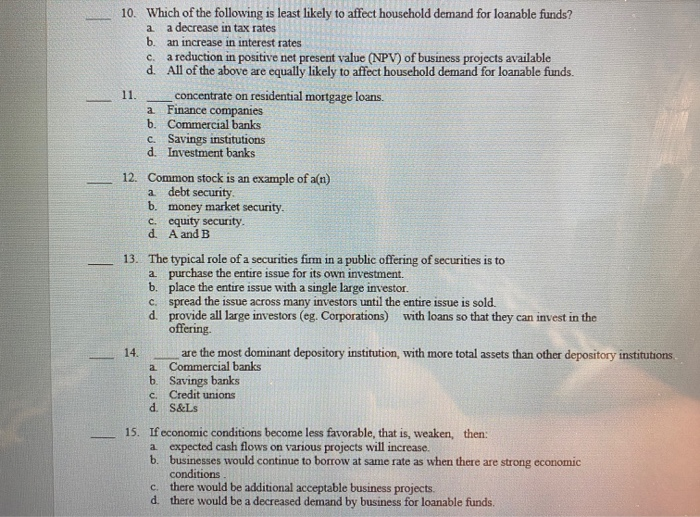

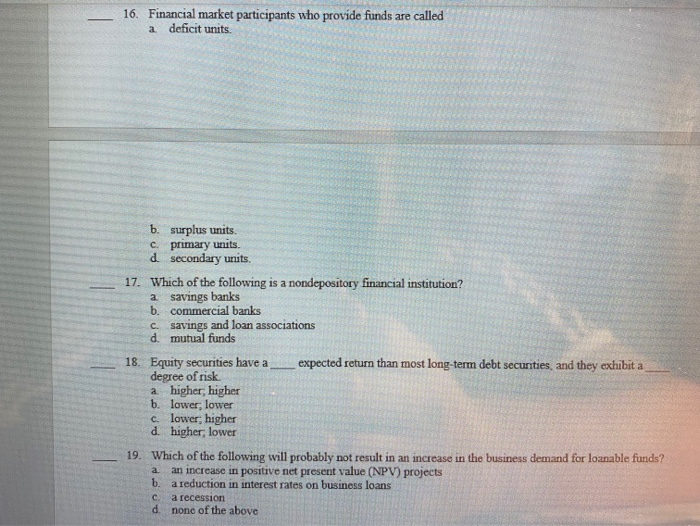

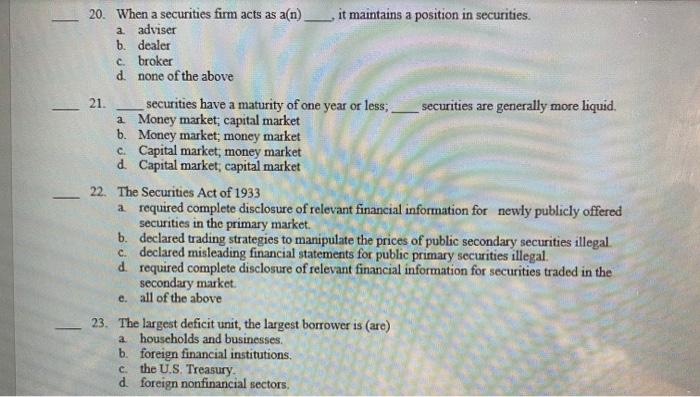

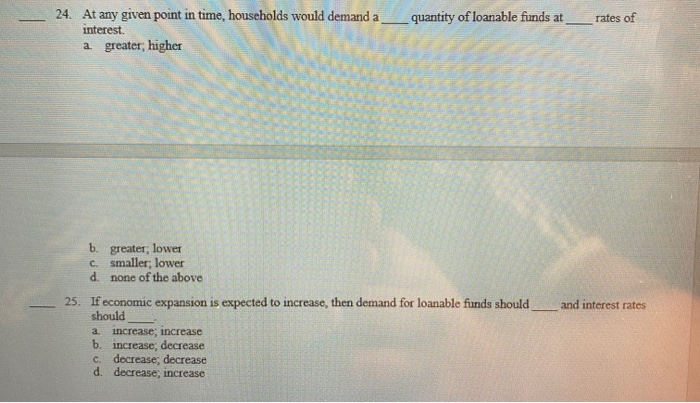

a 1. The equilibrium interest rate Is when the total (or aggregate) demand for funds (ie money) intersects with the total (or aggregate) supply of loanable funds(Money) b. equates the elasticity of the aggregate demand and supply for loanable funds. c. decreases as the aggregate supply of loanable funds decreases. d increases as the aggregate demand for loanable funds decreases. 2. If security prices fully reflect all available information, the markets for these securities are rational or called a efficient 1. primary C. overvalued. d undervalued. 3. If the total demand for loanable funds increases without a corresponding in total supply, there will be a of loanable funds. a increase; surplus b. increase; shortage c. decrease, surplus d. decrease; shortage 4. Businesses demand money, that is, loanable funds to To pay management bonuses. b. subsidize other companies, c. invest in long term and short-term assets. d. none of the above 5. Funds are provided to the initial issuer of securities (eg. A corporation) in an initial public offering (IPO) in the a secondary market. b. primary market c. deficit market. d. surplus market a rates, 6. Which of the following statements is incorrect? a The Fed's monetary policy is intended to control the economic conditions in the U.S. b. The Fed's monetary policy affects the supply of loanable funds, which affects interest c. By influencing interest rates, the Fed is able to influence the amount of money that corporations and households are willing to borrow and spend. d. All of the statements above are true. 7. Those financial markets that facilitate the flow of short-term funds are known as a money markets. b. capital markets c. primary markets. d. secondary markets. 8. The sector is the largest supplier of loanable funds. a household b. government c. business d. none of the above Without the participation of financial intermediaries in financial market transactions, a information and transaction costs would be lower b. transaction costs would be higher but information costs would be unchanged. c. information costs would be higher but transaction costs would be unchanged. d information and transaction costs would be higher 9 c. a 10. Which of the following is least likely to affect household demand for loanable funds? a decrease in tax rates b. an increase in interest rates a reduction in positive net present value (NPV) of business projects available d. All of the above are equally likely to affect household demand for loanable funds. 11. concentrate on residential mortgage loans. Finance companies b. Commercial banks c. Savings institutions d. Investment banks 12. Common stock is an example of a(n) a debt security b. money market security. c. equity security d A and B 13. The typical role of a securities firm in a public offering of securities is to a purchase the entire issue for its own investment. b. place the entire issue with a single large investor. c. spread the issue across many investors until the entire issue is sold. d. provide all large investors (eg. Corporations) with loans so that they can invest in the offering. 14. are the most dominant depository institution, with more total assets than other depository institutions Commercial banks b. Savings banks Credit unions d. S&Ls 15. If economic conditions become less favorable, that is, weaken, then: a expected cash flows on various projects will increase. b. businesses would continue to borrow at same rate as when there are strong economic conditions there would be additional acceptable business projects. d. there would be a decreased demand by business for loanable funds. a C. C 16. Financial market participants who provide funds are called a deficit units. b. surplus units c. primary units. d secondary units. 17. Which of the following is a nondepository financial institution? a savings banks b. commercial banks c. savings and loan associations d. mutual funds 18. Equity securities have a expected return than most long-term debt securities, and they exhibit a degree of risk. a higher, higher b. lower, lower c. lower, higher d. higher, lower a 19. Which of the following will probably not result in an increase in the business demand for loanable funds? an increase in positive net present value (NPV) projects b. a reduction in interest rates on business loans a recession d. none of the above C 20. When a securities firm acts as a(n) it maintains a position in securities. a adviser b. dealer c. broker d none of the above 21. securities have a maturity of one year or less; securities are generally more liquid. a Money market; capital market 6. Money market; money market c. Capital market; money market d Capital market; capital market 22. The Securities Act of 1933 a required complete disclosure of relevant financial information for newly publicly offered securities in the primary market. b. declared trading strategies to manipulate the prices of public secondary securities illegal c. declared misleading financial statements for public primary securities illegal. d. required complete disclosure of relevant financial information for securities traded in the secondary market e. all of the above 23. The largest deficit unit, the largest borrower is (are) a households and businesses b. foreign financial institutions. the U.S. Treasury d. foreign nonfinancial sectors. C. quantity of loanable funds at rates of 24. At any given point in time, households would demand a a greater; higher interest. and interest rates b. greater, lower c. smaller; lower d. none of the above 25. If economic expansion is expected to increase, then demand for loanable funds should should a increase, increase b. increase, decrease c. decrease, decrease d. decrease, increase a 1. The equilibrium interest rate Is when the total (or aggregate) demand for funds (ie money) intersects with the total (or aggregate) supply of loanable funds(Money) b. equates the elasticity of the aggregate demand and supply for loanable funds. c. decreases as the aggregate supply of loanable funds decreases. d increases as the aggregate demand for loanable funds decreases. 2. If security prices fully reflect all available information, the markets for these securities are rational or called a efficient 1. primary C. overvalued. d undervalued. 3. If the total demand for loanable funds increases without a corresponding in total supply, there will be a of loanable funds. a increase; surplus b. increase; shortage c. decrease, surplus d. decrease; shortage 4. Businesses demand money, that is, loanable funds to To pay management bonuses. b. subsidize other companies, c. invest in long term and short-term assets. d. none of the above 5. Funds are provided to the initial issuer of securities (eg. A corporation) in an initial public offering (IPO) in the a secondary market. b. primary market c. deficit market. d. surplus market a rates, 6. Which of the following statements is incorrect? a The Fed's monetary policy is intended to control the economic conditions in the U.S. b. The Fed's monetary policy affects the supply of loanable funds, which affects interest c. By influencing interest rates, the Fed is able to influence the amount of money that corporations and households are willing to borrow and spend. d. All of the statements above are true. 7. Those financial markets that facilitate the flow of short-term funds are known as a money markets. b. capital markets c. primary markets. d. secondary markets. 8. The sector is the largest supplier of loanable funds. a household b. government c. business d. none of the above Without the participation of financial intermediaries in financial market transactions, a information and transaction costs would be lower b. transaction costs would be higher but information costs would be unchanged. c. information costs would be higher but transaction costs would be unchanged. d information and transaction costs would be higher 9 c. a 10. Which of the following is least likely to affect household demand for loanable funds? a decrease in tax rates b. an increase in interest rates a reduction in positive net present value (NPV) of business projects available d. All of the above are equally likely to affect household demand for loanable funds. 11. concentrate on residential mortgage loans. Finance companies b. Commercial banks c. Savings institutions d. Investment banks 12. Common stock is an example of a(n) a debt security b. money market security. c. equity security d A and B 13. The typical role of a securities firm in a public offering of securities is to a purchase the entire issue for its own investment. b. place the entire issue with a single large investor. c. spread the issue across many investors until the entire issue is sold. d. provide all large investors (eg. Corporations) with loans so that they can invest in the offering. 14. are the most dominant depository institution, with more total assets than other depository institutions Commercial banks b. Savings banks Credit unions d. S&Ls 15. If economic conditions become less favorable, that is, weaken, then: a expected cash flows on various projects will increase. b. businesses would continue to borrow at same rate as when there are strong economic conditions there would be additional acceptable business projects. d. there would be a decreased demand by business for loanable funds. a C. C 16. Financial market participants who provide funds are called a deficit units. b. surplus units c. primary units. d secondary units. 17. Which of the following is a nondepository financial institution? a savings banks b. commercial banks c. savings and loan associations d. mutual funds 18. Equity securities have a expected return than most long-term debt securities, and they exhibit a degree of risk. a higher, higher b. lower, lower c. lower, higher d. higher, lower a 19. Which of the following will probably not result in an increase in the business demand for loanable funds? an increase in positive net present value (NPV) projects b. a reduction in interest rates on business loans a recession d. none of the above C 20. When a securities firm acts as a(n) it maintains a position in securities. a adviser b. dealer c. broker d none of the above 21. securities have a maturity of one year or less; securities are generally more liquid. a Money market; capital market 6. Money market; money market c. Capital market; money market d Capital market; capital market 22. The Securities Act of 1933 a required complete disclosure of relevant financial information for newly publicly offered securities in the primary market. b. declared trading strategies to manipulate the prices of public secondary securities illegal c. declared misleading financial statements for public primary securities illegal. d. required complete disclosure of relevant financial information for securities traded in the secondary market e. all of the above 23. The largest deficit unit, the largest borrower is (are) a households and businesses b. foreign financial institutions. the U.S. Treasury d. foreign nonfinancial sectors. C. quantity of loanable funds at rates of 24. At any given point in time, households would demand a a greater; higher interest. and interest rates b. greater, lower c. smaller; lower d. none of the above 25. If economic expansion is expected to increase, then demand for loanable funds should should a increase, increase b. increase, decrease c. decrease, decrease d. decrease, increase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts