Question: can you answer this question for me please? 1 point The idea behind is that a stock's price cannot be evaluated in isolation. The method

can you answer this question for me please?

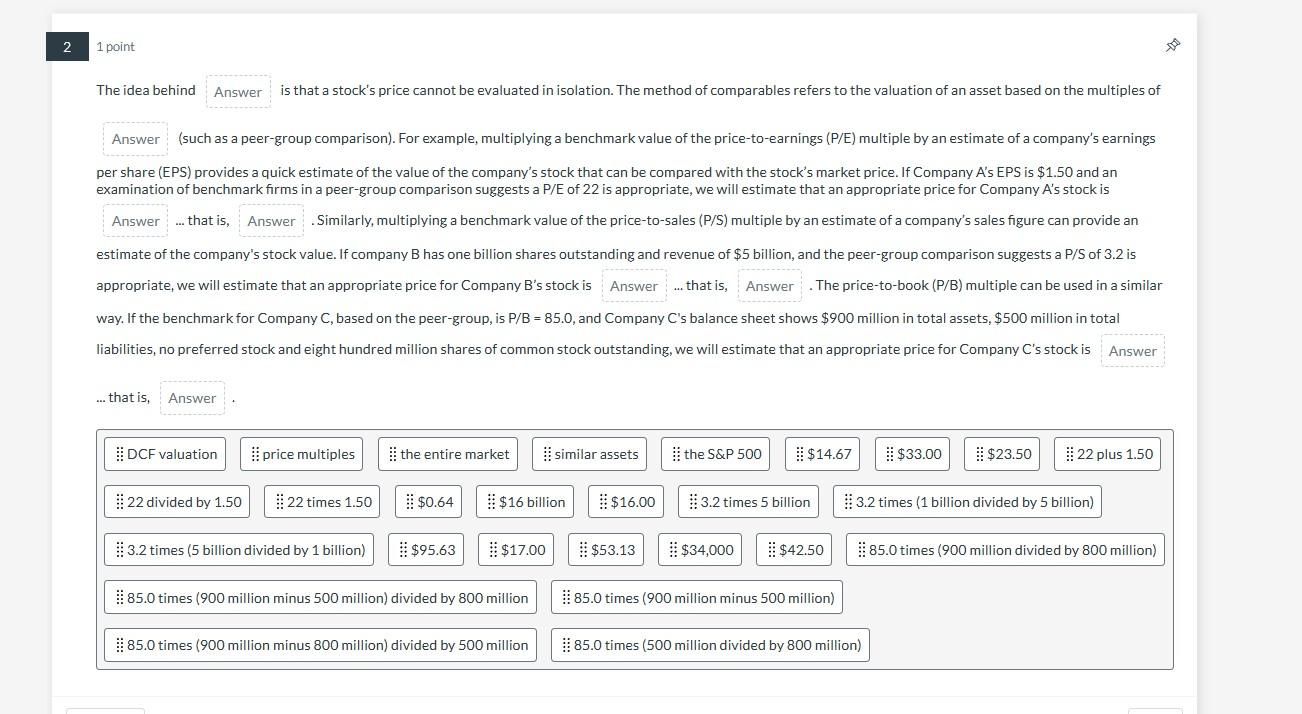

1 point The idea behind is that a stock's price cannot be evaluated in isolation. The method of comparables refers to the valuation of an asset based on the multiples of (such as a peer-group comparison). For example, multiplying a benchmark value of the price-to-earnings (P/E) multiple by an estimate of a company's earnings per share (EPS) provides a quick estimate of the value of the company's stock that can be compared with the stock's market price. If Company A's EPS is $1.50 and an examination of benchmark firms in a peer-group comparison suggests a P/E of 22 is appropriate, we will estimate that an appropriate price for Company A's stock is ... that is, . Similarly, multiplying a benchmark value of the price-to-sales (P/S) multiple by an estimate of a company's sales figure can provide an estimate of the company's stock value. If company B has one billion shares outstanding and revenue of $5 billion, and the peer-group comparison suggests a P/S of 3.2 is appropriate, we will estimate that an appropriate price for Company B's stock is that is, . The price-to-book (P/B) multiple can be used in a similar way. If the benchmark for Company C, based on the peer-group, is P/B=85.0, and Company C's balance sheet shows $900 million in total assets, $500 million in total liabilities, no preferred stock and eight hundred million shares of common stock outstanding, we will estimate that an appropriate price for Company C's stock is ... that is, 1 point The idea behind is that a stock's price cannot be evaluated in isolation. The method of comparables refers to the valuation of an asset based on the multiples of (such as a peer-group comparison). For example, multiplying a benchmark value of the price-to-earnings (P/E) multiple by an estimate of a company's earnings per share (EPS) provides a quick estimate of the value of the company's stock that can be compared with the stock's market price. If Company A's EPS is $1.50 and an examination of benchmark firms in a peer-group comparison suggests a P/E of 22 is appropriate, we will estimate that an appropriate price for Company A's stock is ... that is, . Similarly, multiplying a benchmark value of the price-to-sales (P/S) multiple by an estimate of a company's sales figure can provide an estimate of the company's stock value. If company B has one billion shares outstanding and revenue of $5 billion, and the peer-group comparison suggests a P/S of 3.2 is appropriate, we will estimate that an appropriate price for Company B's stock is that is, . The price-to-book (P/B) multiple can be used in a similar way. If the benchmark for Company C, based on the peer-group, is P/B=85.0, and Company C's balance sheet shows $900 million in total assets, $500 million in total liabilities, no preferred stock and eight hundred million shares of common stock outstanding, we will estimate that an appropriate price for Company C's stock is ... that is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts