Question: can you answer this question for me please? 61 point Determine equity value per share given the following information. Round your final answer to two

can you answer this question for me please?

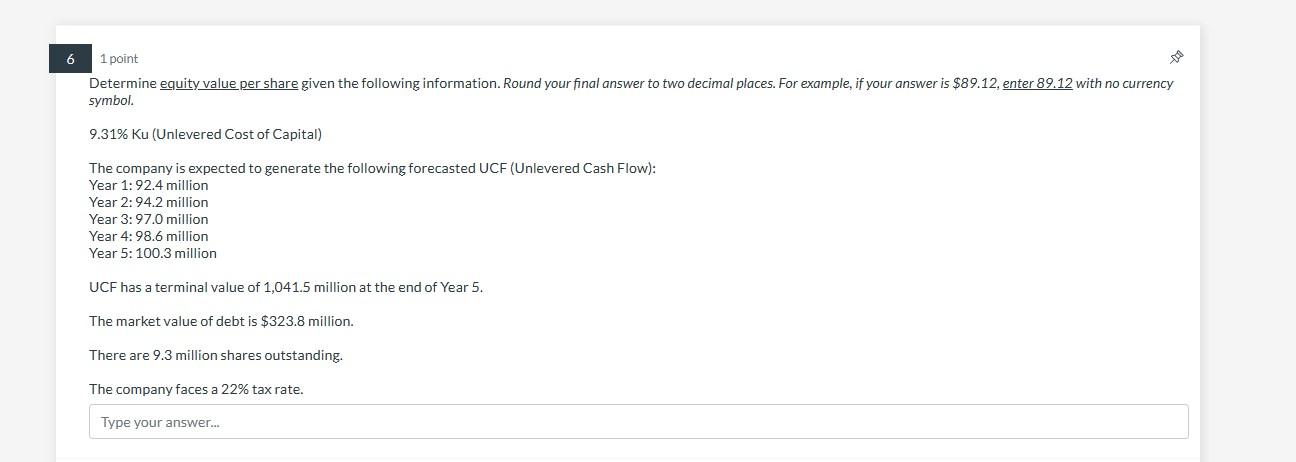

61 point Determine equity value per share given the following information. Round your final answer to two decimal places. For example, if your answer is $89.12, enter 89.12 with no currency symbol. 9.31%Ku (Unlevered Cost of Capital) The company is expected to generate the following forecasted UCF (Unlevered Cash Flow): Year 1: 92.4 million Year 2: 94.2 million Year 3: 97.0 million Year 4: 98.6 million Year 5: 100.3 million UCF has a terminal value of 1,041.5 million at the end of Year 5. The market value of debt is $323.8 million. There are 9.3 million shares outstanding. The company faces a 22% tax rate. Type your answer... 61 point Determine equity value per share given the following information. Round your final answer to two decimal places. For example, if your answer is $89.12, enter 89.12 with no currency symbol. 9.31%Ku (Unlevered Cost of Capital) The company is expected to generate the following forecasted UCF (Unlevered Cash Flow): Year 1: 92.4 million Year 2: 94.2 million Year 3: 97.0 million Year 4: 98.6 million Year 5: 100.3 million UCF has a terminal value of 1,041.5 million at the end of Year 5. The market value of debt is $323.8 million. There are 9.3 million shares outstanding. The company faces a 22% tax rate. Type your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts