Question: Can you answer these questions? Problem 7 Intro The interest rate (yield) on Treasury bonds is 3.5% and the expected inflation rate is 1% Attempt

Can you answer these questions?

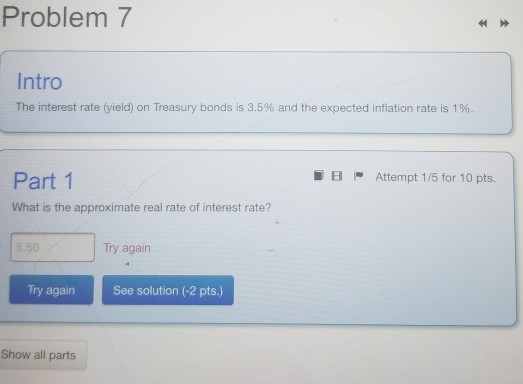

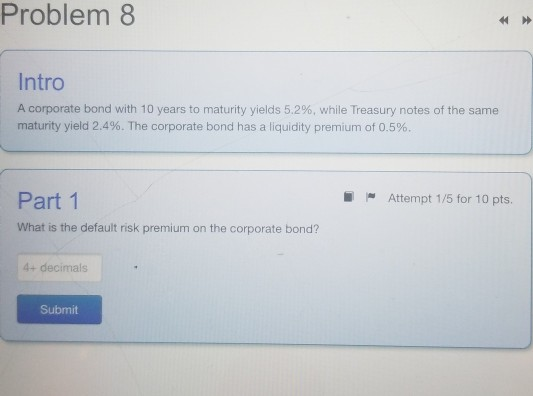

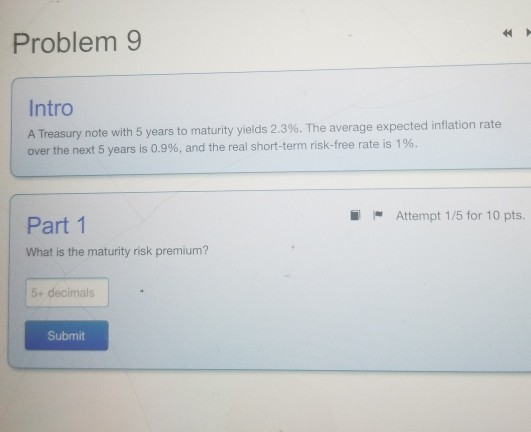

Problem 7 Intro The interest rate (yield) on Treasury bonds is 3.5% and the expected inflation rate is 1% Attempt 1/5 for 10 pts. Part 1 What is the approximate real rate of interest rate? 5.50 Try again Try again See solution (-2 pts.) Show all parts Problem 8 > Intro A corporate bond with 10 years to maturity yields 5.2%, while Treasury notes of the same maturity yield 2.4%. The corporate bond has a liquidity premium of 0.5%. Attempt 1/5 for 10 pts. Part 1 What is the default risk premium on the corporate bond? 4+ decimals Submit Problem 9 Intro A Treasury note with 5 years to maturity yields 2.3%. The average expected inflation rate over the next 5 years is 0.9%, and the real short-term risk-free rate is 1%. Attempt 1/5 for 10 pts. Part 1 What is the maturity risk premium? 5+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts