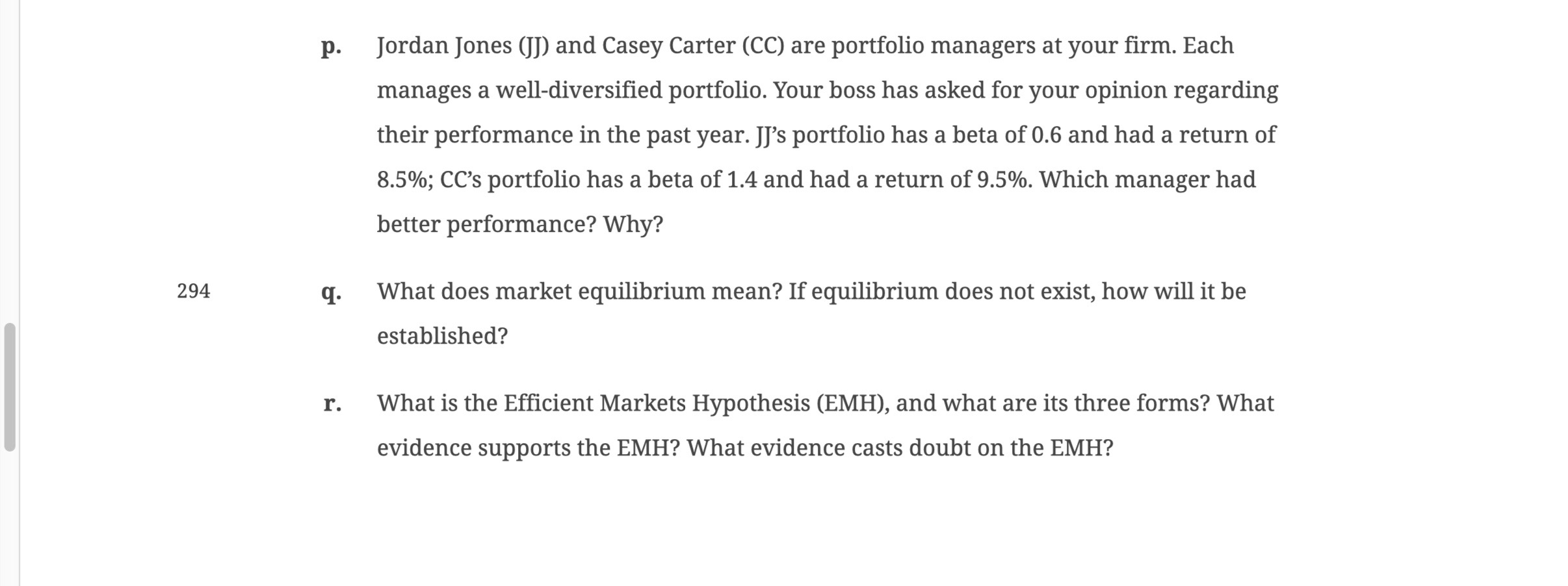

Question: Can you answer these three question on the end? o [T R CNET LN I 6-9. The Fama-French Three-Factor Model 6-10. Behavioral Finance 6-11. The

Can you answer these three question on the end?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock