Question: can you answer this? 1. Expected Returns (L01, CFA1) Use the following information on states of the economy and stock returns to calculate the expected

can you answer this?

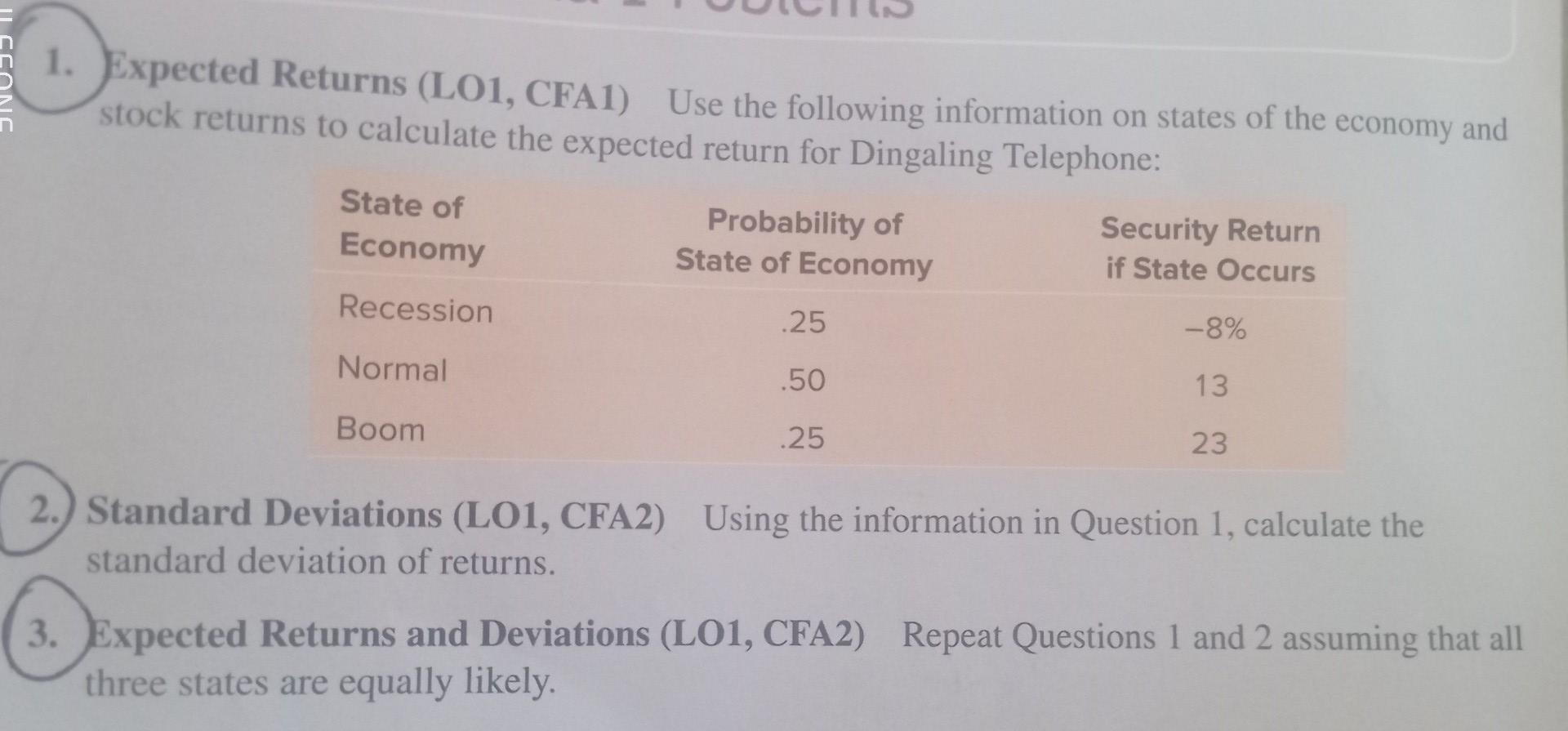

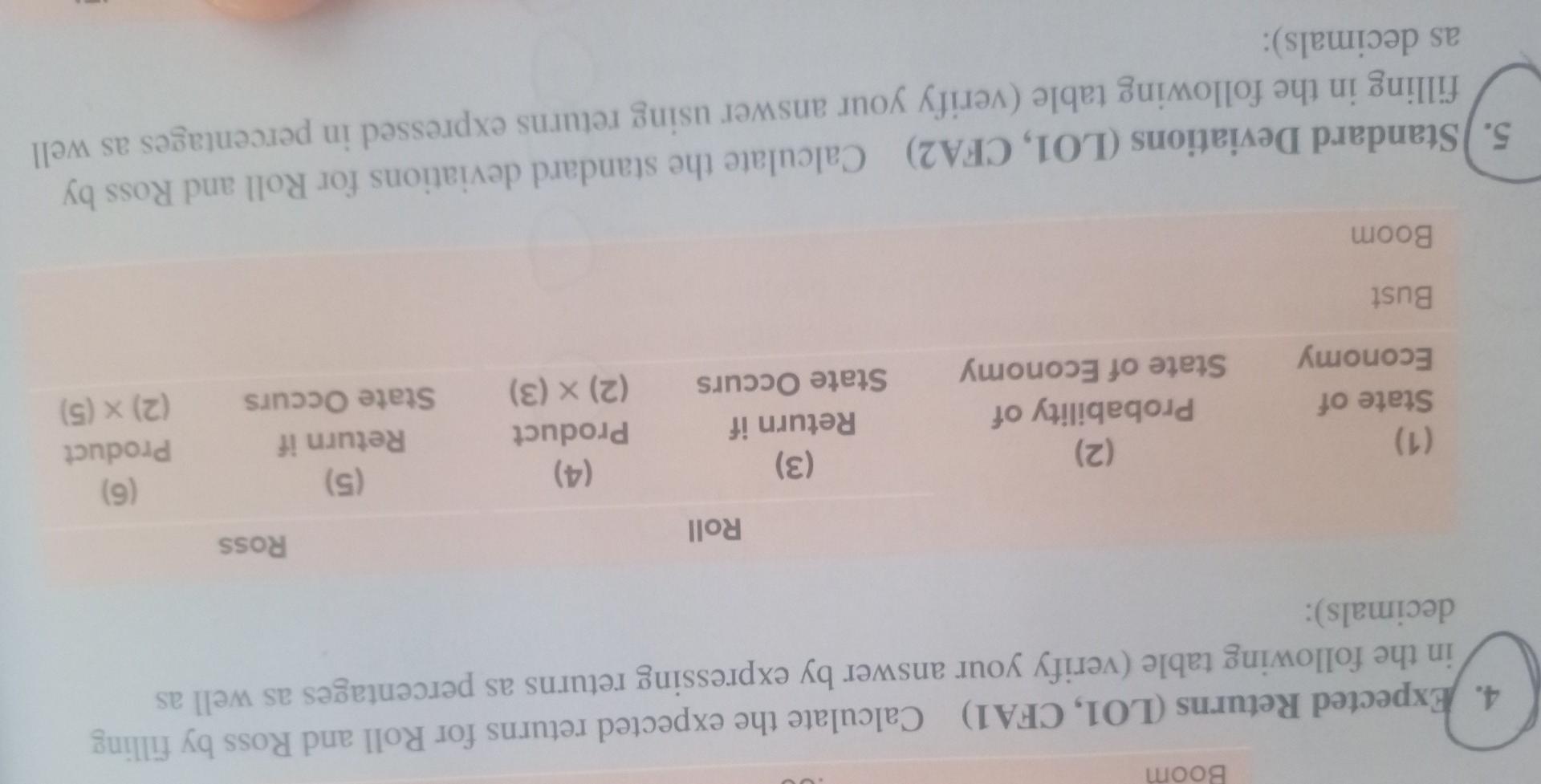

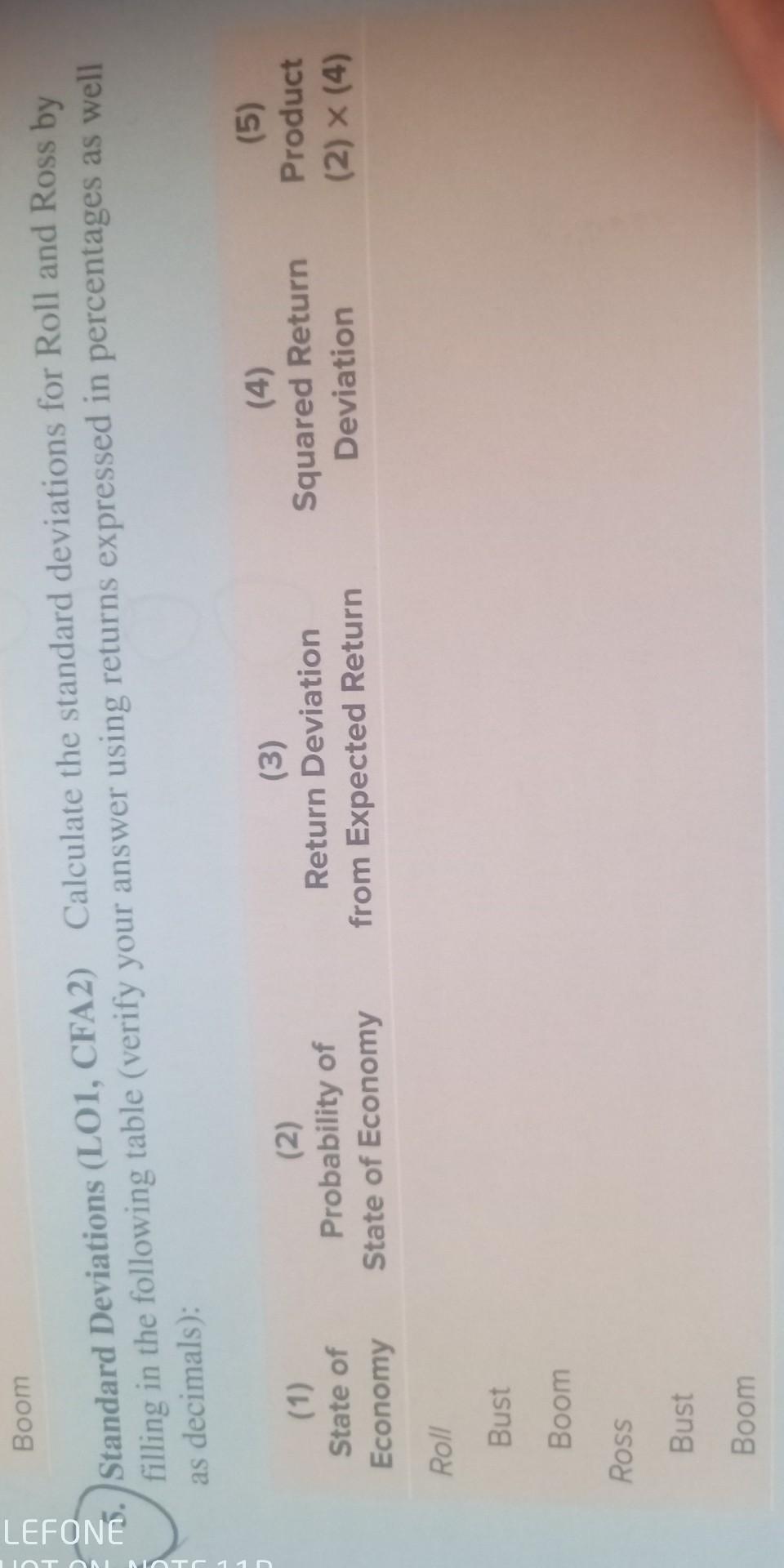

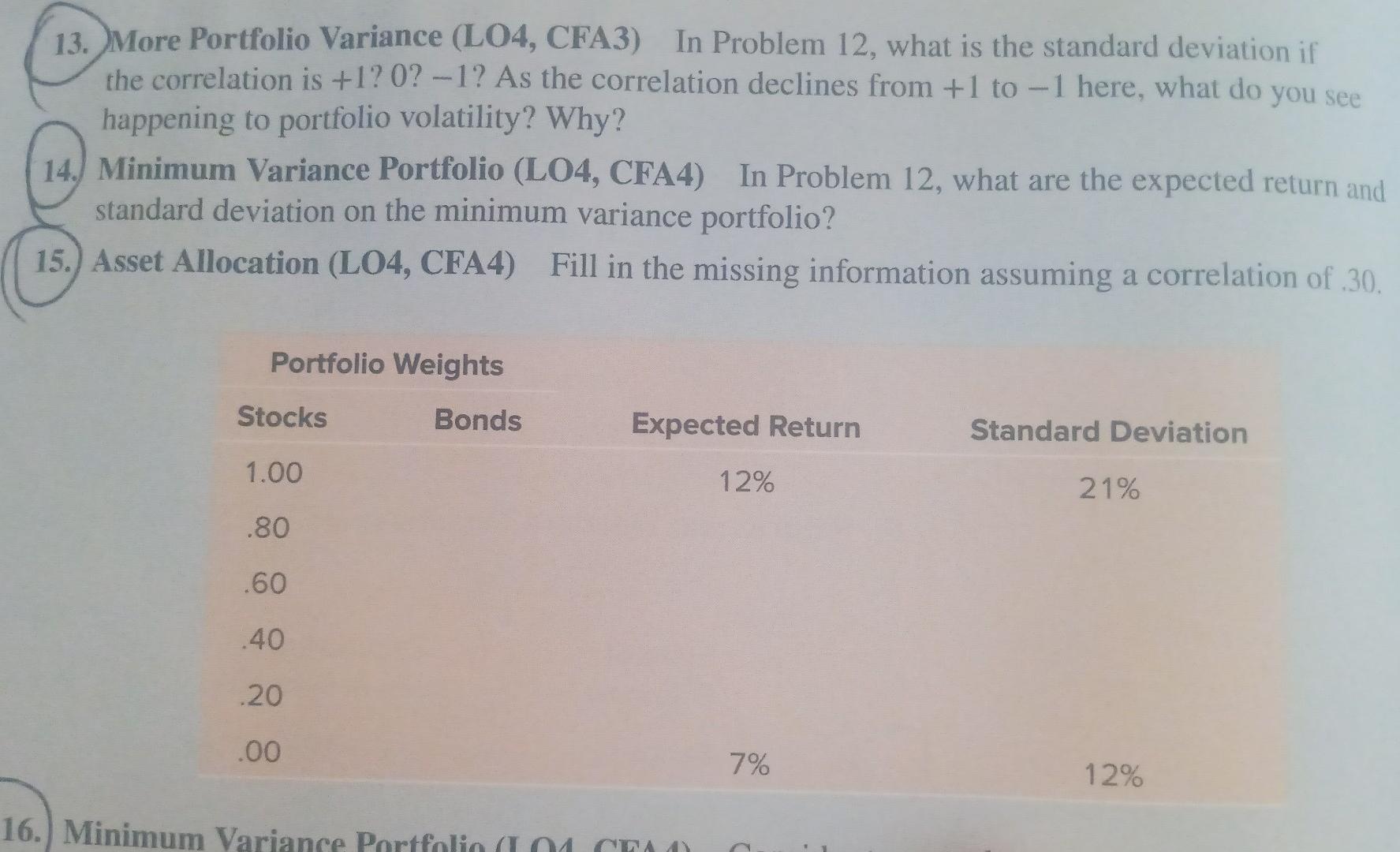

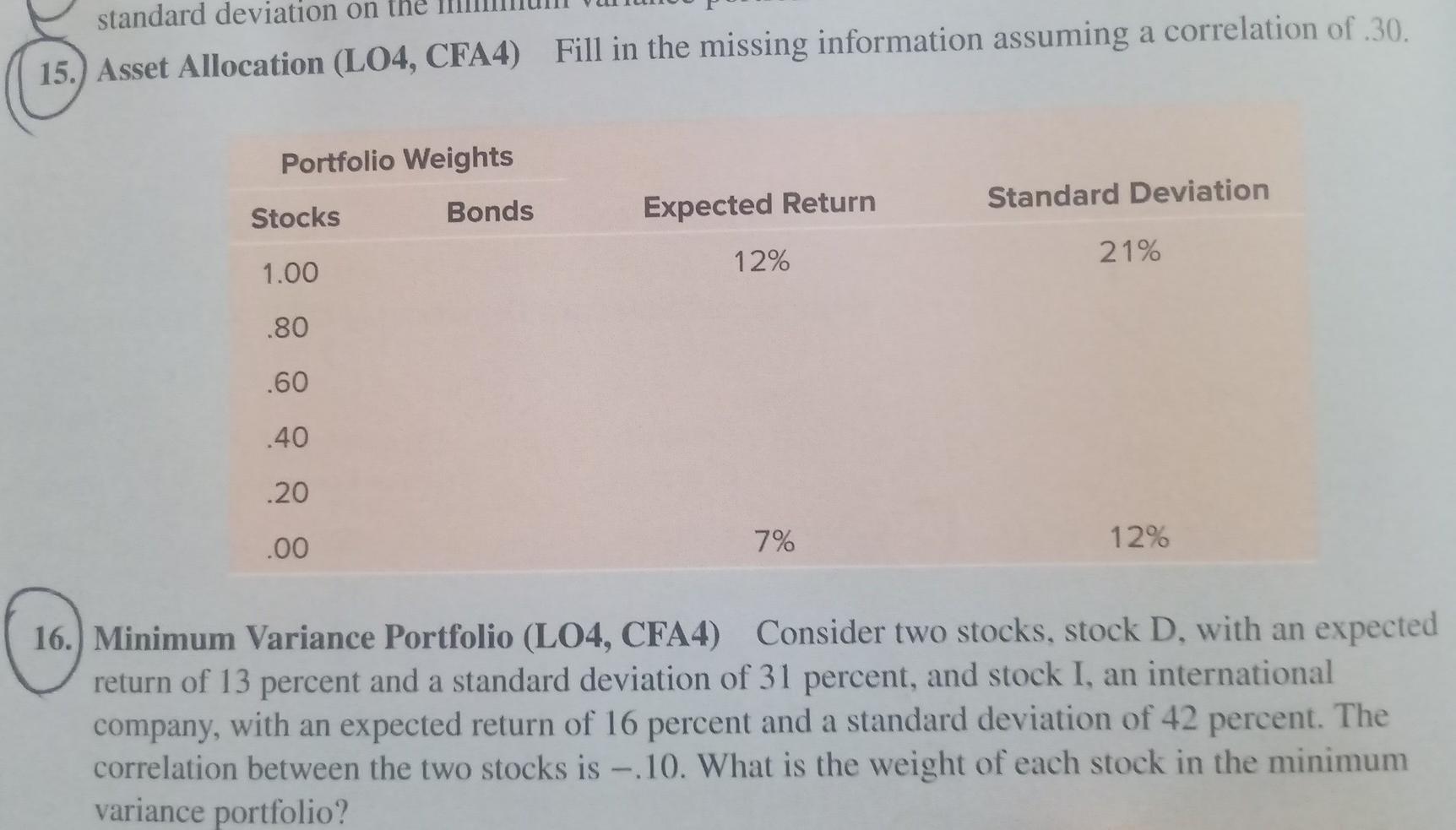

1. Expected Returns (L01, CFA1) Use the following information on states of the economy and stock returns to calculate the expected return for Dingaling Telephone: State of Probability of Security Return Economy State of Economy if State Occurs Recession .25 -8% Normal .50 13 Boom .25 23 2.) Standard Deviations (L01, CFA2) Using the information in Question 1, calculate the standard deviation of returns. 3. Expected Returns and Deviations (L01, CFA2) Repeat Questions 1 and 2 assuming that all three states are equally likely. Boom 4. Expected Returns (L01, CFA1) Calculate the expected returns for Roll and Ross by filling in the following table (verify your answer by expressing returns as percentages as well as decimals): Ross Roll (1) State of Economy (2) Probability of State of Economy (3) Return if State Occurs (4) Product (2) X (3) (5) Return if State Occurs (6) Product (2) x (5) Bust Boom 5. Standard Deviations (L01, CFA2) Calculate the standard deviations for Roll and Ross by filling in the following table (verify your answer using returns expressed in percentages as well as decimals): Boom LEFONE m. Standard Deviations (L01, CFA2) Calculate the standard deviations for Roll and Ross by filling in the following table (verify your answer using returns expressed in percentages as well as decimals): (1) State of Economy (2) Probability of State of Economy (3) Return Deviation from Expected Return (4) Squared Return Deviation (5) Product (2) x (4) Roll Bust Boom Ross Bust Boom 13. More Portfolio Variance (L04, CFA3) In Problem 12, what is the standard deviation if the correlation is +1? 0?-1? As the correlation declines from +1 to - 1 here, what do you see happening to portfolio volatility? Why? 14.) Minimum Variance Portfolio (L04, CFA4) In Problem 12, what are the expected return and standard deviation on the minimum variance portfolio? 15.) Asset Allocation (L04, CFA4) Fill in the missing information assuming a correlation of 30. Portfolio Weights Stocks Bonds Expected Return Standard Deviation 1.00 12% 21% .80 .60 .40 20 .00 7% 12% 16.) Minimum Variance Portfolio standard deviation on the 15.) Asset Allocation (L04, CFA4) Fill in the missing information assuming a correlation of 30. Portfolio Weights Stocks Standard Deviation Bonds Expected Return 1.00 12% 21% .80 .60 .40 .20 .00 7% 12% 16. Minimum Variance Portfolio (L04, CFA4) Consider two stocks, stock D, with an expected return of 13 percent and a standard deviation of 31 percent, and stock I, an international company, with an expected return of 16 percent and a standard deviation of 42 percent. The correlation between the two stocks is -. 10. What is the weight of each stock in the minimum variance portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts