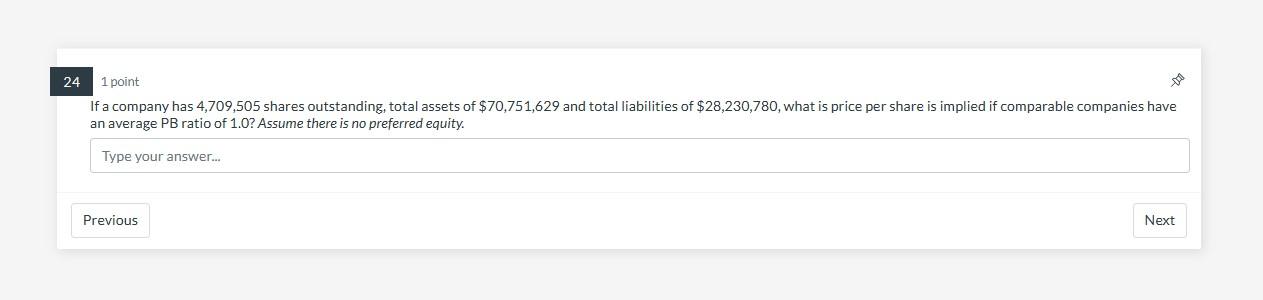

Question: can you answer this question for me please? 1 point If a company has 4,709,505 shares outstanding, total assets of $70,751,629 and total liabilities of

can you answer this question for me please?

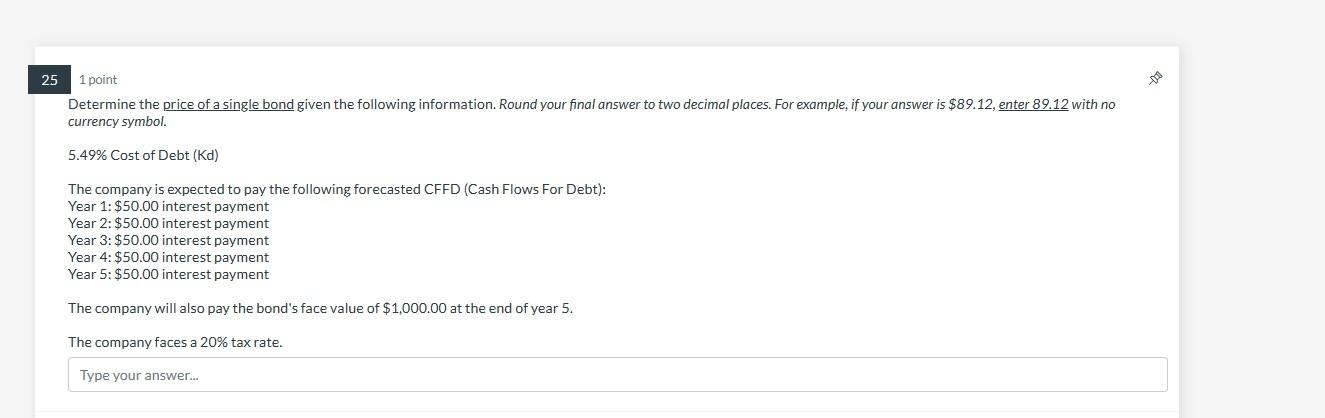

1 point If a company has 4,709,505 shares outstanding, total assets of $70,751,629 and total liabilities of $28,230,780, what is price per share is implied if comparable companies have an average PB ratio of 1.0 ? Assume there is no preferred equity. 251 point Determine the price of a single bond given the following information. Round your final answer to two decimal places. For example, if your answer is $89.12, enter 89.12 with no currency symbol. 5.49% Cost of Debt(Kd) The company is expected to pay the following forecasted CFFD (Cash Flows For Debt): Year 1: $50.00 interest payment Year 2:$50.00 interest payment Year 3:$50.00 interest payment Year 4:$50.00 interest payment Year 5: $50.00 interest payment The company will also pay the bond's face value of $1,000.00 at the end of year 5 . The company faces a 20% tax rate. Type your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts