Question: can you answer this case study parts a and b Case 5-2Earnings QualityEconomic income is considered to be a better predictor of future cash flows

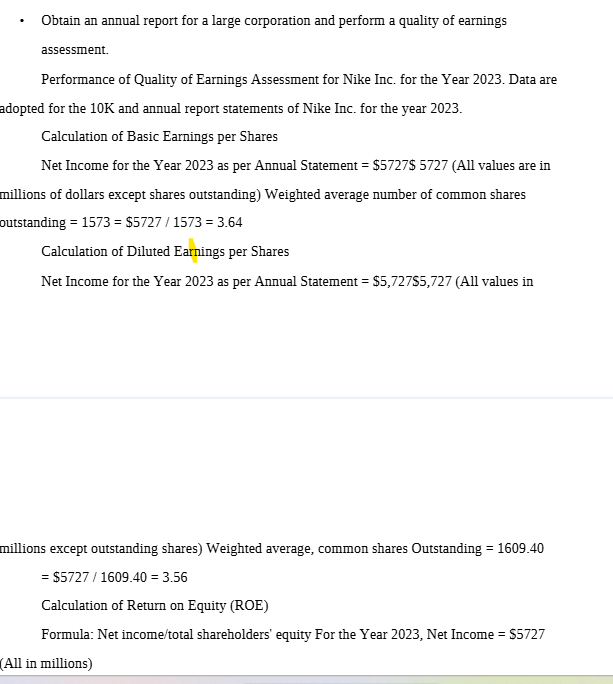

can you answer this case study parts a and b "Case 5-2Earnings QualityEconomic income is considered to be a better predictor of future cash flows than accounting income is. A technique used by securities analysts to determine the degree of correlation between a firm's accounting earnings and its true economic income is quality of earnings assessment.Required:a. Discuss measures that may be used to assess the quality of a firm's reported earnings.b. Obtain an annual report for a large corporation and perform a quality of earnings assessment." and use the photo for part b for a nike annual report as an example. Also include in the write-up a listing of the appropriate Area(s), Topic(s), Subtopic(s), and Section(s), including the titles and ASC numeric identifiers regarding each case study topic as found in the FASB ASC database (FASB ASC required for Case 3-9 only).

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts