Question: can you answer these questions Assignment - Risk and Rates of Return 9. Portfolio beta and weights Search this Rafael is an analyst at a

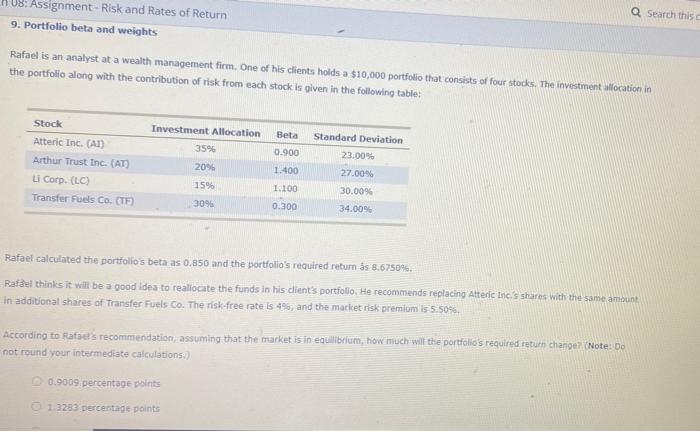

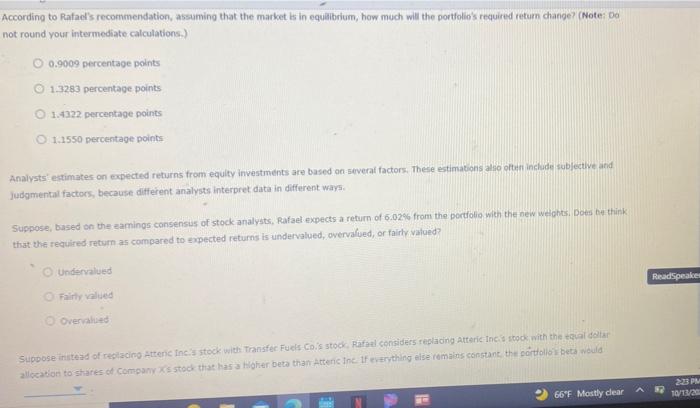

Assignment - Risk and Rates of Return 9. Portfolio beta and weights Search this Rafael is an analyst at a wealth management firm. One of his clients holds a $10,000 portfolio that consists of four stodes. The investment location in the portfolio along with the contribution of risk from each stock is given in the following table: Beta Stock Atteric Inc. (AT Arthur Trust Inc. (AT) Corp. (LC) Transfer Fuels Co. CTF Investment Allocation 35% 2096 15% Standard Deviation 23.00 0.900 1.400 1.100 27.00% 30.00% 3096 0.300 34.00% Rafael calculated the portfolio's beta as 0.850 and the portfolio's required return s 8.6750%. Rafdel thinks it will be a good idea to reallocate the funds in his client's portfolio. He recommends replacing Atteric Inc.'s share with the same amount In additional shares of Transfer Puls Co. The risk-free rate is 4%, and the market risk premium is 5.50% According to Rate's recommendation, assuming that the market is in equilibriurin, how much will the portfolio's required return change? (Note: Do not round your intermediate calculations.) 0.9009 percentage points 1.3283 percentage points According to Rafad's recommendation, assuming that the market is in equilibrium, how much will the portfolio required return change? (Note: Do not round your intermediate calculations.) O 0.9009 percentage points 1.3283 percentage points 1.4322 percentage points O 1.550 percentage points Analysts estimates on expected returns trom equity investments are based on several factors. These estimations also often include subjective and Judgmental factors, because different analysts interpret data in different ways, Suppose, based on the caminos consensus of stock analysts, Rafael expects a return of 6.02from the portfolio with the new weights. Dots to think that the required return as compared to expected returns is undervalued, overvalued, or fairly valued Undervalued ReadSpeaker Fairly valued Overvalued Supposed of replacing Attenines stock with Transfer Fuel Coi's stoo Rafael considers replacing Atteric inc's stock with the qualcoltar allocation to shares of Companys stock that has a loter beta than Attene Inc. If everything else remains constant the portfolios beta would 2:33 PM 10/11/20 66F Mostly dear

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts